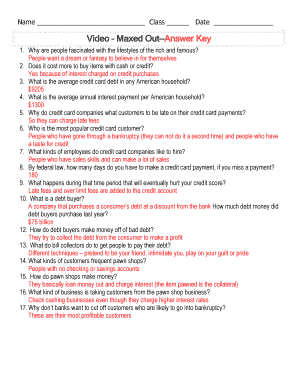

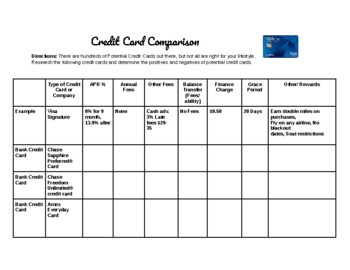

41 credit card comparison worksheet answer key

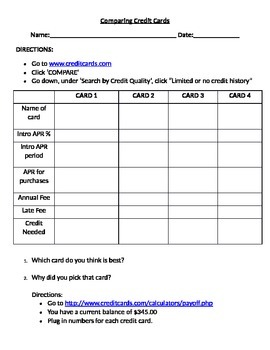

"Credit Card Offers" and "Credit Card Comparison" Answer Key. Students will need the following supplies: Computers with Internet access (for individuals or groups) Notebook or journal

Understanding Credit Cards reinforcement worksheet 2.6.3.A4 Comparison Shopping for a Credit Card 2.6.3.A5 Comparison Shopping for a Credit Card Essay 2.6.3.B1 ... Answer Key 2.6.0.M1 & C1 ...

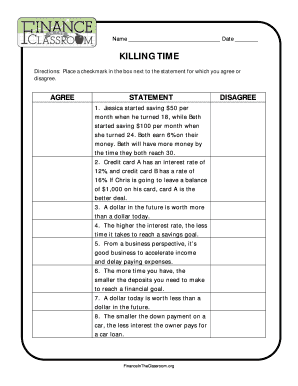

An informed consumer will know these advantages and disadvantages and be able to compare credit cards with different terms of agreement and conditions of repayment. In essence, a credit card is a short-term loan with a stipulated interest rate. ... Credit Card Worksheet Answer Key; Process. 1. Navigate your students to the Federal Reserve Bank: ...

Credit card comparison worksheet answer key

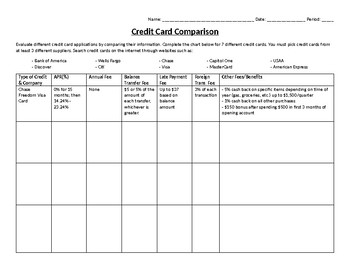

Comparing Two Credit Card Offers 3.99% APR for the life of transferred balances; 13.25 % APR for all other purchases Minimum monthly payment of $ 15 or of balance Rewards program: $ I O shopping card with each $1 in spending 0.00% APR for 6 months; 19.8% APR for remaining lifetime of card Monthly balance must be paid in full each month

Understanding a Credit Card Statement Name_____ Date_____ Class_____ Directions: Refer to the provided credit card statement to answer the following questions. 1. What is the current APR for purchases, balance transfers, and cash advances? (3 points) 2.

Oct 24, 2021. |. Question of the Day, Credit Cards. Answer: $935.95 We multiplied the average credit card balance of $5,897 by the average credit card APR of 16.43%. Assuming they don't rack up any more debt, consumers who make 2% minimum payments every month would pay $935.95 in credit card interest that year.

Credit card comparison worksheet answer key.

Also, credit card issuers can change your rate if they make proper notifica-tion to you. • A variable rate card can fluctuate at the card issuer’s discretion. MCU Visa® Platinum Smart Rate Card MCU Visa® Platinum Smart Reward Card Card #4 Card #5 Annual Percentage Rate [APR] 7.99%APR to 15.99%APR Based on Credit Score 9.99%APR to 16.99%APR

Understanding a credit card for personal finance: key terms. Learn with flashcards, games, and more — for free.

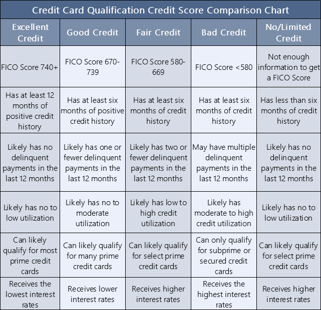

Compare credit cards from all the major credit card companies and quickly find the best credit card for your needs. To use WalletHub's free credit card comparison tool, start by applying the filters on this page to narrow down your search based on card feature, required credit standing, issuer and more (some cards are from WalletHub partners).

3 Introducing the Credit Card - Card Brand: This is similar to the issuing bank, but it represents the credit card company that manages the card. Examples include Visa, MasterCard, Discover, and American Express. - Cardholder: This is the full name of the person or business that owns the card.If the card is for

Answer the following questions: 1.Suppose we have a card with an APR of 33%. The minimum payment is 9% of the balance. Suppose we have a balance of $322 on the credit card. We decide to stop charging and to pay it o by making the minimum payment each month. Calculate the new balance after the rst minimum payment is made and then calculate the ...

Page | 25 2.6.3.A5 Comparison Shopping for a Credit Card Total Points Earned Name Kora Nagle 35 Total Points Date 5315 Directions : Compare at least three sample credit card offers.

turned 21, so he could apply for a few credit cards. Here are some details about his profile: He currently has 3 credit cards (Question #1) He got his first credit card less than 3 months ago (#1) He got his first student loan 3 years ago (#2) He has applied for 5 credit cards in the last year (and had 3 applications accepted). (#3)

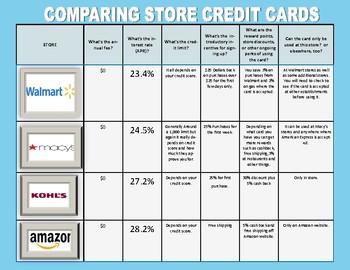

credit card comparison Evaluate different credit card applications comparing finance charges, interest, late fees, closing costs, annual fees, etc. Credit Card information: www.creditcardcomparison.com. Store Cards and Pay Day Lenders search individually on internet.

SC-5.3 Young People & Credit Cards - Sample Completed Student Activity Packet 5 THE FINE PRINT: Credit Card Statement Resource # SC-5.4 Select a Credit Card - Sample Completed Student Activity Packet 4 COMPARE: Select a Credit Card* *No Answer Key available - assignment is open-ended. B ack to Top www.ngpf.org Last updated: 3/27/20 9

A credit card comparison chart can be an extremely valuable took when exploring the numerous cards that are available to consumers these days — hopefully saving both time and money. Once upon a time, credit cards were simple devices, used to conveniently make purchases at your favorite store or restaurant that you paid off when your bill came ...

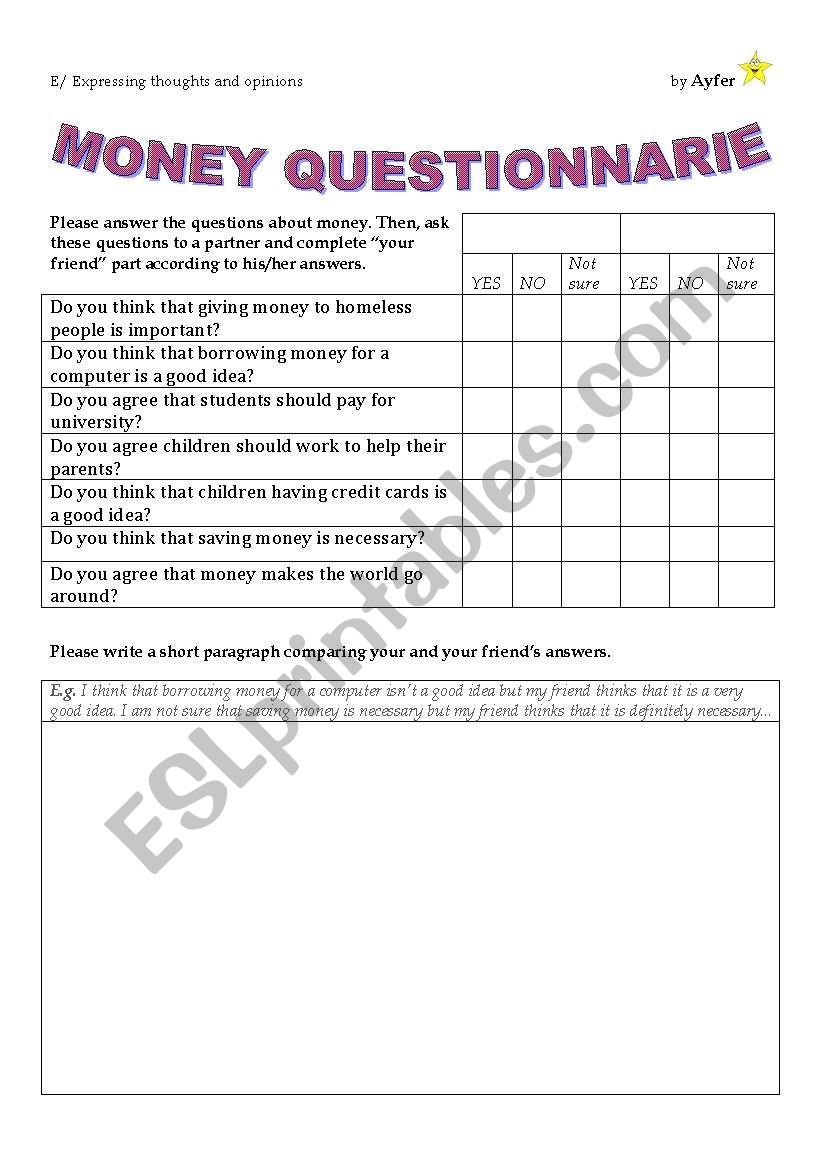

List key terms that are used in the lesson as either a conceptual learning focus or a functional, shared ... to answer the following questions: 1. Name as many credit cards as you can. ... compare three different types of credit cards. Each

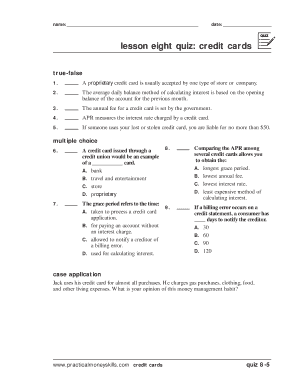

answer key www.practicalmoneyskills.com credit cards student activity key 8-2 A credit card statement provides information such as how and when you’ve used your credit card, how much you owe, how much interest you’re paying to use the card, how much your minimum payment is, and how much credit you have left.

b. When using a credit card, sign the back with a signature and "Please See I.D." c. Do not leave cards lying around. d. Never give out a credit card number unless making purchases. e. If you close a credit card account, notify the credit card company in writing and by phone, then cut up the card. f.

answer key www.practicalmoneyskills.com credit cards student activity key 5-2 A credit card statement provides information such as how and when you’ve used your credit card, how much you owe, how much interest you’re paying to use the card, how much your minimum payment is, and how much credit you have left.

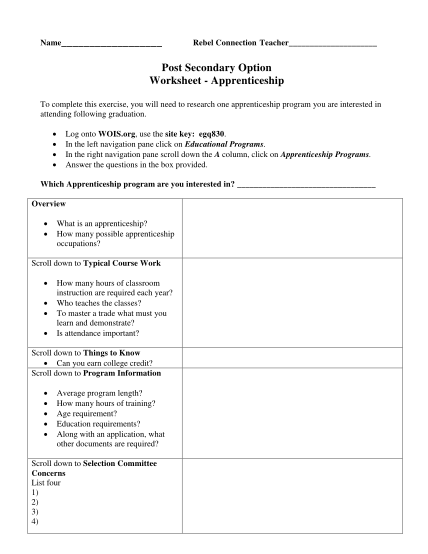

Differences between a bank account and a credit union; FDIC insurance, and what it means; Etc. All of these and more, can be taught with these free banking basics worksheets. Psst: pair these banking worksheets pdfs with over 50 banking activities for kids. 1. Econlowdown's Banking Basics Worksheet. Suggested Age: Middle School

Credit Card Comparison Worksheet Answers Finance In The finance in the classroom credit card comparison answer key is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below.

Determine what features they value in a credit card and then conduct online research to determine which credit cards best meet their needs; Compare and then select which card would be best for them ... Understand how to read a credit card agreement through a step-by-step analysis of the Schumer Box (Note: The Schumer Box summarizes key terms of ...

The fee, expressed as a percentage, a borrower owes for the use of a creditor's money. At an interest rate of 10%, a borrower would pay $110 for $100 borrowed.

Chart indicating appropriate age groups for the key learnings offered in each lesson ... Worksheets; Answer keys to worksheets (when necessary) Introductory Overview to Financial Literacy for High School Students ... These and other questions will be answered in this lesson as students learn about credit cards, and the different types of cards ...

Fillable Online Financeintheclassroom Credit Card Comparison credit card comparison finance in the classroom answer key is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below.

Answer Key Document Full Year Course: Answer Key Document Description: Refer to this document for all answer keys for activities, projects, case studies, and more that are included in Next Gen Personal Finance’s F ull Year Course . P lease do not share this document or individual answer keys with your students.

Worksheet June 21, 2018 08:58. Shopping for a credit card worksheet answers is a requirement that every American must follow. They can be helpful in helping you get the best cards and cash back offers that will suit your needs. They can also be used to help determine the amount of spending you can do with one card and at what price point.

Ngpf Worksheet Answers | TUTORE.ORG - Master of Documents from www.coursehero.com The answer key will be soon released by the board on the official website. The final answer key was released by analysing the challenges made by the candidates on the tentative. Submitted 12 months ago by abdgaming. Ngpf answers my pdf collection 2021.

Welcome to Finance in the Classroom. Providing high-quality personal finance materials for K-12 educators, students and parents, Finance in the Classroom is the place to help you prepare Utah's youth to be money smart. Scope and Sequence.

0 Response to "41 credit card comparison worksheet answer key"

Post a Comment