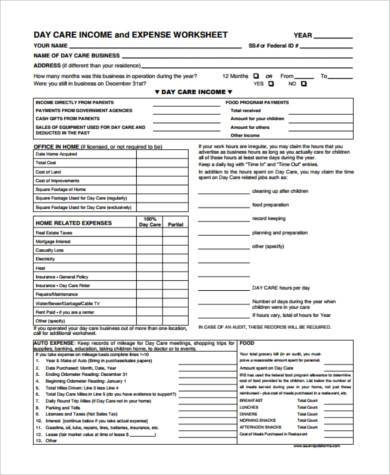

41 daycare income and expense worksheet

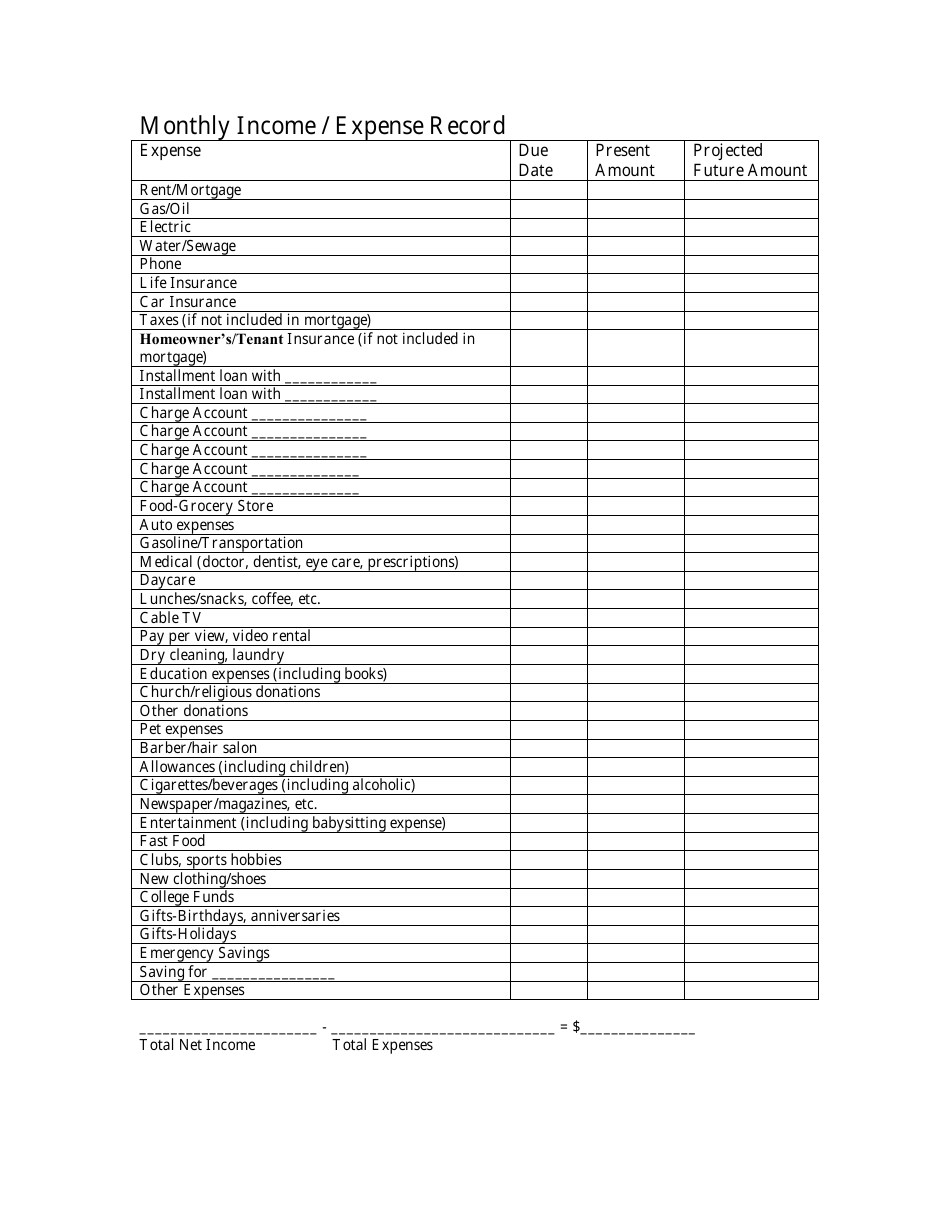

Sq. Ft of Residency Sq. Ft of Daycare PROVIDER MONTHLY INCOME WORKSHEET To Determine Income Qualification Last Month's Gross Household Income: Parent Fees For Day Care (provide copy of payment records) $ Salary received from Outside Employment (provide copy of last paystub) $ Child Support (provide copy of court decree) $ Other Household Income Get help with your American Fidelity account, insurance products, and reimbursement accounts. Find tutorials, contact information, steps for filing a claim, and additional resources.

Monthly Income & Expenses Worksheet: This sheet helps us determine your monthly earnings from your child care home. Use figures from last month to answer each question. If last month does not reflect an average month, use the most recent month which does.

Daycare income and expense worksheet

daycare expense income Daycare Income And Expense Worksheet - Worksheets are a crucial portion of researching English. Toddlers study in numerous ways and interesting them with coloring, drawing, workouts and puzzles really facilitates them grow their language skills. 11.03.2018 · Florida has a table of income levels that determine the amount of child support for a given number of children. The primary figure used to calculate support is the income of both parents. Certain expenses also go into the calculation such as taxes, health insurance, and employment related daycare costs. A popular misconception is that household expenses can … No, I haven't been closed so far this year; Yes, I was closed for a week or less; Yes, I was closed for one-four weeks; Yes, I was closed for 1-2 months

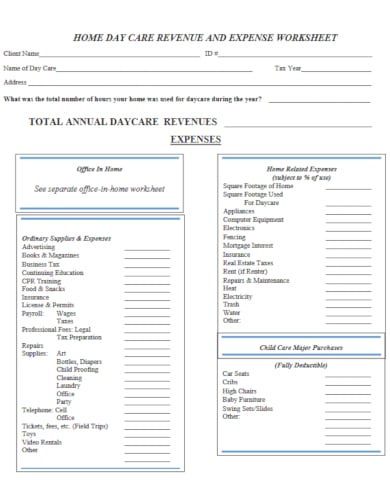

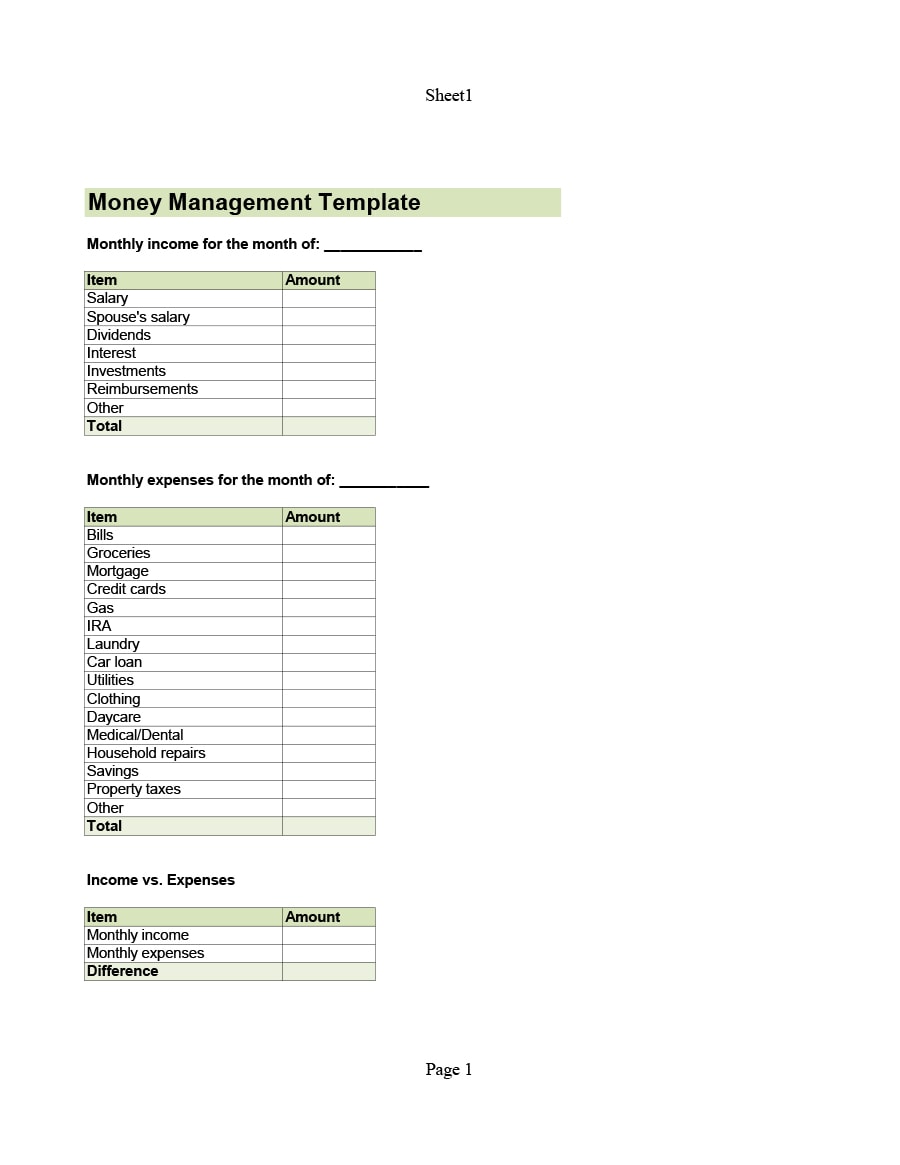

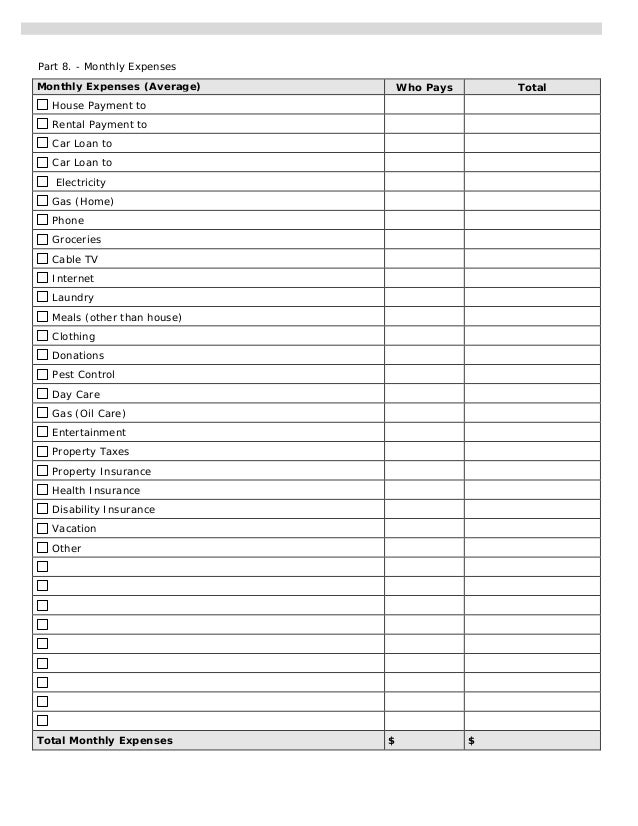

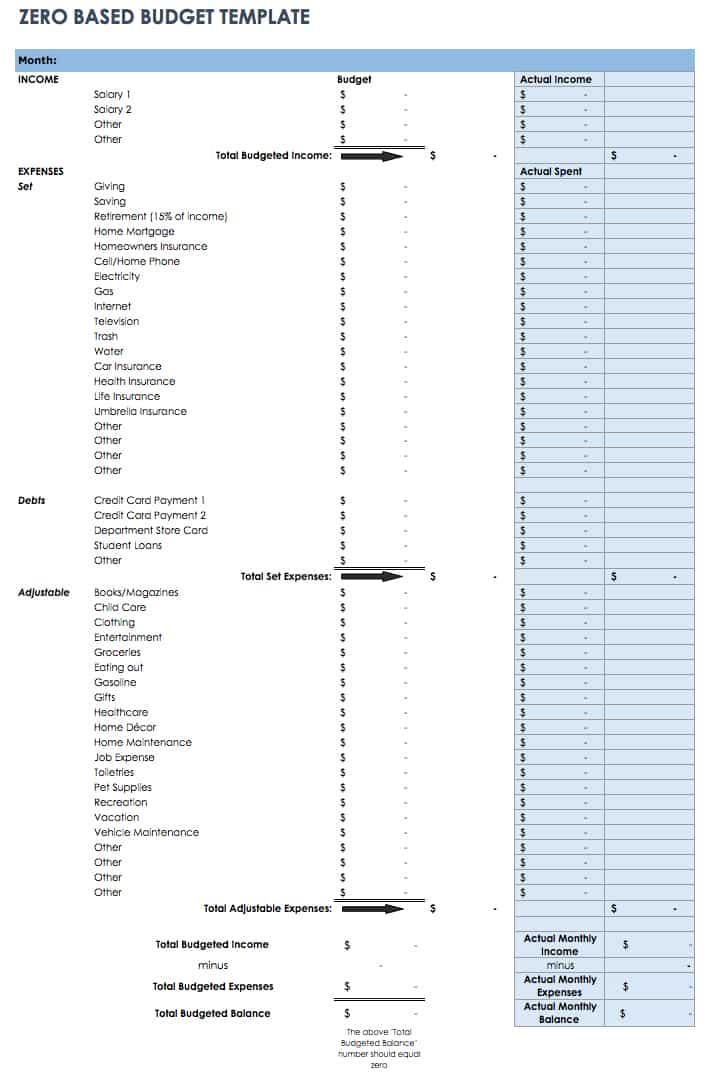

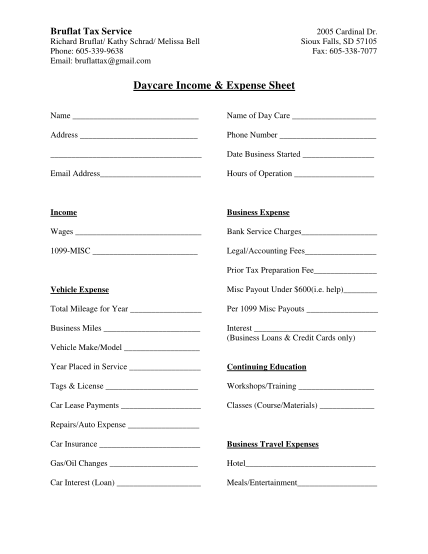

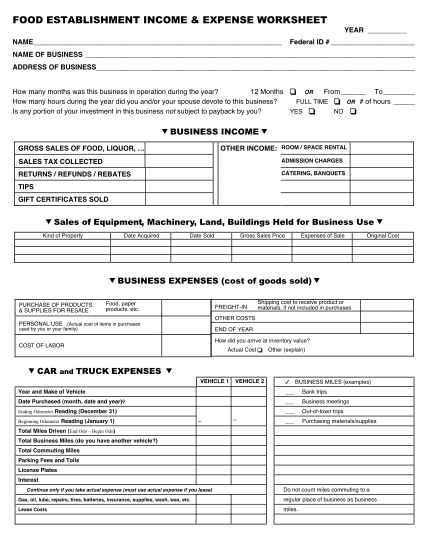

Daycare income and expense worksheet. Daycare recordkeeping means you will need to track all income and expenses. Save ALL receipts, even for those items you will not be deducting on your tax forms. When I was audited several years ago I was asked to provide information that was not on my tax return. They wanted proof of expenses for items I did not claim. Day care statement of income and expenses client name: This is based on the number of hours you spend operating the daycare and the percentage of space the daycare takes up in your home compared to the home's total square footage. If you take expense on mileage basis complete the following lines auto 1 auto 2 auto 3 year & make of auto (bring in 12.04.2021 · I chose these printable budget worksheet links for a variety of reasons. Each sheet or set covers other budget needs – not just your monthly expense budget. I also chose based on looks. It really is more fun to use printable budget worksheets when you love what you’re writing on and working with. 1. Printables By Design Budgeting Printables sun crest tax service llc 3112 southway dr st. cloud, mn 56301 (320)253-3160 day care income and expense worksheet tax year _____ providers name _____

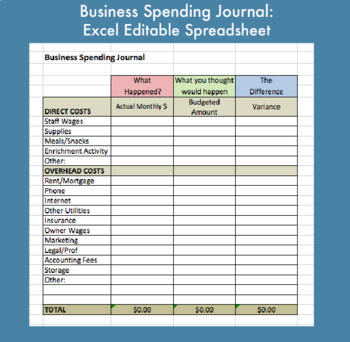

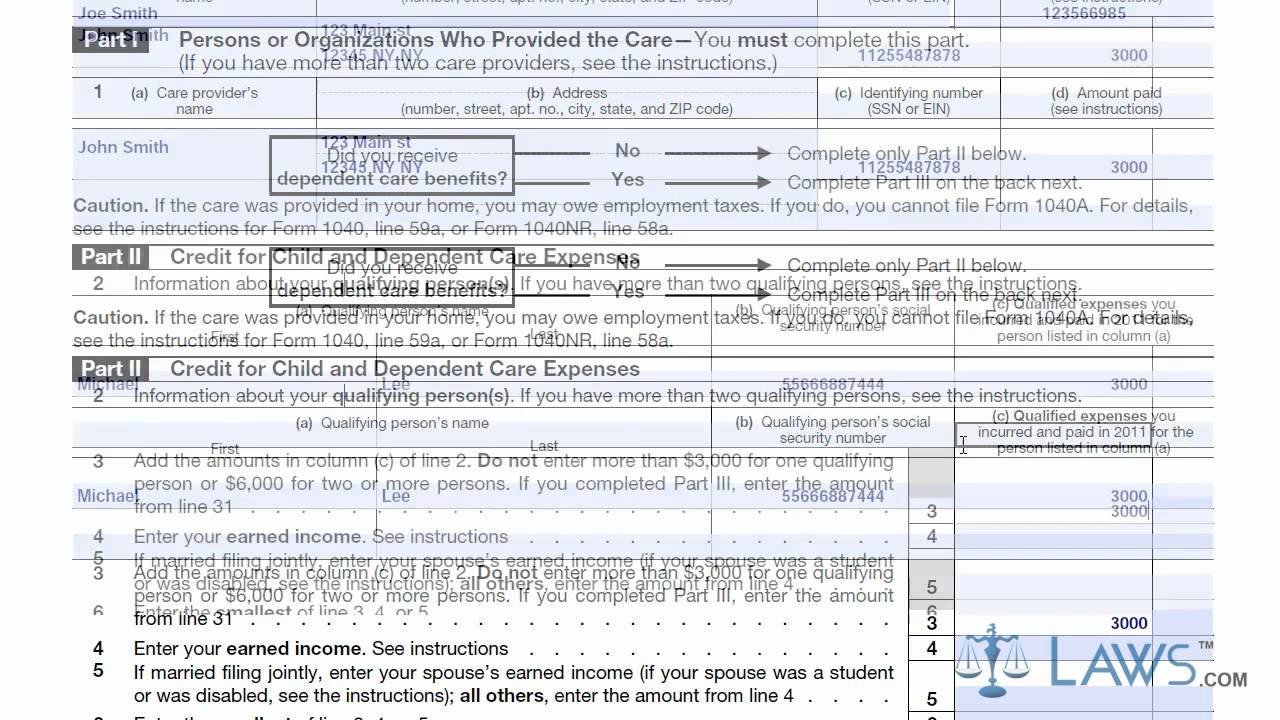

For example, the Daycare Credit starts as 35% of the expense for families who make less than $15,000, but that 35% shrinks by one percentage point for every $2,000 more you make in income. As with deductions, your tax filing software or tax accountant will walk you through all these specific rules to see how much of a credit you qualify for. You can also find information … Ensure the details you add to the Daycare Income And Expense Worksheet is updated and accurate. Include the date to the sample with the Date option. Select the Sign tool and make an electronic signature. You can find 3 available choices; typing, drawing, or capturing one. Make sure that each area has been filled in properly. Open your spreadsheet or worksheet application. Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New". Once you do that, click on the "Available Templates" option and choose "Blank Workbook". You can include both your income and expense spreadsheets in the same workbook. An Expense Statement is not required in cases that can be determined pursuant to the guidelines unless a party avers unusual needs and expenses that may warrant a deviation from the guideline amount of support pursuant to Pa.R.C.P. Income and expense statement pa child support. 1910.16-6: child care expenses, health insurance premiums ...

Title: Daycare Income & Expense Worksheet Author: Cindy Laptop Last modified by: Cindy Created Date: 10/11/2010 9:28:00 PM Company: Olson Accounting Daycare income and expense worksheet. For printable income and expense worksheets, click on the highlighted links below. Home Daycare Income Worksheet. Home Daycare Expense Worksheet . Record keeping software. If you like to use technology to help you, you can make excel spreadsheets to keep your records on. Working on your income and expenses worksheet is always a great idea. Doing so will help you in planning out your budget for the next month. You can also estimate the amount of money you can spend for the whole month by calculating your expenses at the end of each day. It can also help you track where your expenses have gone to and how much money you withdrew. Daycare Expense Worksheet | Print | Email . Below are forms and worksheets to help you keep track of your expenses: Daycare Expense Worksheet (.xls) Daycare Expense Worksheet (.pdf) Daycare Expenses Spreadsheet (.xls)

16.10.2021 · Deducting Summer Camps and Daycare with the Child and Dependent Care Credit. Tax Deductions for Funeral Expenses. TaxCaster Tax Calculator . Estimate your tax refund and where you stand Get started. Tax Bracket Calculator. Easily calculate your tax rate to make smart financial decisions Get started. W-4 Withholding Calculator. Know how much to withhold from …

04.11.2021 · For tax year 2020, the CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit as well as the Earned Income Tax Credit (EITC). How to file Form 8812. First, complete the Child Tax Credit and Credit for Other Dependents Worksheet that applies to you. You ...

Showing top 8 worksheets in the category - Monthly Daycare Expence. Some of the worksheets displayed are Day care income and expense work, Day care providers work, Day care income and expense work year, Monthly income expense work early, Family child care provider or child care center owner, Monthly budgeting work, Day care providers work, Family child care net income work.

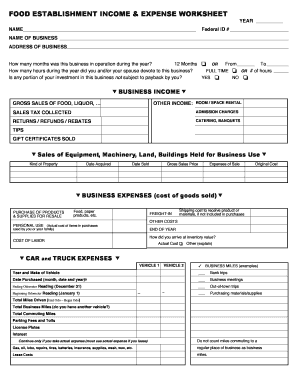

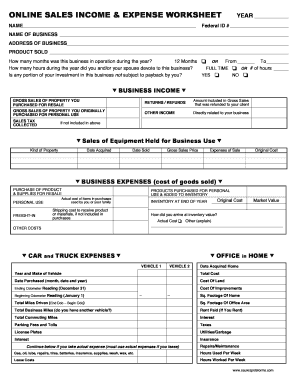

DAY CARE INCOME and EXPENSE WORKSHEET YEAR _____ YOUR ... DAY CARE BUSINESS EXPENSES (continued) MAJOR PURCHASES and IMPROVEMENTS (Computers, office equipment, furnishings) Item Purchased Date Purchased Cost Item Purchased Date of Purchase Cost CHECK LAST YEAR'S DEPRECIATION FORM TO SEE IF ALL ITEMS ARE CURRENT

DAY CARE INCOME AND EXPENSE WORKSHEET . ... DAY CARE INCOME . Gross income from day care $ _____ Federal food reimbursement $ _____ OFFICE IN HOME - IF LICENSED ... AUTO EXPENSE . Keep records of mileage for day care meetings, shopping for supplies, groceries, or to events, etc.

Printable Forms Available: Day Care Income and Expense Worksheet. To make tax preparation a little easier for our clients, we have placed some popular forms on our website. Our clients who are daycare providers will find the Day Care Income and Expense Worksheet invaluable for recording their business expenses for the year.

2014 DAYCARE INCOME & EXPENSE WORKSHEET Business Name Total Income $ Income from parents Government payments Food program payments Other income (cash child care receipt template Receipt for Child Care Services Date Received from /100 Dollars Child Care payment for the weeks of Payment method Cash Money Order Quality Child Care

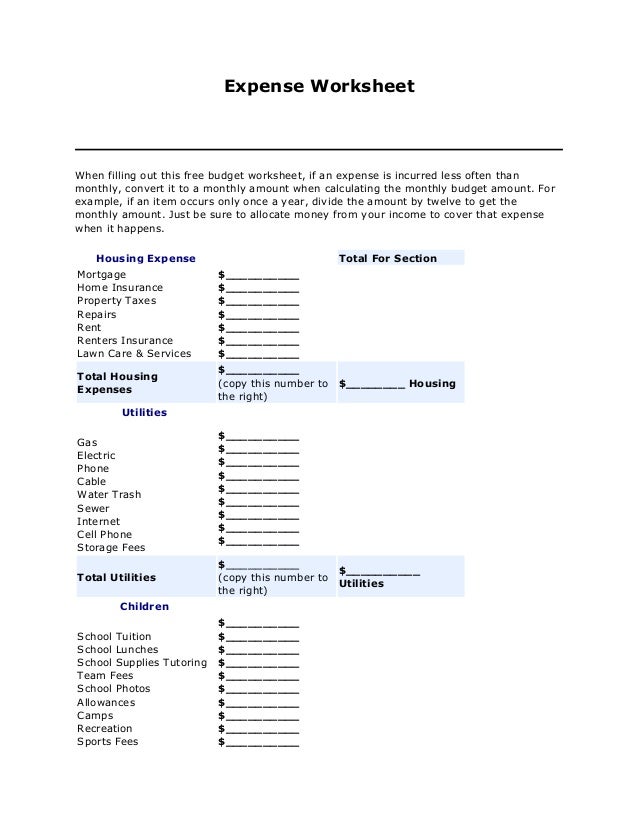

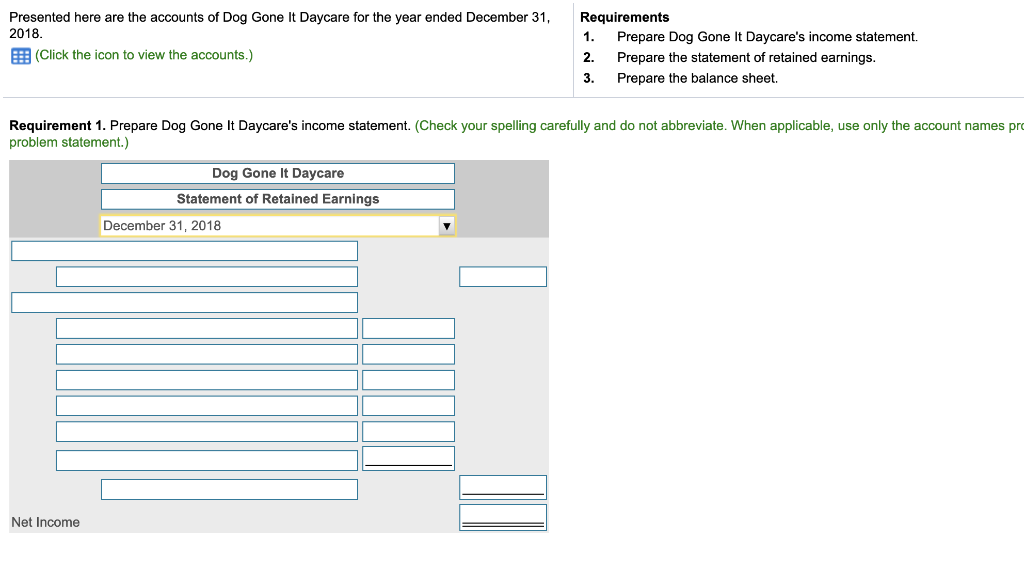

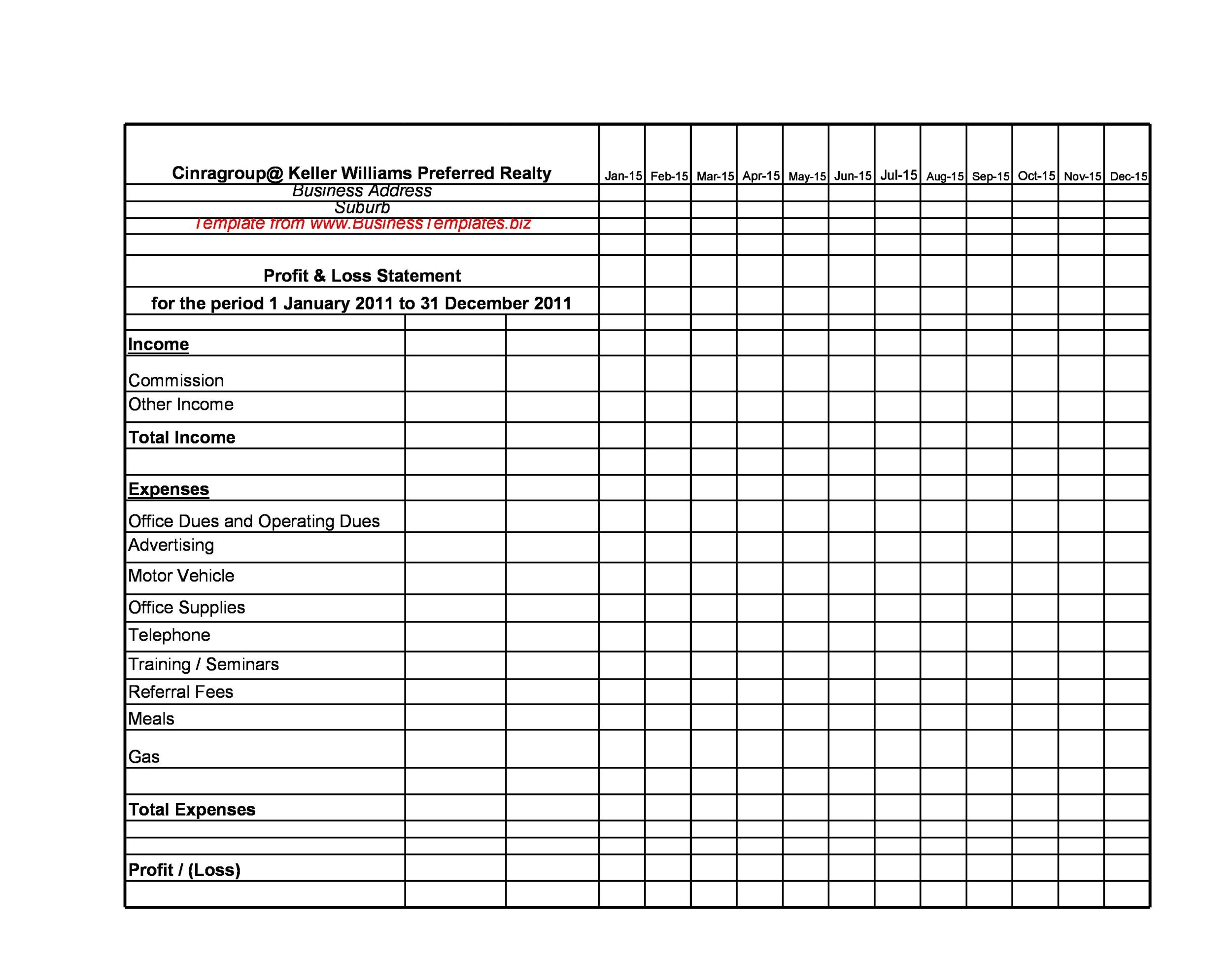

you estimated income and expenses. When figuring your budget, you can choose to start with figuring out your expenses or your income. Let's start with the income side here first. INCOME Make a list of all the different places from which your program gets payments or fees. A typical list

100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water,

09.07.2021 · QBI allows people with “pass-through income” — business income reported on personal tax returns — to deduct up to 20% of their business income. There are limitations though. To qualify for the deduction, as of 2020, your total taxable income must be below $163,300 for individuals and $326,600 for married couples filing jointly. 16. Tax ...

Day Care Income and Expense Worksheet mer-tax.com Details File Format PDF Size: 191 KB Download This is a professionally designed budget template which gives detailed information about the income expenditure, costs of purchases and improvements made during the year.

Monthly Income Worksheet. T.EA.C.H. Early Childhood® MISSOURI . 4236 Lindell Blvd. Ste. 202 St. Louis, MO 63108 Toll Free: 800-200-9017 x604, 607, 609 ... TOTAL MONTHLY EXPENSES (Add lines 6 through 13) 15. MONTHLY EARNINGS (Subtract Line 14 from Line 5) STATEMENT & SIGNATURE OF APPLICANT.

Home Daycare Monthly Budget Worksheet | Tax Preparation Records | Expense Reporting | Childcare | Income | Profit | PDF Printable | Editable

INCOME EXPENSES Budget Worksheet Monthly Amount Indicate here if Annual Expense wages / pension second income commission / tips child tax benefits support payments other TOTAL INCOME HOUSING EXPENSES first mortgage rent property taxes* strata fee / pad rental house / tenant insurance hydro gas alternate heating source water / sewer / garbage* phone …

Vertext42 Monthly Budget Worksheet Excel. If you're anticipating some big life changes within the next year, Vertex42's planner may be right for you. Create a yearly personal budget and estimate how major life changes like moving, switching jobs and buying a home can affect your financial future. Available in Excel, OpenOffice or Google Sheets.

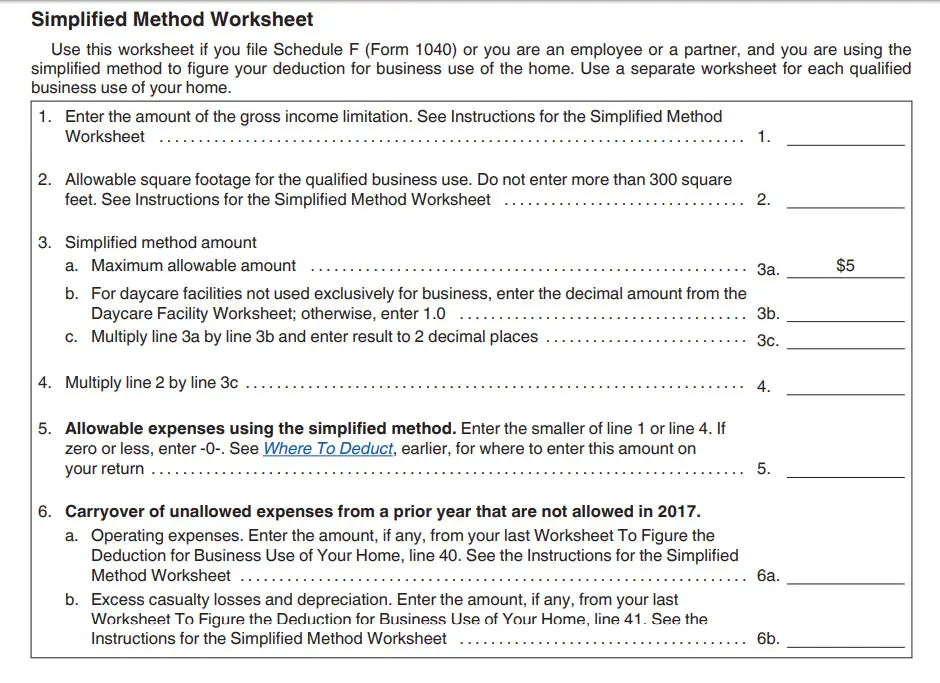

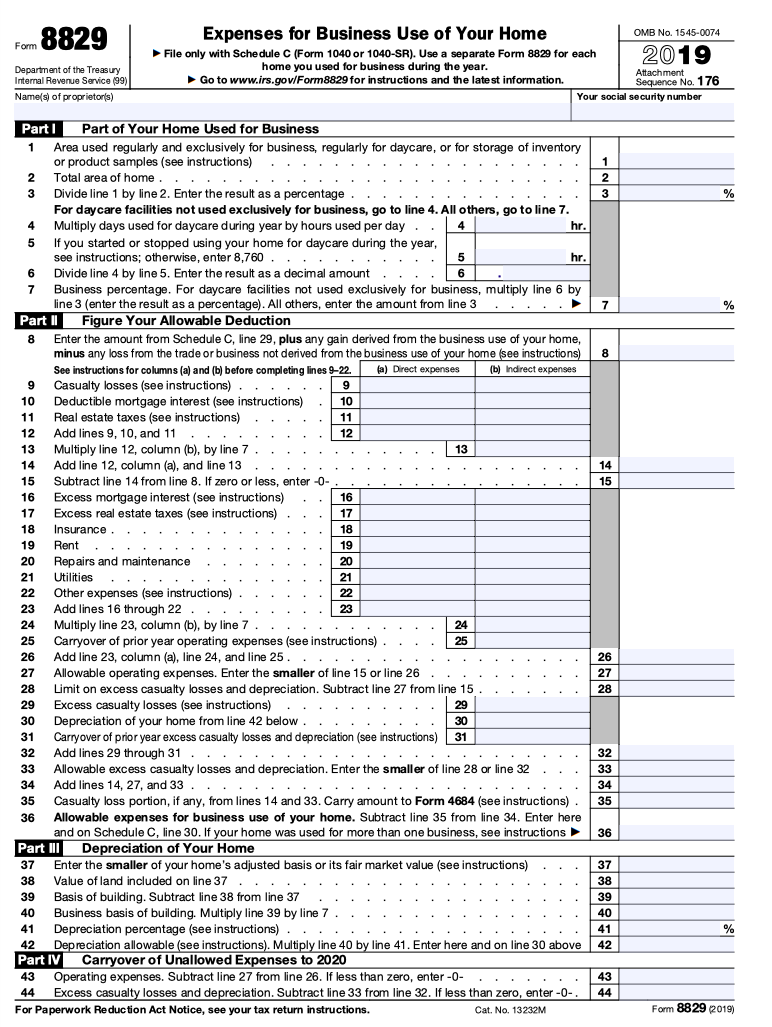

Although you cannot deduct any depreciation or section 179 expense for the portion of your home used for a qualified ... Gross income from her daycare business: $50,000: Expenses not related to the business use of the home : $25,000: Tentative profit: $25,000: Rent: $8,400: Utilities: $850: Painting the basement: $500: Mary enters her tentative profit, $25,000, on line 8. (This figure is …

First off, I strongly recommend reading Tom Copeland's books, especially the Family Child Care Record-Keeping Guide.. The more detailed records you record, the better. The Redleaf Calendar-Keeper 2021 or the software KidKare are two great ways of doing that. To help you prepare your information for your tax return AND to thoroughly understand your daycare tax return (either if you do your ...

Home daycare income and expense worksheet Before you go through your first (or 30 th) year in home daycare, I implore you to RUN and buy Tom Copeland's tax workbook. Even if you pay an accountant to fill out your tax forms, this book will help you organize your expenses and prepare them for the tax preparer.

Page 2 of 2 Day Care Income and Expense Worksheet (Continued) Food - A standard food allowance may be claimed in lieu of actual food costs. List below the number of meals served in each category not including meals for you or members of your household.

Worksheet for 2020 expenses paid in 2021. We moved Worksheet A, Worksheet for 2020 Expenses Paid in 2021 from Pub. 503 to the Instructions for Form 2441. See Payments for prior-year expenses, later, for more information about the credit for 2020 expenses paid in 2021. Reminders. Personal exemption suspended. For 2021, you can’t claim a personal exemption …

Daycare income and expense worksheet. This worksheet can be the first step in your journey to control your personal finances. Summary Income and Expenses. Daycare sheet is for items that are used exclusively for daycare. DAY CARE INCOME INCOME DIRECTLY FROM PARENTS FOOD PROGRAM PAYMENTS.

No, I haven't been closed so far this year; Yes, I was closed for a week or less; Yes, I was closed for one-four weeks; Yes, I was closed for 1-2 months

11.03.2018 · Florida has a table of income levels that determine the amount of child support for a given number of children. The primary figure used to calculate support is the income of both parents. Certain expenses also go into the calculation such as taxes, health insurance, and employment related daycare costs. A popular misconception is that household expenses can …

daycare expense income Daycare Income And Expense Worksheet - Worksheets are a crucial portion of researching English. Toddlers study in numerous ways and interesting them with coloring, drawing, workouts and puzzles really facilitates them grow their language skills.

![Free Household Budget Worksheet [Excel, Word, PDF] - Best ...](https://www.bestcollections.org/wp-content/uploads/2021/04/household-budget-worksheet-for-wisconsin-works.jpg)

0 Response to "41 daycare income and expense worksheet"

Post a Comment