40 excel debt payoff worksheet

The Accelerated Debt Payoff Spreadsheet is going to be based on one of the most successful and recognizable debt payoff strategies. It is called the debt snowball strategy. It has gone by other names depending upon who has been teaching the strategy at the time but in general, they all share the same common principles. In the spreadsheet, you will begin by creating a total of all of your debts.

Debt snowball calculator template excel is a Debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.Once the littlest obligation is paid off, one continues to the following somewhat bigger little obligation over that, et cetera, bit by bit ...

Nov 20, 2020 · To create a credit card payoff spreadsheet for your debt snowball method, you can use Excel. Here are the steps to create a perfect one. First, at the top of the spreadsheet, input the name of each of the loans you have and the corresponding interest rates. You will use the interest rate later, so it’s best to know it now.

Excel debt payoff worksheet

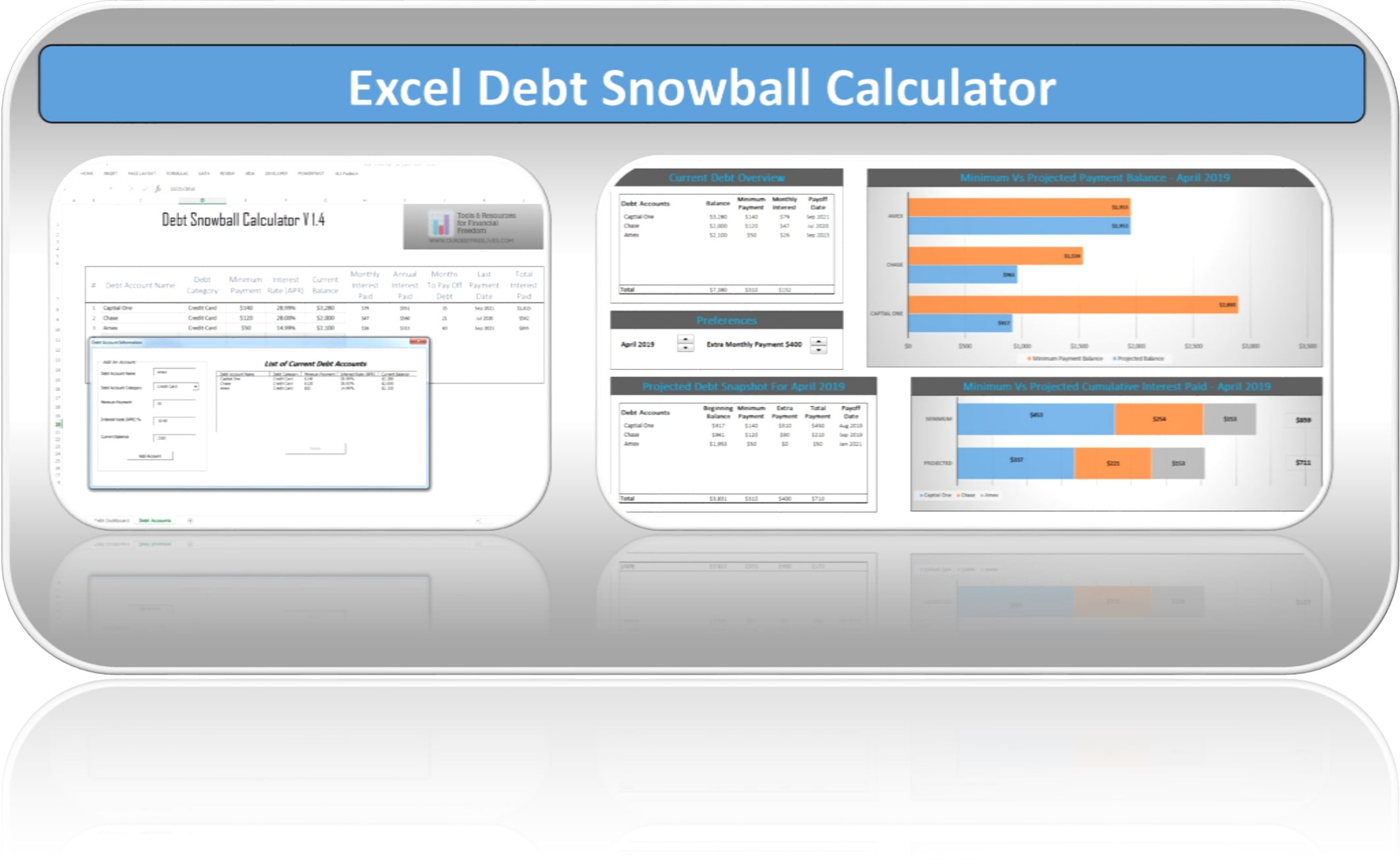

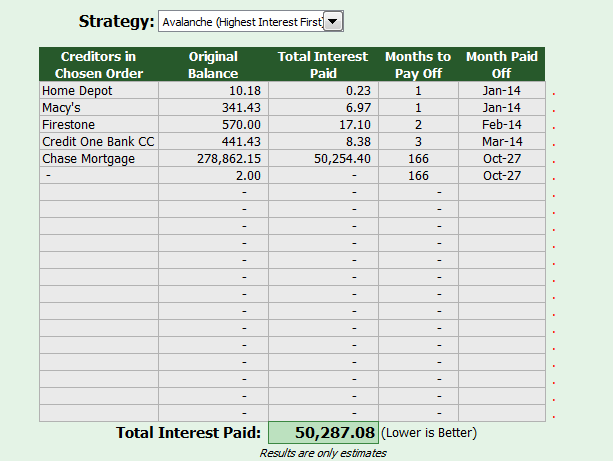

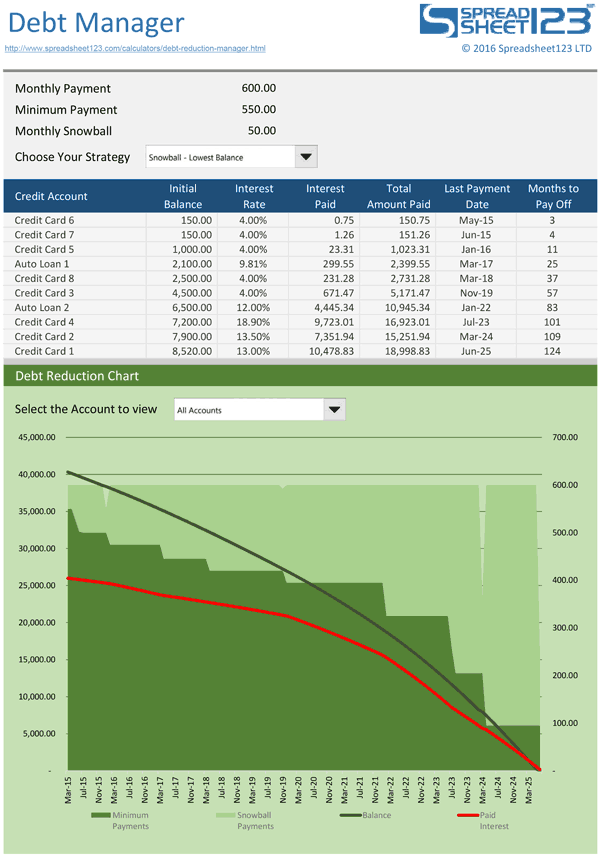

The Tiller Community Debt Snowball Spreadsheet allows you to calculate estimated payoff dates and track your progress towards debt freedom. You can use this sheet to switch back and forth between the avalanche and debt snowball methods. Graphs will help you compare the two strategies side by side. The spreadsheet can be used for any type of debt.

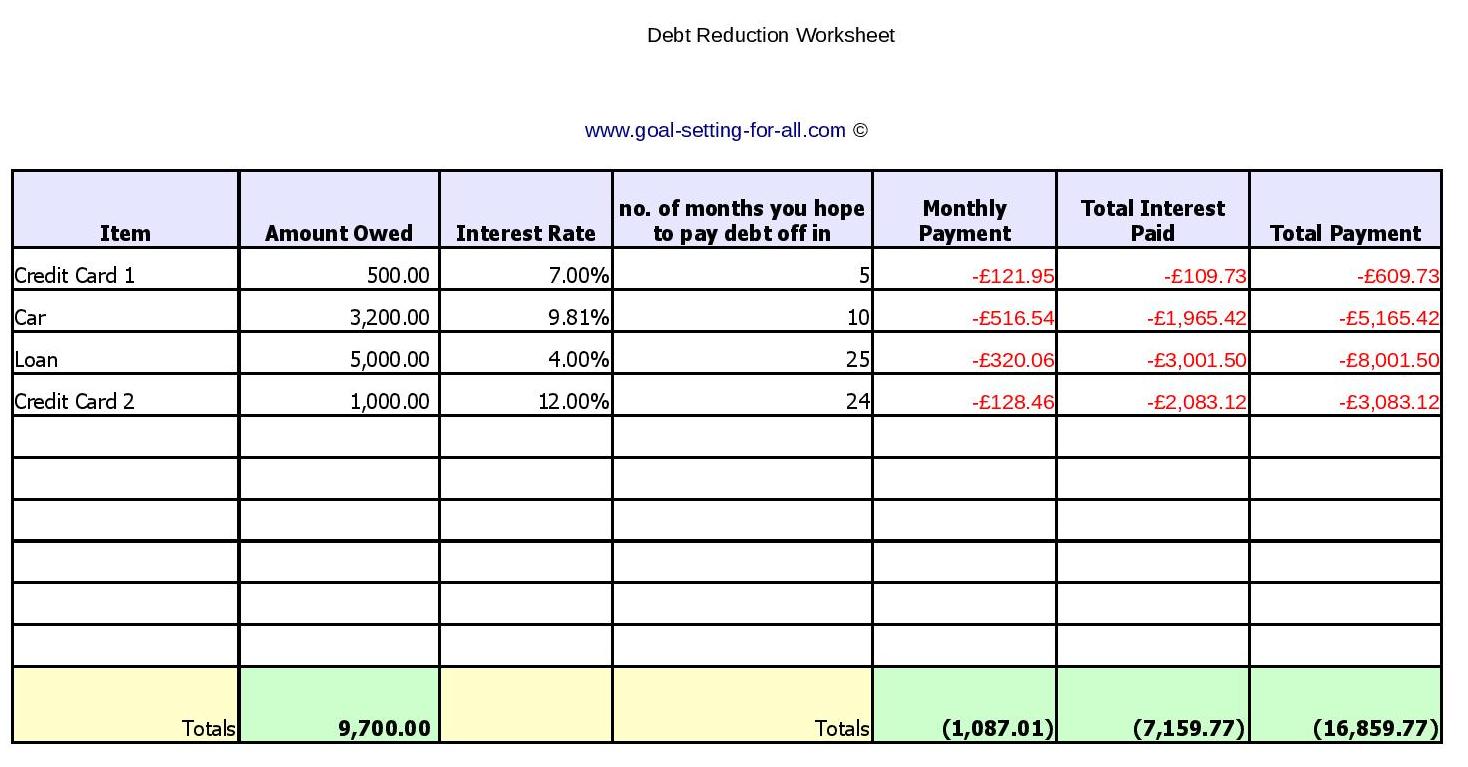

The Debt Payoff Spreadsheet will help you make a payment schedule, show you exactly how much interest you will pay, and your debt-free date. Input your numbers in the spreadsheet and compare different debt reduction strategies to see which one is best for you. You can track up to 20 debts in the Debt Payoff Spreadsheet.

While a free debt snowball worksheet can help you quickly tackle and pay down debt. How to Use Debt Tracker Worksheets to Pay Off Debt. Using a free template is an easy way to get control of your debt. Follow these steps: Step 1: Find a Budgeting Spreadsheet. The first order of business to paying off any debt is working out a budget.

Excel debt payoff worksheet.

Student Loan Spreadsheet. Student loans are a big issue for many people in this country. Not only do recent graduates need to come up with a plan for paying off these loans, but many people in their 40s, 50s and even higher are still working to pay off the debt they used to help them get their degree.

Step 4: Create a Payoff plan A debt payoff plan targets one debt at a time and systematically pays off your debts over time. When you pay off one debt, you re-allocate and add that money to the minimum balance of the next smallest debt—increasing your payments and paying the loans off faster. Create a plan using the Payoff Debt example from ...

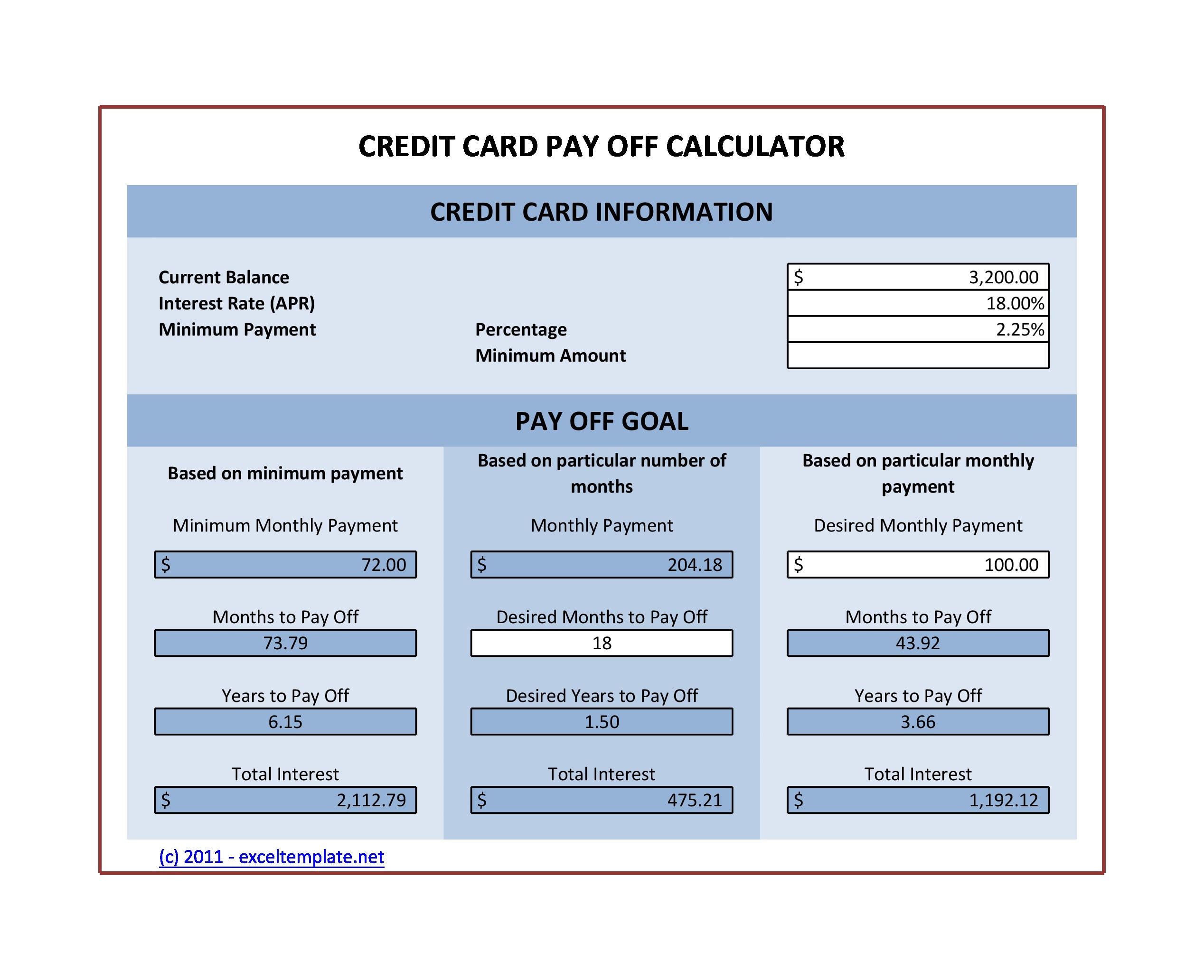

Credit Card Payoff Calculator. Easily see what it will take to pay off your credit card at different interest rates and payment amounts with this credit card payoff calculator. This simple credit card payoff template is perfecting for calculating credit card interest and payments. This is an accessible template. Excel. Download Open in browser.

Jan 25, 2019 · This debt payoff excel spreadsheet will allow you to record both the interest you pay as noted on your bill statement as well as your extra payment. Seeing these numbers really helps you to understand what is going on with your payments and how your money is being applied.

9+ Debt Snowball Excel Templates. The snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off and the move to the next debt and repeat it so that the full cash may pay off. Commonly the debts are paid at their minimum rate until the extreme need of a credit card to be snowballed.

Debt Payoff Projections on Excel Worksheet I have started an Excel spreadsheet that calculates the payoff of consumer debt using the a technique called the debt snowball. I've run into the complications with the equations and projections and need help completing the worksheet.

A financial template is a great resource to generate a monthly budget, track spending, and manage your debt. Try a financial template calculator in Excel to help pay off a car loan, student loan, or credit card balance. Need help with big financial decisions? Use finance templates for Excel to compare mortgage types, assess the pros and cons of ...

Savings Snowball Calculator . Use this spreadsheet to estimate how long it will take you to reach your short-term and mid-term savings and debt payoff goals. The focus is on savings, but it is based on the debt reduction calculator, so it lets you include debt payoff in addition to your savings goals. 7.

PaymentSchedule worksheet. Visit Vertex42.com END BALANCE the minimum monthly payments on credit cards or lines of credit. See tip #3 below. Totals: row 1 or after row 10, the formulas will be messed up. above the normal monthly payment. You can add debt "snowflakes" in the Note: It is not possible to insert more rows to increase the number of ...

Free Debt Snowball Spreadsheet (for 2021) Creating a debt snowball is my preferred method of getting out of debt . When Linda and I were paying off $46k of debt, we actually didn't use a debt snowball spreadsheet or worksheet, but looking back I think it really could have helped us. If you are wanting to pay off debt on your own, this works!

Debt Snowball Worksheet For Excel. Rated 4.90 out of 5 based on 29 customer ratings. ( 29 customer reviews) $ 19.99 $ 14.99. Optimized Debt Payoff Schedule To Save You $1,000's vs Similar Excel Templates. Excel Debt Snowball Calculator. Simulate Over 10,000 Different Scenarios By A Click of A Button. Add up-to 8 Debt Accounts.

The start of a new year is a time for planning, renewal, and figuring out how to pay off that holiday debt. This article considers how to model debt repayment calculations from a practical perspective. It addresses three common calculations using Excel's financial functions for the last item.

debt snowball calculator template excel is a debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations.once the littlest obligation is paid off, one continues to the following somewhat bigger little …

Credit Card Debt Payoff Spreadsheet. Credit Card Debt Payoff Spreadsheet for Calculating Your Credit Card Payoff Schedule According to Experion, one of the three major credit reporting agencies, the average American has slightly over $6... View Template.

Debt payoff calculator spreadsheet - debt snowball, excel, student loan and credit card debt tracker

Debt Reduction Example. In the example above, there's a total debt of $274,987.45 with an average interest rate of 4.50%. The total average monthly interest is $1,031.56, and the total monthly payment is $2,596.46. The debt reduction spreadsheet helped find an additional $379.54 available to put against debt.

With our debt snowball calculator, we'll tell you which debt to pay off first, while creating a customized plan that will minimize the amount you pay in interest. This excel worksheet was built for you to quickly and efficiently run 1000's of different "what if" scenarios with just the click of a button. Our debt snowball worksheet will ...

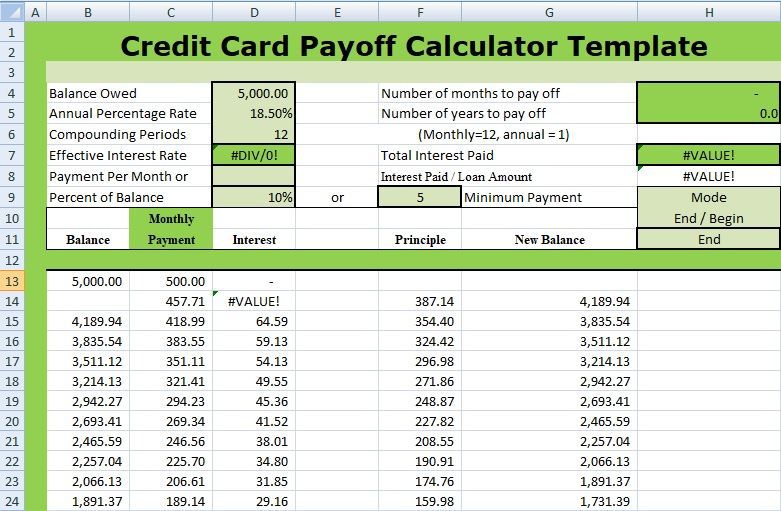

Create Your Own Debt Pay Off Calculator in Excel. Now, would you like to build a debt payoff calculator yourself? Customize it, share it, and utilize it however you want - Enter Excel! To build a debt payoff calculator, you need to create the input fields and organize the layout so that users can enter their details, all the while making it ...

Description. This printable worksheet can be used to track individual debts you are trying to pay off. Record the creditor and the minimum payment at the top of the worksheet. The minimum payment represents the amount of cash flow you will free up by completely paying off the debt. Enter the Start Debt, then print the worksheet.

Free Printable Debt Payoff Worksheet as a PDF. With this debt snowball tool, you got an organized place to put your numbers, you got an excel template that lays out your debts, and you got a dynamic tool that can help you understand what it might take to pay off your debts faster.

Squawkfox Debt Reduction Spreadsheet . The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet.. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and average monthly interest paid.

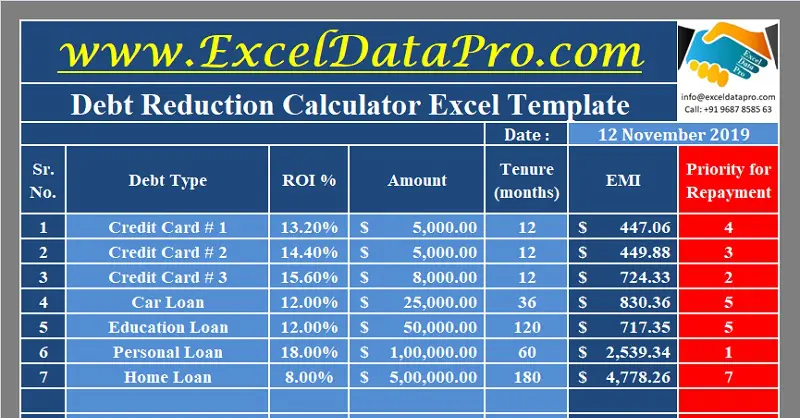

Download Debt Reduction Calculator Excel Template. Debt Reduction Calculator is a ready-to-use excel template that helps you calculate your total debt and helps you design a payoff plan for debt reduction. Usually, many of us are trapped in debt. It can be anything such as credit cards, educational loans, car/auto loan or home mortgage loans.

To make your own debt snowball spreadsheet, collect the name, interest rate and minimum payment of each of your debts. You will then put these in a spreadsheet, from smallest to largest balance, to keep track of each payment you make against all of the debts, as well as to see when you will become debt-free.

Dave Ramsey highly recommends the debt snowball method to eliminate your debt in the Baby Steps, but let’s dig into what template can help you get out of Baby Step 2 fast. While I use my favorite app on my phone for my debt payoff, let’s go through great printables, excel and PDF resources to help you eliminate your debt.. Although most debtors that pay off their debt with the debt ...

Figure out the monthly payments to pay off a credit card debt. Assume that the balance due is $5,400 at a 17% annual interest rate. Nothing else will be purchased on the card while the debt is being paid off. Using the function PMT(rate,NPER,PV) =PMT(17%/12,2*12,5400) the result is a monthly payment of $266.99 to pay the debt off in two years.

Free Debt Snowball Excel Worksheet (XLSX file). Free Debt Snowball Excel Worksheet (XLS file for older versions of Excel). If you are not familiar with the Debt Snowball method, then please read the steps involved in a Debt Snowball Repayment Plan. Instructions for using the Debt Snowball Excel Worksheet On the Debt-Snowball worksheet ...

0 Response to "40 excel debt payoff worksheet"

Post a Comment