38 fannie mae rental income worksheet

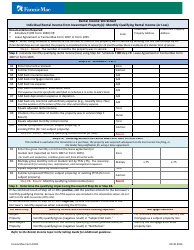

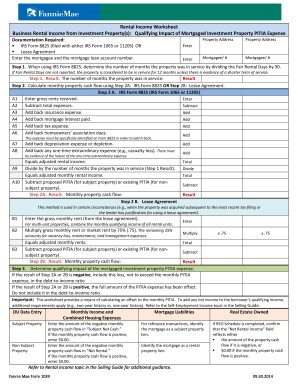

Even if your application for a mortgage was rejected in the past, you might be approved now. Fannie Mae will include rent-payment history as part of their underwriting process, making it easier for borrowers to qualify for mortgages—startin... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair ...

Fannie Mae. Posted: (4 days ago) Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ...

Fannie mae rental income worksheet

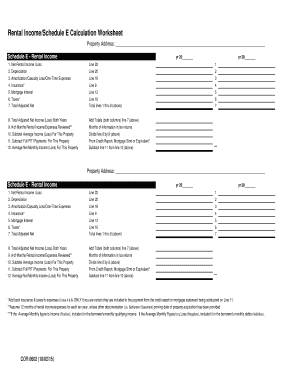

Fannie Mae's new refinance program "RefiNow" is scheduled to launch June 5, available for qualifying homeowners with a Fannie Mae-owned mortgage. Low-income households could potentially save hundreds... Many of the offers appearing on this ... COR 0602 Rental Income/Schedule E Calculation Worksheet 10/02/2015 COR 1404 Salaried/Hourly Income Calculation Worksheet 08/07/2020 Fannie Mae Form 1084 Fannie Mae Cash Flow Analysis 06 /20 1 9 Freddie Mac Form 91 Freddie Mac Income Calculations(Income Analysis Form) 05/01/2019 . Rental Income Worksheet - Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ...

Fannie mae rental income worksheet. (As of August 31, 2021)If you are an individual who can demonstrate that you’ve lost income due to COVID... The Federal Housing Finance Administration (FHFA) announced on May 4, 2020, that Fannie Mae and Freddie Mac... the Rental Registry. There cannot be any outstanding code violations for the property for which rent is... Monthly qualifying rental income (loss): Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I and rental agreements (in English or Spanish) collect and return deposits handle repairs, minimize your... Use this top-selling book to: screen and choose tenants prepare leases and rental agreements avoid... Applicants Rental Application Consent to Contact References and Perform Credit Check Tenant References Notice of Denial... Leases & Rental Agreements Add to... 99 Leases & Rental Agreements Add... 99 Leases & Rental Agreements Add... Fannie Mae Form 1039 02/23/16. Rental Income Worksheet Documentation Required: Enter If Fair Rental Days are not reported, the property is considered to be in service for 12 months unless there is evidence of a shorter term of service. Result A1 A2 Subtract A3 Add A4 A5 A6 A7 A8 Equals adjusted rental income. Total A9 Divide Equals adjusted monthly rental income A10 B1

Schedule E - Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below. View student reviews, rankings, reputation for the online MAE from Cumberland University The online Master of Arts in Education helps teachers gain inspiration to teach while developing advanced skills in the classroom and expanding their u... Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was ... To ensure a productive conversation, take the time to prepare before you reach out by having all documentation about your mortgage, income and debts ready, along with a brief explanation and evidence of your financial hardship. If you’re planning to buy a home If homeownership is in your future plans, our housing counselors... Skip to Content Toggle Menu Search Loan Look-Up Tool Find out if Freddie Mac owns your loan. Glossary of...

WASHINGTON (MarketWatch) -- Worsening housing market conditions and credit-market turmoil dragged down Fannie Mae's earnings in the first three quarters of... WASHINGTON (MarketWatch) -- Worsening housing market conditions and credit-market... cartolina dalla vacanza ... Design by Gio&Vi Mitopositano com - NewsManciano - Saturnia - indexvecchia - index cogn - Hotels of the world - Agriturismi Vacanze cardomino Vacanza Costiera Amalfitana Vacanze a Positano in hotel a prezzi economici - Music - francaise - viaggi - Musica - vocabolivocname Agriturismo Toscana Trascorri una vacanza nella natura incontaminata della Toscana, tra Arezzo e Siena. Cartoline . lubiam - deutsche - chicago - singer - ulla - ulix - chico - zorn - spano - zorneng - ruski - med - nomivie gal Use our paperwork to get the advantage in your dealings with government, IRS, courts and corporations. Eliminate Credit Card Debt NO BANKRUPTCY, Credit Cleanup, Fresh Credit Start, Asset Protection, B Fannie Mae expands the liquidity of the mortgage market and helps low- to moderate-income borrowers obtain financing for a home. Fannie Mae—known officially as the Federal National Mortgage Association (FNMA)—is a government-sponsored enter...

Started by the federal government in the 1930s, Fannie Mae is now a privately-held mortgage lending company. It does not lend directly to home buyers, but it does provide funds to third-party lenders to loan to borrowers who want to buy a h...

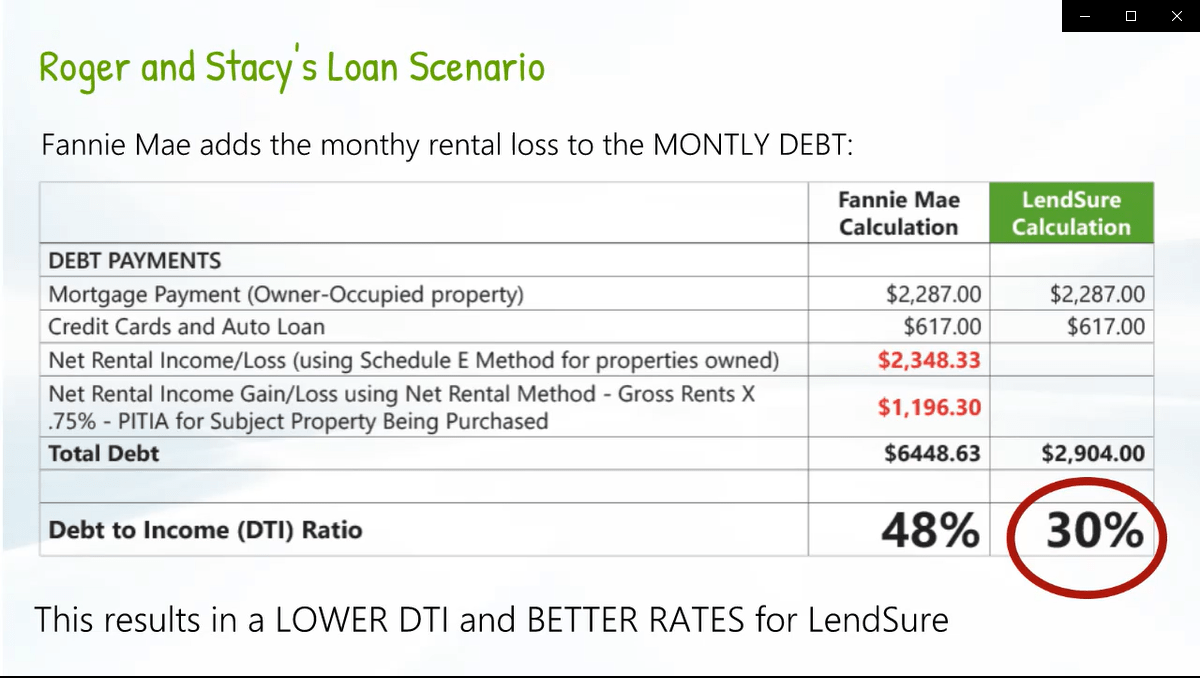

Fannie Mae HomeReady; Ready, Set, Go… FHA. Low down payment, higher debt to income ratios and flexible credit requirements makes FHA a great option for first time homebuyers and those who may not qualify for a conventional product. Pair this with our TPO GO 100 Chenoa product and make sure every borrower can get a loan.

Schedule E - Supplemental Income and Loss . Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Home Current: Blog share Freddie Mac Blog Helpful information and tips on buying, owning or renting a home and the housing market6 Tips to Help Avoid Rental Scams Although it is impossible to avoid encountering a fraudulent rental listing, following these tips can help ensure you don’t... Tool Rental Lookup Tool CreditSmart Our Company About Freddie Mac Our Business...

Fannie Mae Rental Income Worksheet search trends: Gallery Guidelines calculation calculate perfect images are great Calculation calculate expense photos taken in 2015 Very nice work, photo of calculate expense property Expense property schedule e perfect images are great Nice one, need more property schedule e net images like this

Fannie Mae's Tenants in Place program allows current renters in foreclosed homes to remain in the property. Owners in foreclosure can also rent back their homes from Fannie Mae if they successfully complete one of the agency's mortgage rele...

Enter the amount of the monthly qualifying income (positive result) or monthly qualifying loss (negative result) in “Net Rental.” Identify the mortgage as a rental property lien. Refer to the Rental Income topic in the Selling Guide for additional guidance. +-+ + + + = + = / =-Click the gray button to calculate the adjusted monthly rental income.

: 0-50231 Federal National Mortgage Association (Exact name of registrant as specified in its charter) Fannie Mae Federally chartered corporation (State or other... 170 Note 11—Income Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . 176 Note 12—Employee Retirement...

Schedule E - Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

If you’re on the hunt for a new home, you’ve probably heard of the mortgage funding powerhouse Fannie Mae as you’ve started looking into your financing options for this life-changing purchase. Fannie Mae is a government enterprise that help...

Enter the amount of the monthly qualifying income “Subject Net Cash.” Enter the amount of the monthly qualifying income “Net Rental.” Include as the borrower’s primary housing expense. For refinance transactions, identify the mortgage as a subject property lien. Include as the borrower’s primary housing expense. 3A Add the monthly qualifying rental income to the borrower’s monthly qualifying income. 3B

Whether you’re starting the process of mortgage shopping in your quest for a new home or you’ve watched your fair share of news reports about the economy, you’ve likely heard of Freddie Mac and Fannie Mae. Their names don’t give away too mu...

Rural Affordable Rental Housing: Quantifying Need, Reviewing Recent Federal Support, and Assessing the Use of Low Income Housing Tax Credits in Rural Areas Andrew M. Dumont 2018-077 Please cite this paper as: Dumont, Andrew M. (2018). “Rural Affordable Rental Housing: Quantifying Need, Re- viewing Recent Federal Support, and...

Get and Sign. Fannie Mae Rental Income Worksheet 2014-2022 Form. To be in service for 12 months unless there is evidence of a shorter term of service. Step 1. Result: The number of months the property was in service: Result Step 2 Calculate the monthly qualifying rental income using Step 2A: Schedule E OR Step 2B: Lease Agreement or Form 1025.

Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a.

Use fannie mae rental income worksheet s Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E. All you need is smooth internet connection and a device to work on. Schedule e irs form 1040 or lease agreement or fannie mae form 1007 or form 1025 enter investment property address step 1.

As with any home purchase, negotiating Fannie Mae HomePath property is possible, but not likely. You'll often find you're competing with other offers, which means you'll lose out to someone willing to pay more. You can sometimes negotiate t...

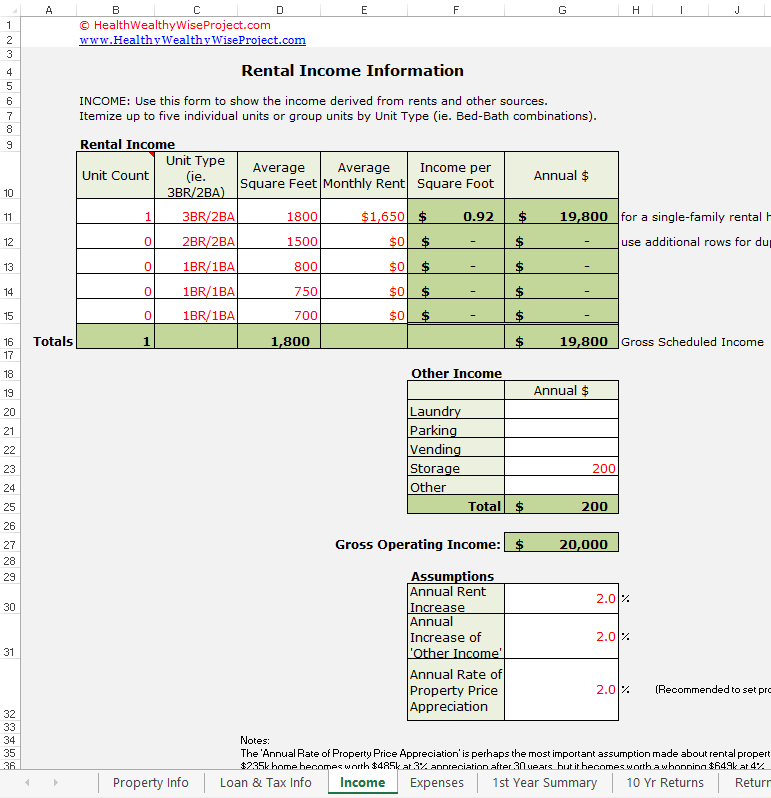

Posted: (1 days ago) Jul 10, 2021 · Month-to-month fannie mae rental income worksheet is a straightforward economical manager tool that could be use both Digital or printable or Google Sheets. If you utilize the Digital template, you can also make fannie mae rental income worksheet on Microsoft Excel.

Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to ...

documentation as indicated above and execute Fannie Mae 1019 HomeReady Non-Borrower Income Worksheet. RENTAL INCOME FROM THE SUBJECT PROPERTY Rental income is an acceptable source of qualifying income in the following instances: - One-unit principal residence with an accessory unit. - Two-to four-unit principal residence properties BOARDER INCOME

Aug 27, 2020 · Fannie Mae Primary Conversion Guidelines - Rental Income on a Departure Property. Fannie Mae's guidelines are straight forward and less nuanced than Freddie's. Fannie Mae allows 75% of the documented rents as reported on the lease or Form 1007 or Form 1025 to be used.

YTD P&L and Business Statement Analysis. Use our flow chart to guide you in applying temporary COVID-19 agency guidelines and determining a stable monthly income. Download Worksheet (PDF) Ask 2. Save 10. Handout. Here are two simple questions to ask self-employed borrowers, so you can save 10. Download Worksheet (PDF)

A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F - Profit or Loss from Farming a. Net Farm Profit or Loss (Line ...

The rental income may be considered effective if shown on the consumer's tax return. If not on the tax return, rental income paid by the roommate or boarder may not be used in qualifying. 4. Documentation Required To Verify Rental Income. Analysis of the following required documentation is necessary to verify all consumer rental income: a.

Get And Sign Fannie Mae Income Worksheet 2014-2021 Form Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025.

However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as ordinary income on Form 4797. Use Part III of Form 4797 to figure the amount of ordinary income recapture. The recapture amount is included on line 31 (and line 13) of Form 4797. See the instructions for Part III. If the...

Return of Partnership Income Department of the Treasury Internal Revenue Service Section references are to... 17 Income ................. 18 Deductions .............. 19 Schedule B. Other Information ............ 24... 32 Flowchart To Help Determine if Items Are Qualified Business Income ............... 48 Analysis of Net...

Mortgage Worksheet Rental Income Worksheet - Principal Residence, 2- to 4-unit Property Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 4 properties) Rental Income Worksheet - Individual Rental Income from Investment Property(s) (up to 10 properties) Rental Income Worksheet - Business...

, HUD/FHA or USDA), purchased or securitized by Freddie Mac or Fannie Mae, or who are receiving assistance... emergency rental assistance funds. It is important to research how those requirements might affect you.... household income, incurred significant costs, or experienced a financial hardship due to COVID-19; (ii)...

Fannie Mae Rental Income Worksheet . the transaction is a purchase or the property was acquired subsequent to the most receIf Fair Rental Days are not reported, the property is considered to be in serviceCalculate the monthly qualifying rental income using Step 2A: Schedule Eetermine the number of months the property was in service byEnter the amount of the monthly qualifying income in-time ...

Partner's Instructions for Schedule K-1 (Form 1065) (2020) Partner's Share of Income, Deductions, Credits... gross income under section 703 unless the partnership and the partner are treated as a single employer under... partnership's income, deductions, credits, etc. Keep it for your records. Do not file it with your tax... Limitations Worksheet for Adjusting the Basis of a... Other Net Rental Income (Loss) Box 4a. Guaranteed...

Fannie Mae Form 1039 09.30.2014 Refer to Rental Income topic in the Selling Guide for additional guidance. Rental Income Worksheet Business Rental Income from Investment Property(s) : Qualifying Impact of Mortgaged Investment Property PITIA Expense . Documentation Required: IRS Form 8825 (filed with either IRS Form 1065 or 1120S) OR

Fannie Mae Form 1038 "Rental Income Worksheet" Posted: (5 days ago) Sep 30, 2014 · Download Printable Fannie Mae Form 1038 In Pdf - The Latest Version Applicable For 2021. Fill Out The Rental Income Worksheet Online And Print It Out For Free. Fannie Mae Form 1038 Is Often Used In Federal National Mortgage Association (fannie Mae), Financial Worksheet Template, United States Federal Legal ...

Borrowers may use foreign income to qualify if the following requirements are met. Copies of his or her signed federal income tax returns for the most recent two years that include foreign income. The lender must satisfy the standard documentation requirements based on the source and type of income as outlined in Chapter B3-3, Income ...

Fannie Mae HomeReady and Freddie Mac Home Possible allow down payments even lower than those through the FHA. And income limits don’t apply if you’re a first-time buyer.

What causes otherwise smart, even super-intelligent, people to take leave of their senses and do really dumb things? What causes otherwise smart, even super-intelligent, people to take leave of their senses and do really dumb things? I wish...

Rental Income Worksheet - Business Rental Income from Investment Property(s) . Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the ...

COR 0602 Rental Income/Schedule E Calculation Worksheet 10/02/2015 COR 1404 Salaried/Hourly Income Calculation Worksheet 08/07/2020 Fannie Mae Form 1084 Fannie Mae Cash Flow Analysis 06 /20 1 9 Freddie Mac Form 91 Freddie Mac Income Calculations(Income Analysis Form) 05/01/2019 .

0 Response to "38 fannie mae rental income worksheet"

Post a Comment