40 clergy tax deductions worksheet

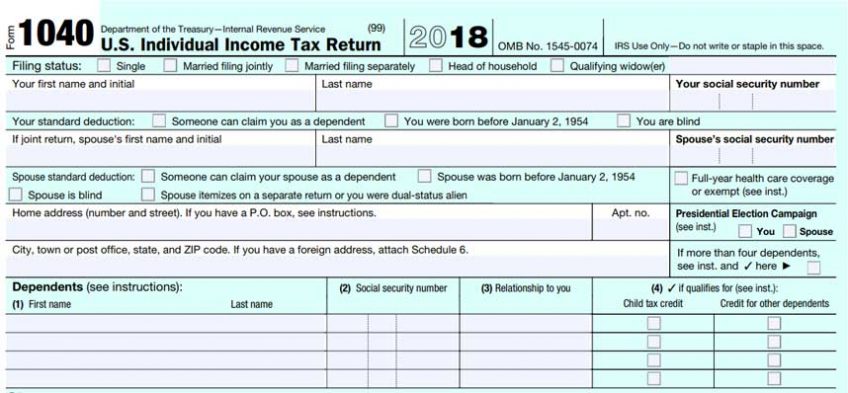

IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income) the allowable deduction of expenses for church-related income reported on Schedule C (Worksheet 2, Figuring the Allowable Deduction of Schedule C or C-EZ expenses) How a member of the clergy or religious worker figures net earnings from self-em-ployment. This publication also covers certain income tax rules of interest to ministers and members of a religious order. In the back of Pub. 517 is a set of work-sheets that you can use to figure the amount of your taxable ministerial in-come and allowable deductions.

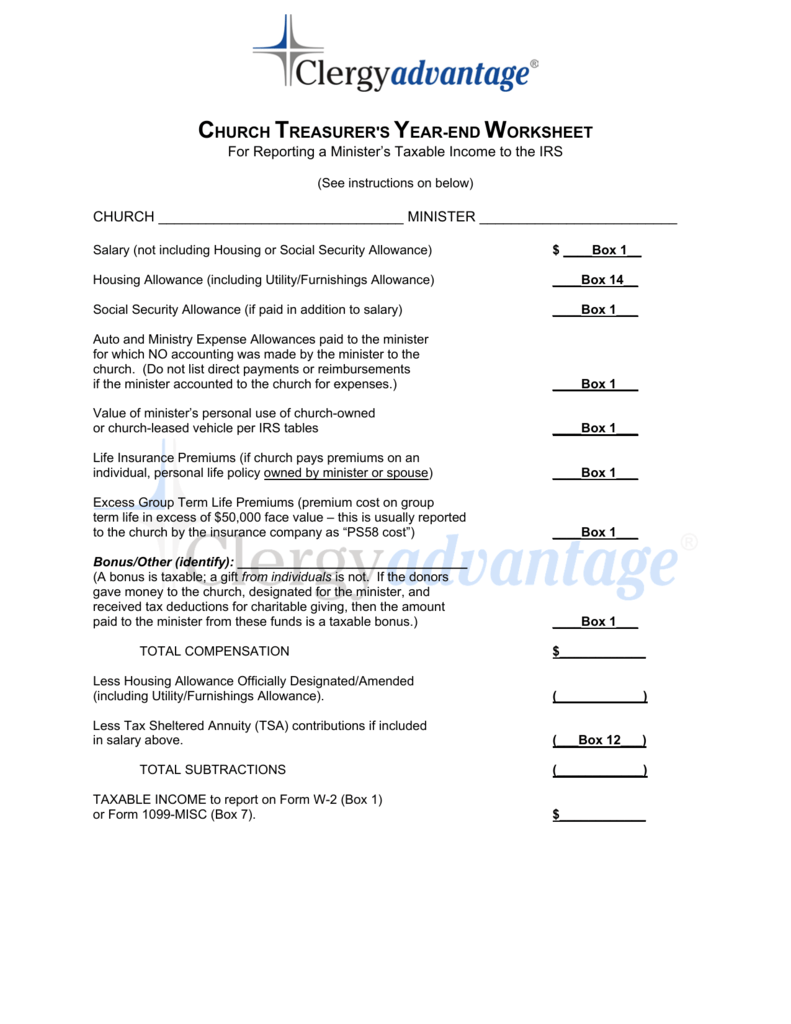

tax resource guide entitled, Ministers' Taxes Made Easy. ... Housing Allowance Worksheet - Minister Living in Home Owned or Rented by Church…….Pg. 5.7 pages

Clergy tax deductions worksheet

Infirm - Hospital Visits. Rent - Home. Outings - Congregation. Repairs - Home. Parishioner Meetings. Taxes - Home. Visitation. Utilities - Home. Weddings.1 page CLERGY BUSINESS EXPENSES (continued) EQUIPMENT PURCHASED Musical instruments, office equipment, office furniture, professional library, etc. Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Business Use Other Information 1099s: Amounts of $600.00 or more paid to individuals (not Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church. Neither a cash allowance (to the extent it is used to pay for home

Clergy tax deductions worksheet. Basics of Clergy Taxation Q3. What are the key federal tax provisions that apply to clergy compensation? A3. The key provisions include the following: Self-employment tax. Clergy are not eligible to have FICA taxes withheld from their church compensation. In lieu of FICA taxes, clergy pay self-employment tax, also known as Self-Employment ... Jan 23, 2022 · Clergy tax deductions worksheet. The 2018 Tax Laws may affect most of our pastors. The 2018 Tax Laws may affect most of our pastors. The Standard Deduction for 2018 will double to $24,000 (married filing jointly), which will affect most pastors on them deducting certain items (mileage, dues, ministry expenses, etc) from their Schedule A. Beginning on January 1, 2018, Unreimbursed Business Expenses are gone! Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church. Neither a cash allowance (to the extent it is used to pay for home CLERGY BUSINESS EXPENSES (continued) EQUIPMENT PURCHASED Musical instruments, office equipment, office furniture, professional library, etc. Item Purchased Date Purchased Cost (including sales tax) Item Traded Additional Cash Paid Business Use Other Information 1099s: Amounts of $600.00 or more paid to individuals (not

Infirm - Hospital Visits. Rent - Home. Outings - Congregation. Repairs - Home. Parishioner Meetings. Taxes - Home. Visitation. Utilities - Home. Weddings.1 page

0 Response to "40 clergy tax deductions worksheet"

Post a Comment