40 self employment tax and deduction worksheet

Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, anytime the wording "self-employment tax" is used, it only refers to …

This deduction is taken into account in calculating net earnings from self-employment. See the Form 1040 or 1040-SR and Schedule SE instructions for calculating and claiming the deduction. Who Must Pay Self-Employment Tax? You must pay self-employment tax and file Schedule SE (Form 1040 or 1040-SR) if either of the following applies.

Use a simpler calculation to work out income tax for your vehicle, home and business premises expenses.

Self employment tax and deduction worksheet

Instead, you may need to make quarterly estimated tax payments throughout the year if you expect: You'll owe at least $1,000 in federal income taxes this year, ...

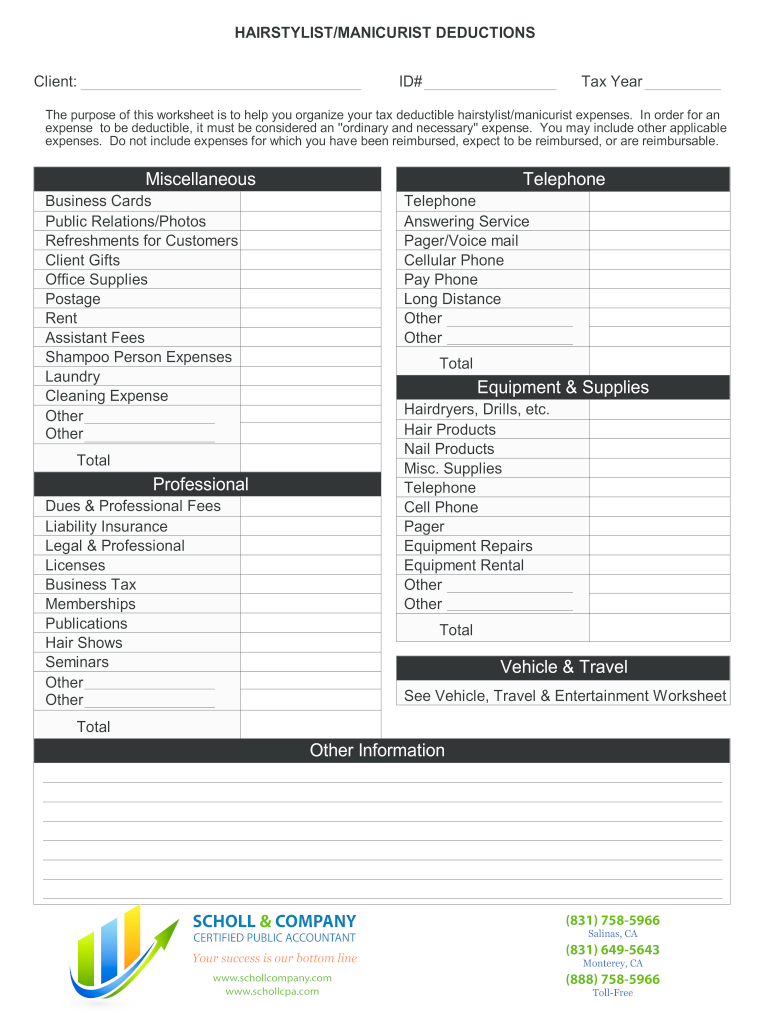

Deductible Expense: Advertising. Car/Truck Expenses. Commissions/Fees. Contract Labor. Depletion. Depreciation. Employee Benefit Programs. Insurance.1 page

21/01/2021 · One available deduction is half of the Social Security and Medicare taxes. That’s right, the IRS considers the employer portion of the self-employment tax (7.65%) as a deductible expense. Only 92.35% of your net earnings (gross earnings minus any deductions) are subject to self-employment tax. There are a number of other tax deductions that self-employed …

Self employment tax and deduction worksheet.

08/12/2021 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

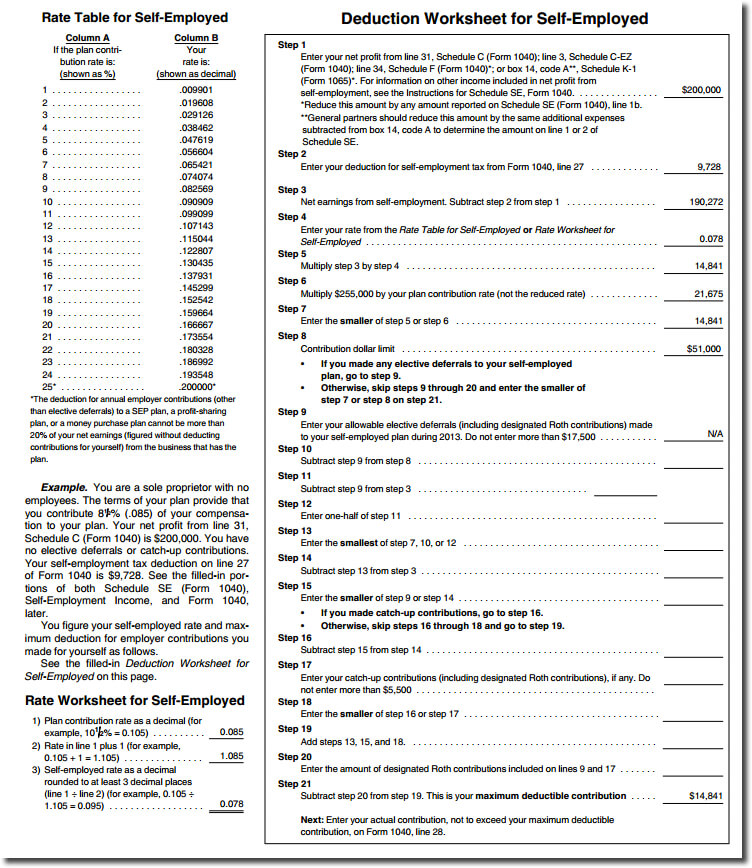

18/11/2021 · The tax code allows self-employed people to deduct half of their total self-employment tax as an above-the-line deduction. This deduction mirrors the employer portion of Social Security and Medicare that would be paid by your boss if you worked for someone else. Take your calculated self-employment tax and divide it in half. The result goes on line 14 of

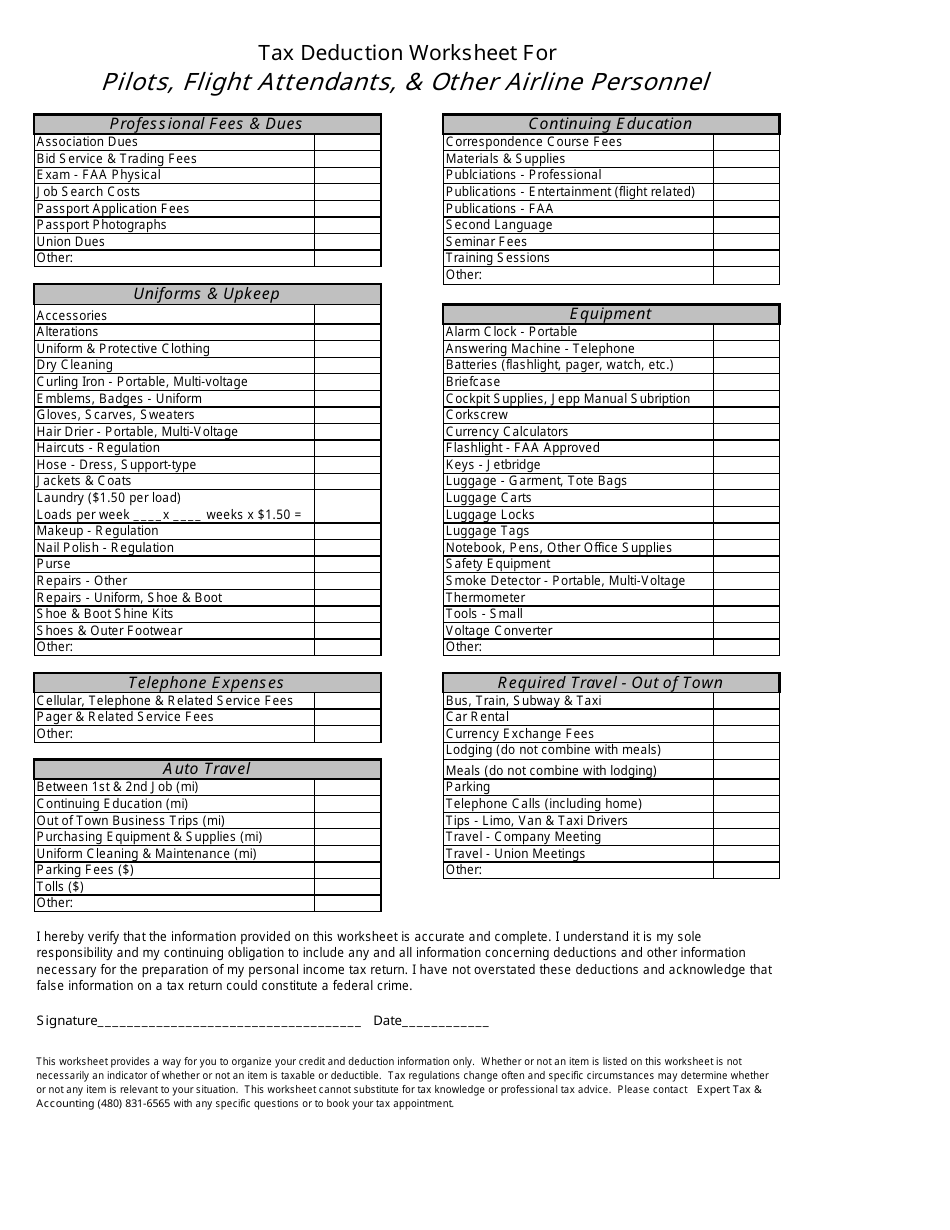

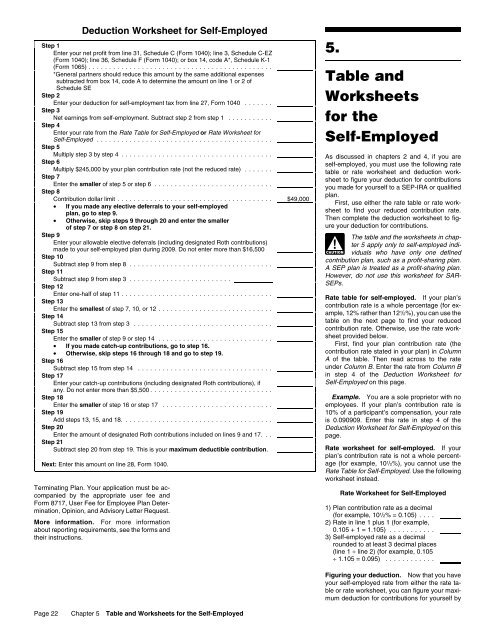

10/05/2021 · To calculate this yourself, use the Deduction Worksheet for Self-Employed found in chapter 5 of Publication 560. Self-employed persons have a lower contribution rate than employees. This is due to an unfortunate situation in the tax code whereby determining the contribution amount and determining net earnings are mutually dependent on each other. The …

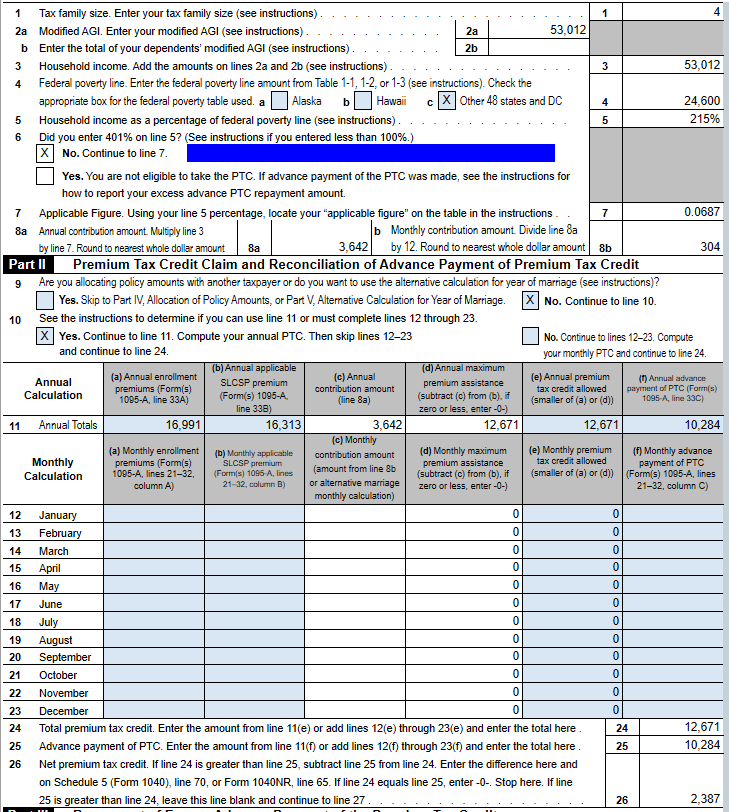

30/12/2019 · Some Other Tips for Claiming the Deduction Enter your self-employment health insurance deduction on line 29 of Form 1040. A worksheet is provided in the Instructions for Form 1040 to calculate the deduction, and a more detailed worksheet can be found in Publication 535.

Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC ... rate above will be a better deduction) ... Taxes & Licenses.2 pages

09/12/2021 · It's actually one of the most common self-employment tax deductions. The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare ...

18/11/2020 · Unlike other tax deductions for self-employed people, the self-employed health insurance deduction isn’t taken on Schedule C or on a business return. Because it’s an adjustment to income, you claim it on Schedule 1 attached to …

(LIHEAP ) does not allow the same business deductions as the IRS Federal Income Tax. Some common IRS deductions not allowed for these purposes are:.2 pages

Self employed tax preparation printables - instant download - small business expense tracking - accounting

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

0 Response to "40 self employment tax and deduction worksheet"

Post a Comment