38 gross pay vs net pay worksheet

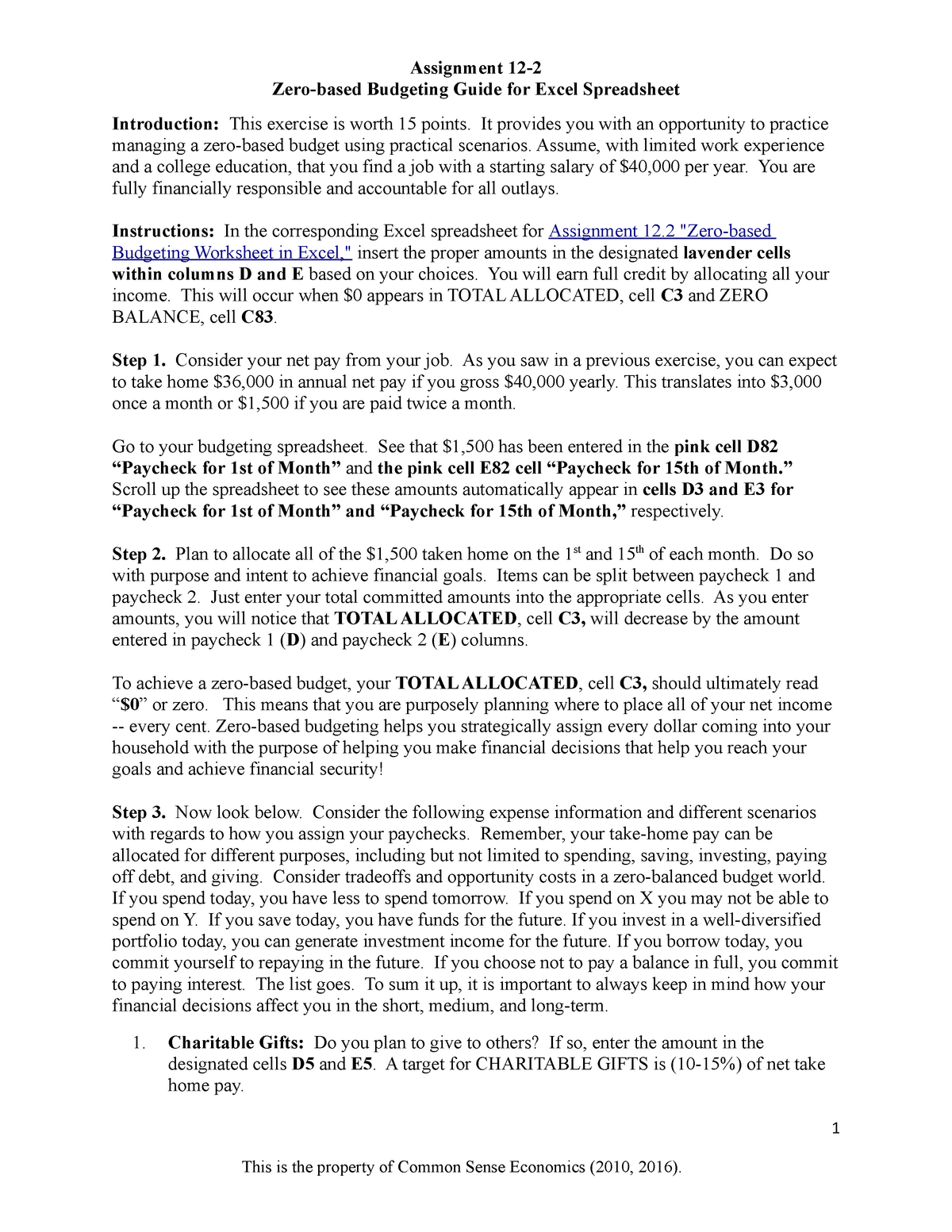

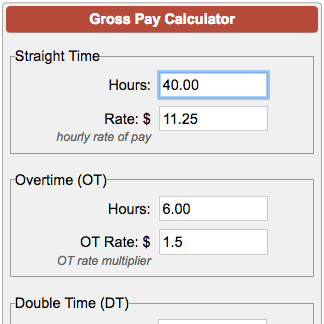

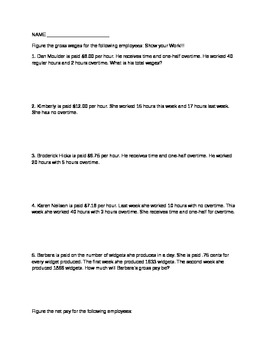

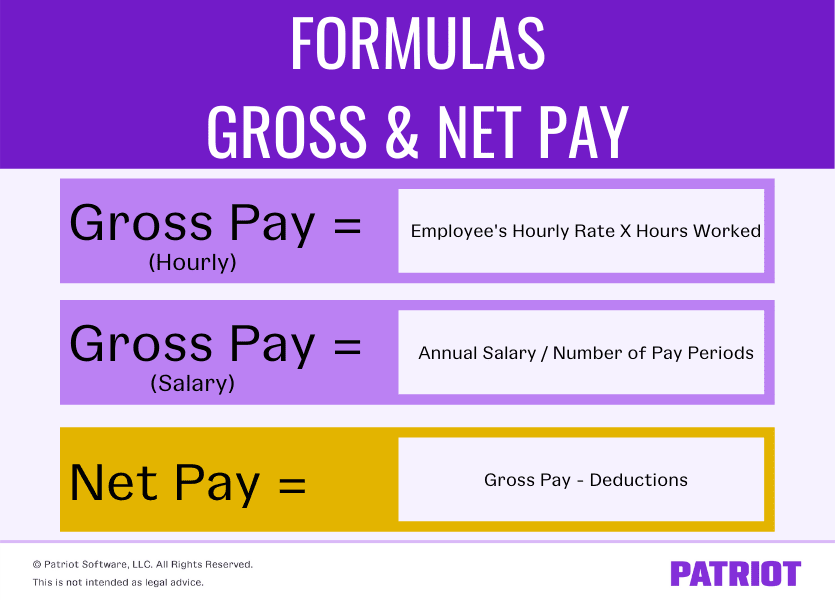

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a … If last week she worked 46 hours, calculate her net pay. Regular Pay: Over- time Pay: Gross Pay: Deductions: Deduction x Factor Amount.2 pages

1) Sandra earns $13.50/hour and works 32 hours. Determine gross pay_______________________________. (hint hourly rate x hours worked). Gross Pay: Deductions:.3 pages

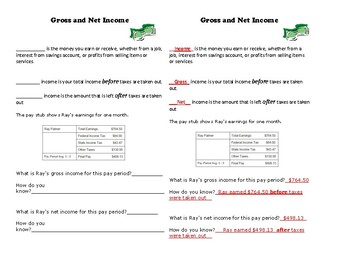

Gross pay vs net pay worksheet

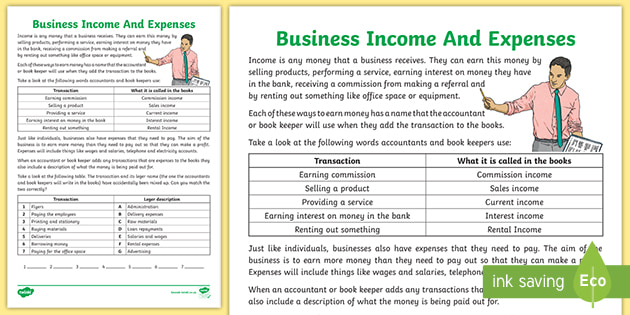

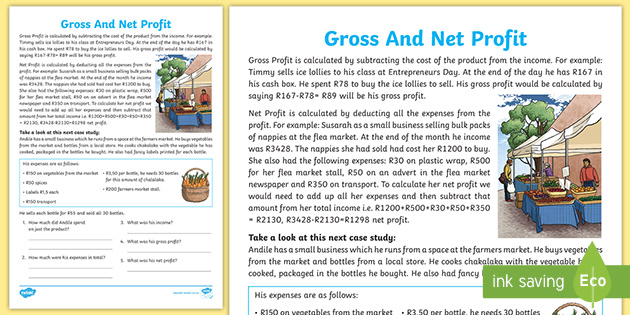

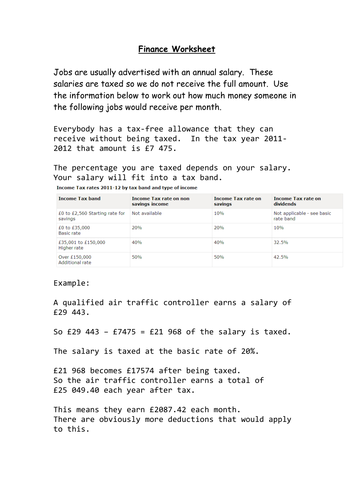

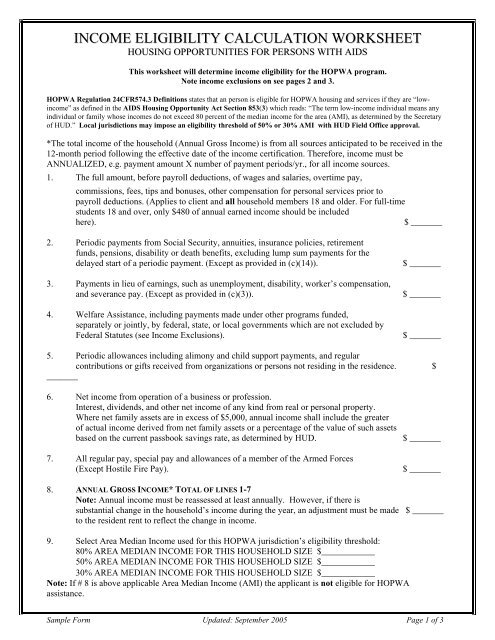

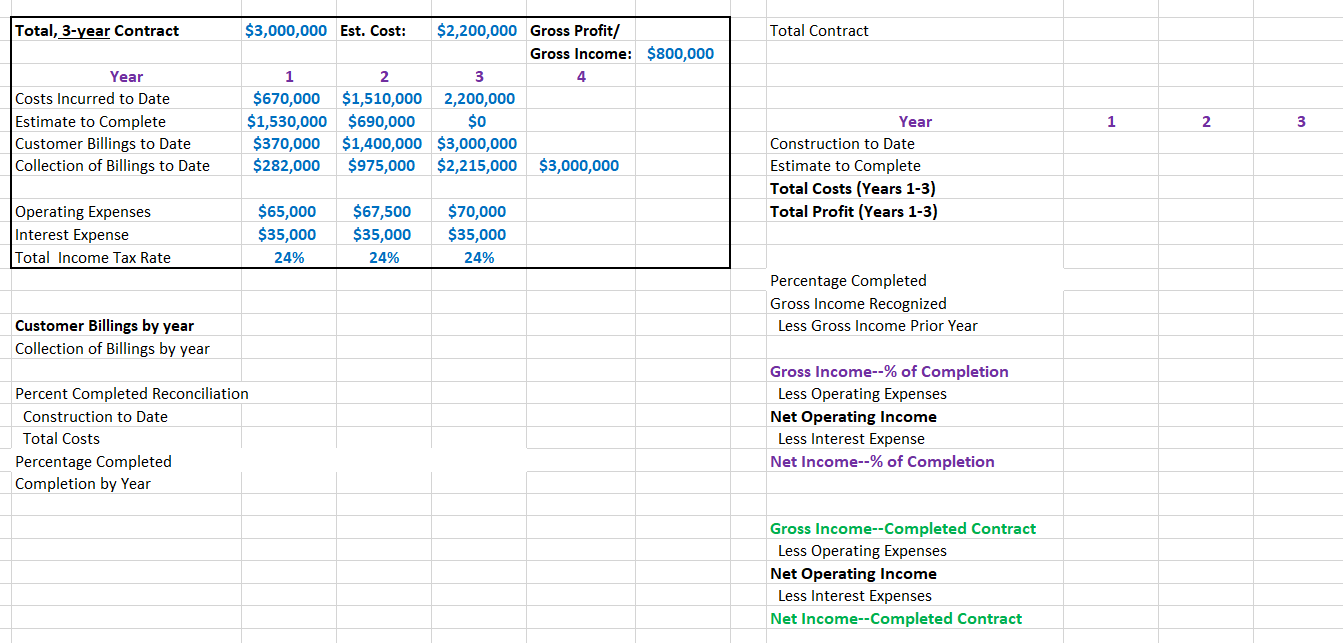

24/09/2018 · Gross Income Versus Federal Taxable Gross. Your gross income is all of the money you have coming to you, including your salary, your … Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). Support Guidelines Worksheet and the Income Table. The Income Table lists the Monthly Gross Income, Net Income, and Standard Of Living Allowance (SOLA) Income. It also calculates 70% of Net Income. Gross Income is the total of all incomes of the parent averaged on a monthly basis before taxes, Social Security and other deductions.

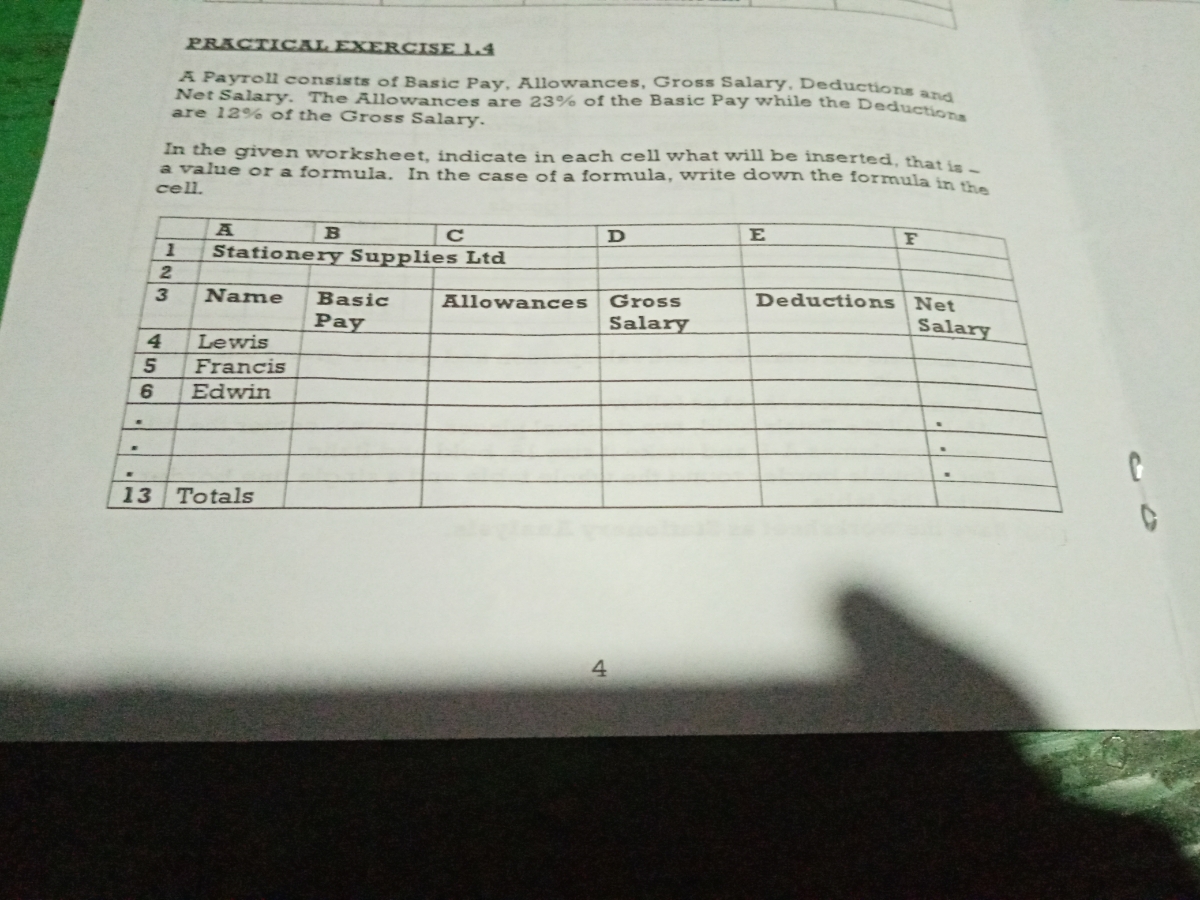

Gross pay vs net pay worksheet. you take home. 2. What is the difference between Hourly Wages and Salary? • Hourly you get paid for the hours you work, including ...4 pages A lender will consider what a business made in net profit, not gross profit. For instance, a pet shop owner pulled in $80,000 last year in revenue. Not bad, right? But the business also had to pay rent, supplies, utilities and insurance to the tune of $30,000 last year. So a lender will only consider $50,000 in profit as real income. Worksheet and lesson to learn to read the IRS W-2 tax form, a basic wage and tax statement used by employers. Understand reported income and taxes. EARNINGS STATEMENT. Earnings Statement. Practice reading an earnings statement, also known as a paycheck or pay stub, and answering related questions. Gross Pay, Net Pay. & Required Deductions | 4-6. Exercise 1, Filling out Form W-4 | 7. Worksheet 1, Form W-4 | 8. Exercise 2, Questions | 9.32 pages

making calculations related to personal finance (e.g., wage rates, paycheck deductions, taxes). Vocabulary. Gross pay. Commission. Salaried. Net pay.11 pages Military Pay - All military pay and allowances shall be included as gross income for determining child support (see Rose vs. Rose, 107 S.Ct. 2029 (1987)). a. All service members receive Basic Allowance for Quarters (BAQ) and Basic Allowance for Subsistence (BAS) or live in government accommodations and eat at mess halls for free. 14/07/2021 · Blog » Heat Pump vs Furnace Calculator for Natural Gas Replacement. Heat Pump vs Furnace Calculator for Natural Gas Replacement. Updated July 14th, 2021 by Nomer Caceres. Posted in News - 9 Comments. A MassLandlords air source heat pump vs furnace calculator has been developed to help owners, managers, and builders evaluate operational … understand the difference between gross and net pay. • identify taxes and deductions taken ... Calculating Monthly Gross & Net Pay worksheet (1 per student).10 pages

Known Issue: Career Sea Pay Premium (CSPP) for TACLETs - SPOs must submit trouble tickets to have CSPP pay out for CSPP eligible TACLET members who go TDY to a ship. Also see: CG-2036, Career Sea Pay Premium Worksheet. Career Sea Pay Premium: 12/09/2020: 12/09/2020 : Combat Tax Exclusion: Combat Tax Exclusion: 09/29/2017: Start, Stop, Delete 04 ... Another caveat: substantial capital gains can increase your adjusted gross income, possibly changing the amount of tax benefits you receive for various deductions and credits. When to make estimated tax payments. You should generally pay the capital gains tax you expect to owe before the due date for payments that apply to the quarter of the sale. Support Guidelines Worksheet and the Income Table. The Income Table lists the Monthly Gross Income, Net Income, and Standard Of Living Allowance (SOLA) Income. It also calculates 70% of Net Income. Gross Income is the total of all incomes of the parent averaged on a monthly basis before taxes, Social Security and other deductions. Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

24/09/2018 · Gross Income Versus Federal Taxable Gross. Your gross income is all of the money you have coming to you, including your salary, your …

0 Response to "38 gross pay vs net pay worksheet"

Post a Comment