41 retirement income planning worksheet

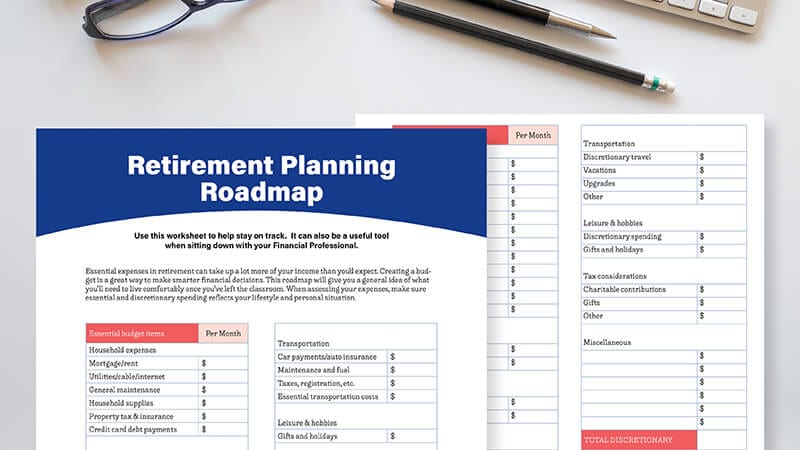

IMPORTANT: The projections or other information generated by the Planning & Guidance Center, Retirement Analysis, and Retirement Income Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Retirement Income Planning Worksheet Download this worksheet to do an analysis of your own situation or with your financial professional. 5 Step five: Develop a tailored solution Together with your financial professional, you can create a guaranteed income stream to cover your essential expenses for life so your basic needs will always be covered.

Retirement Planning Workbook This workbook is designed to help you start building your retirement income plan. It covers the information you need to collect to complete your inventory of retirement income sources and expenses. Please complete as much as you can before meeting with a Fidelity Representative.

Retirement income planning worksheet

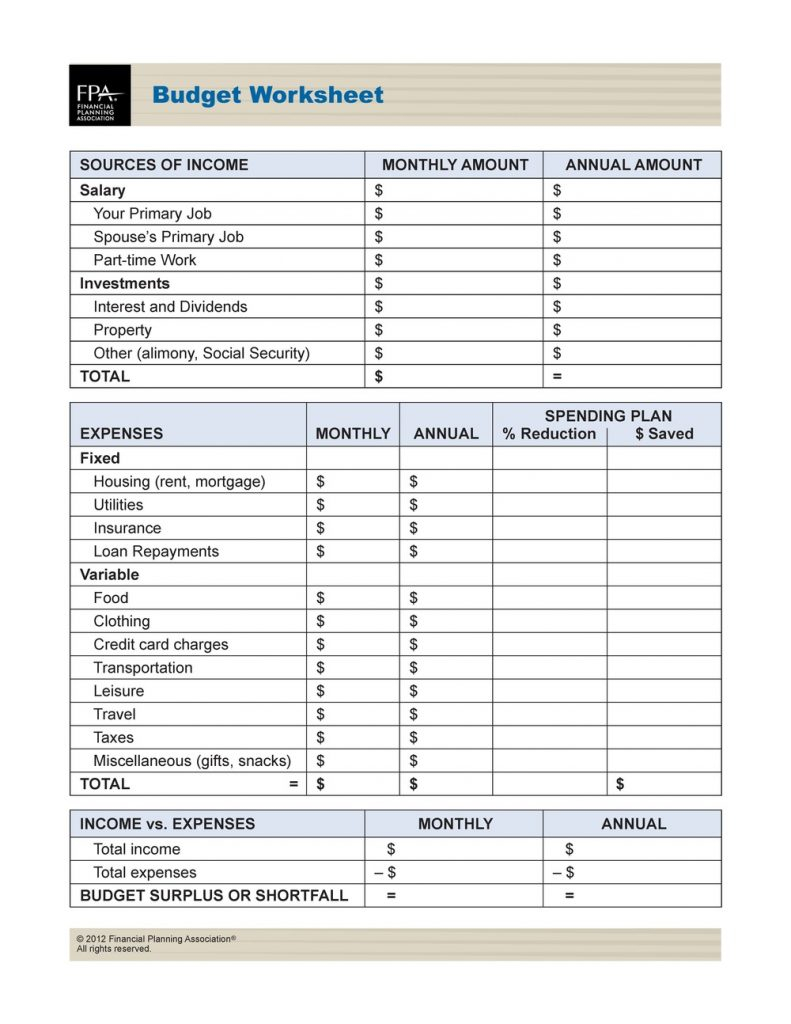

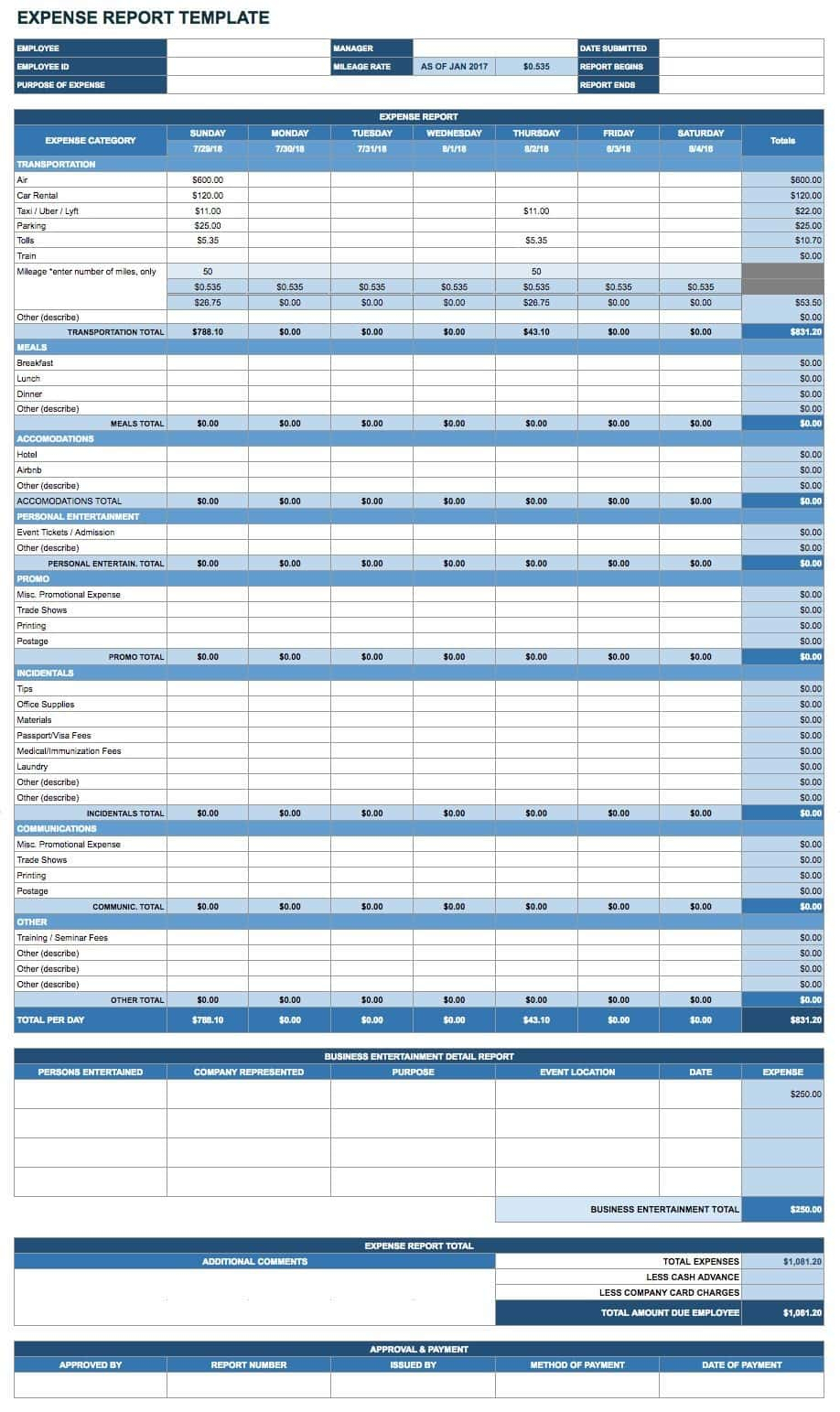

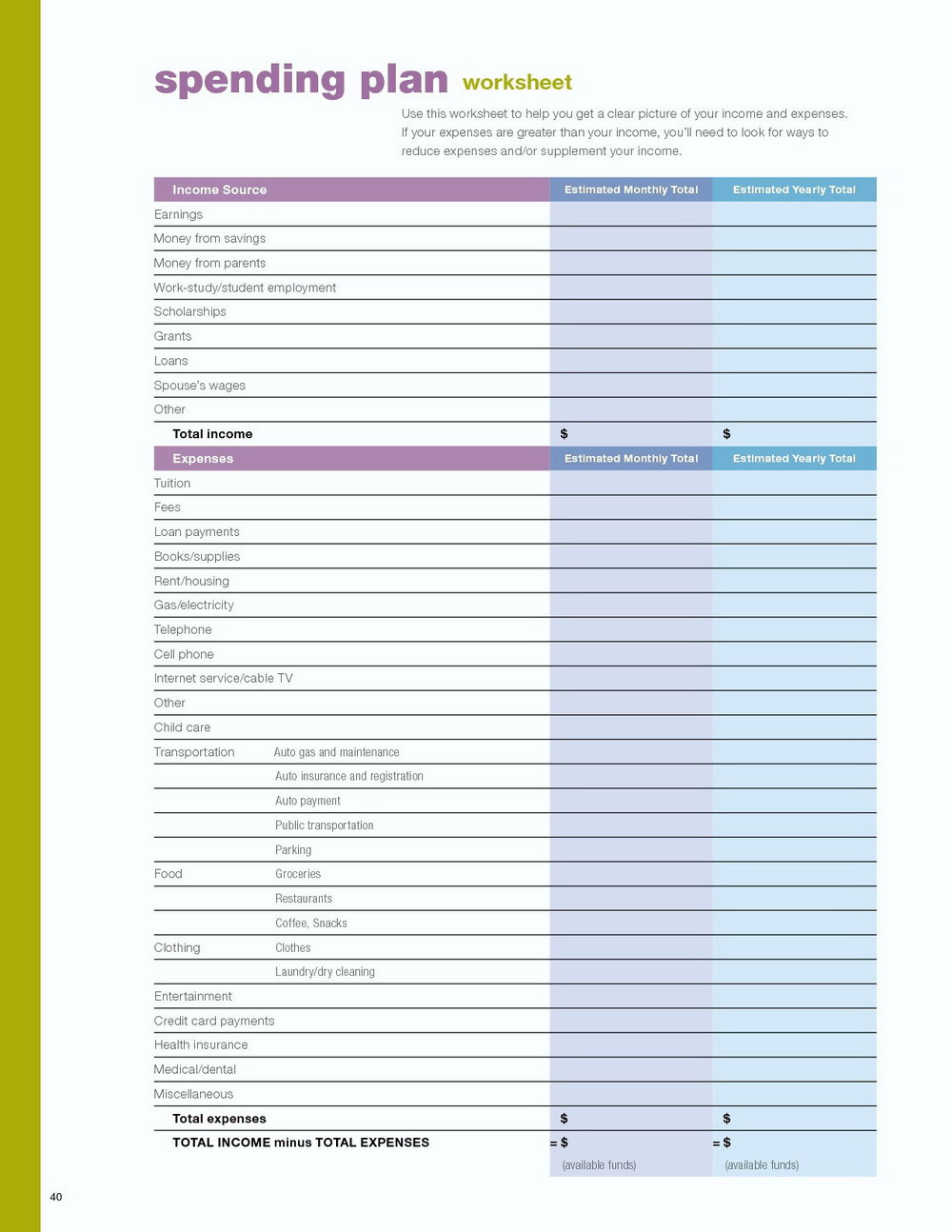

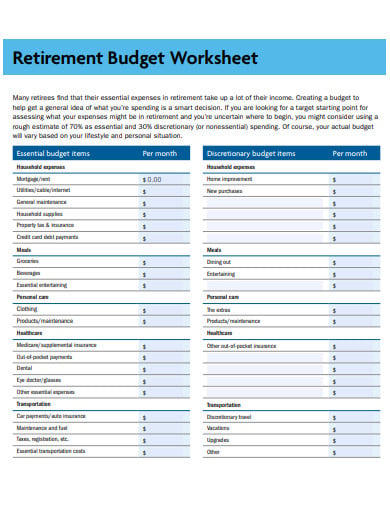

The retirement expense worksheet is to include the expenses planned. And this expenditure is for retirement and afterward. When you have the plan with you then you can make proper expenses later on. There are the plan and the worksheet to write down the expenses in it. It is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager. List everything that has the potential to make you additional income during retirement on this income planning worksheet. Part : 4: TDA 50098 02/20 *Consider including the surrender value or cash value of any life insurance and annuities, if applicable. Also, note in the Account name or description column how much

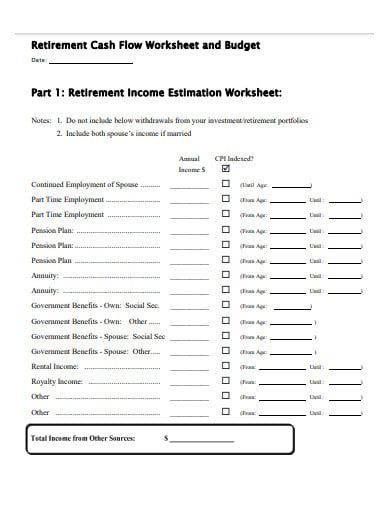

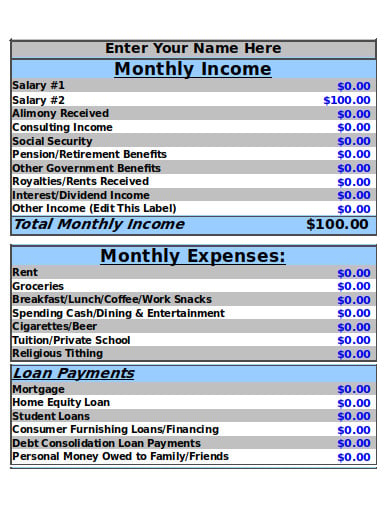

Retirement income planning worksheet. Worksheet What is retirement income? Retirement income can include Social Security benefits as well as benefits from annuities, retirement or profit sharing plans, insurance contracts, IRAs, etc. Retirement income may be fully or partially taxable. For information about Social Security benefits and tier 1 Railroad Retirement benefits, see Our retirement planning worksheet makes it easy to get a complete picture of your retirement budget. Calculate your retirement expenses What's next? Determine your income in retirement Get help from a personal advisor We can help you craft a retirement budget that works for you. See how we can help you make your retirement savings last A 401(k) is part of the US Internal Revenue Code that deals with retirement plans, and which defers the taxation of your periodic savings. Planning Your Retirement. When planning for retirement, one has to do two basic calculations: Figure out what level of income you want to have when you retire. This worksheet is designed to assist you and your advisor with the process of estimating your retirement income needs. Please take a few minutes to fill in as much information as possible and make note of any special situations, priorities or questions for discussion.

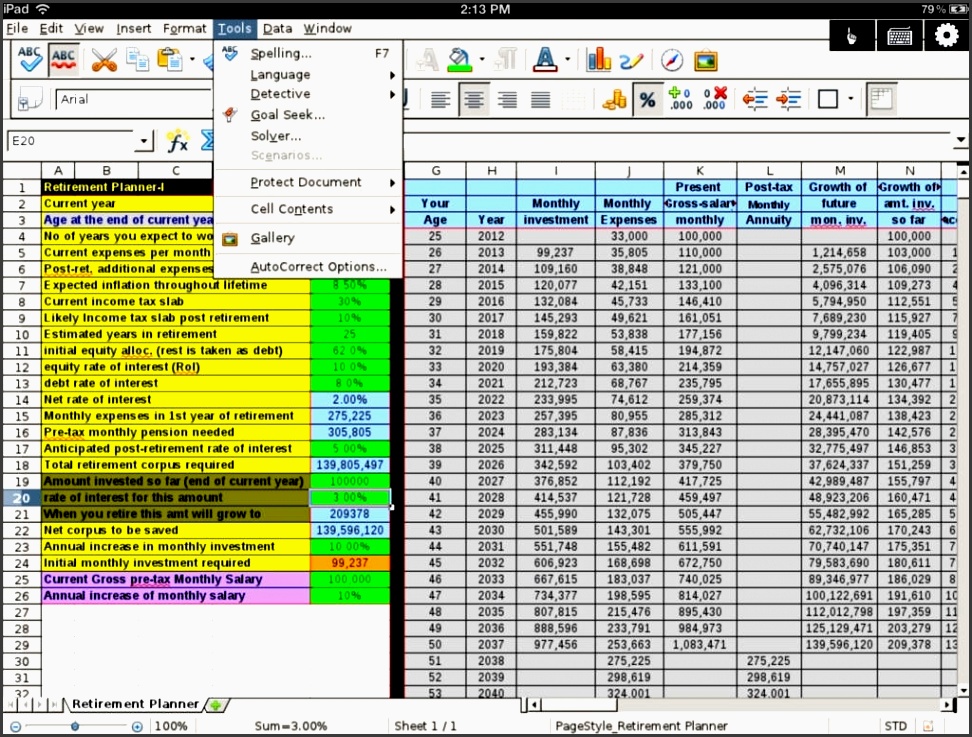

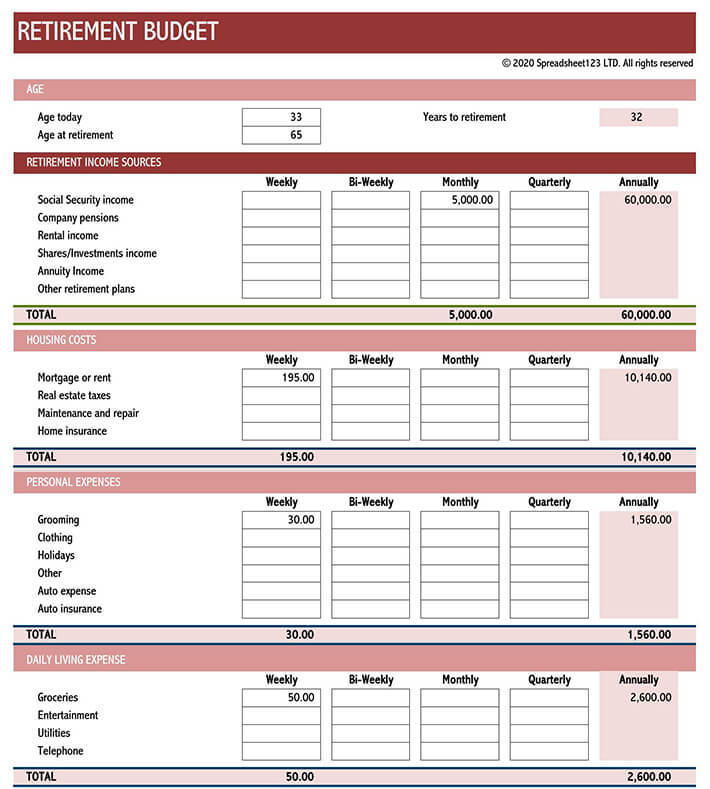

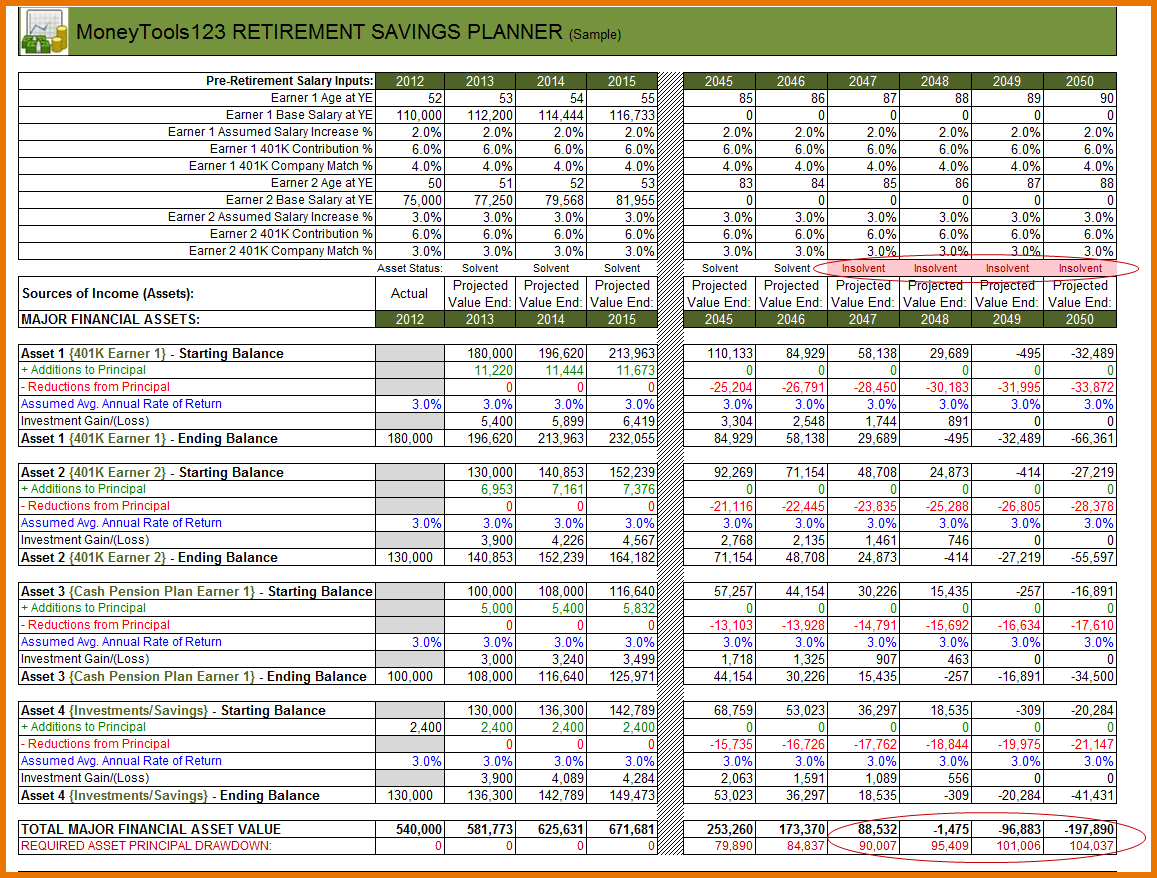

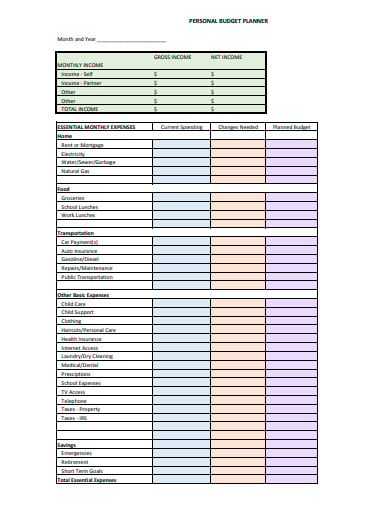

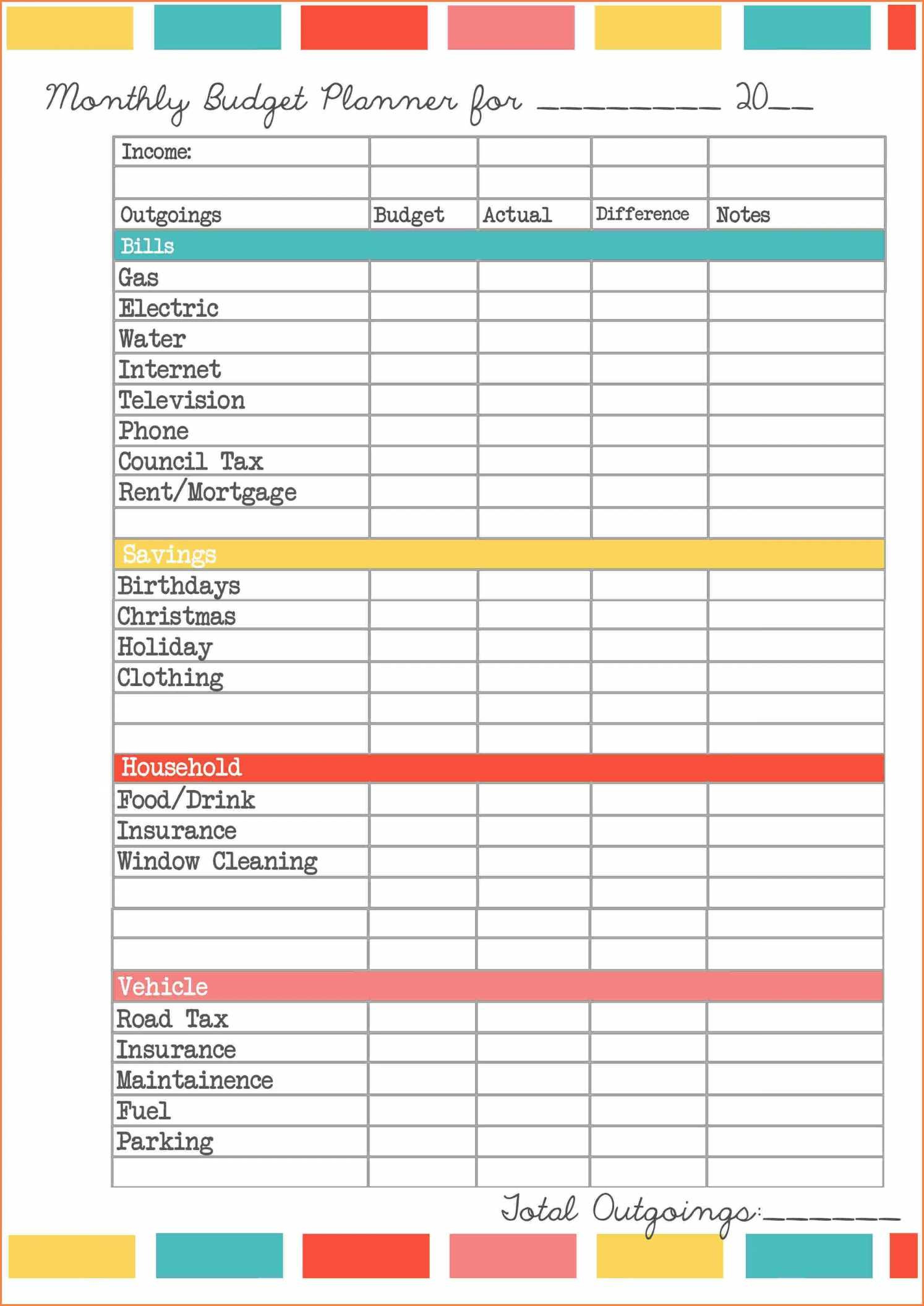

The Retirement Budget worksheet maintains records of the earnings and spending on a weekly, bi-weekly, monthly, quarterly and annual bases. The spreadsheet helps you plan a secure and modest future. Retirement Budget Planner for Excel® 2003+, OpenOffice & Google Docs Screenshots 1 2 Like This Template? Excel 2003 (XP) File: XLS Download This worksheet is designed to help you estimate how much retirement income Social Security and your employer-sponsored pension benefit(s) will provide, and how much you need to provide through the Deferred Compensation Plan and other investments in order to achieve financial security during retirement. RETIREMENT FINANCIAL READINESS - INCOME PLANNING WORKSHEET This is a worksheet that will allow you to estimate your income when you retire from the County. Three possible income sources are included: CalPERS, Fidelity Deferred Compensation, and Social Security. Financial planning worksheets may help you and your investment advisor understand your situation. ... Investing & retirement resources ...

approaching retirement may feel more comfortable with an overly conservative investing approach. But this may mean missing out on potential growth opportunities. Although past performance is no guarantee of future results, a well-rounded retirement income plan includes growth, guarantees, and flexibility. A retirement income plan may help you Build a Comprehensive Retirement Income Plan. Life can change in a moment. Global pandemic, market uncertainty, income loss, mandatory business shutdown and social distancing have changed the world. Retirement should be your time - from the start. What that looks like in today's world may be vastly different from what you imagined. To make it more trustworthy, you can use this retirement income planning worksheet to get a handle on your expenses. It will help you create a retirement income plan that will help you in getting some confidence about the future for you and your family. These 7 free retirement planning spreadsheets will help you plan your financial future and experiment with savings, investment, and withdrawal rate scenarios. By Edward Shepard On August 11, 2021 Preparing your retirement takes careful planning that begins years in advance. A spreadsheet is a perfect tool for the job.

RETIREMENT PLANNING WORKBOOK Moving from PAYCHECK to MY CHECK. You have been able to save for retirement in your employers Retirement Plan (the Plan). Now it's time to think about turning your retirement savings into retirement income. This workbook will help you plan for retirement by providing things to think about, worksheets to estimate

Retirement Readiness Worksheets ... Social Security Pension plan Retirement plan IRAs Savings Other investments Consider distribution options Rollover to IRA Full or partial withdrawals Leave account balance in plan ... Total projected income Worksheet D, Column 3 total Total projected expenses Worksheet F, Column 3 total Health

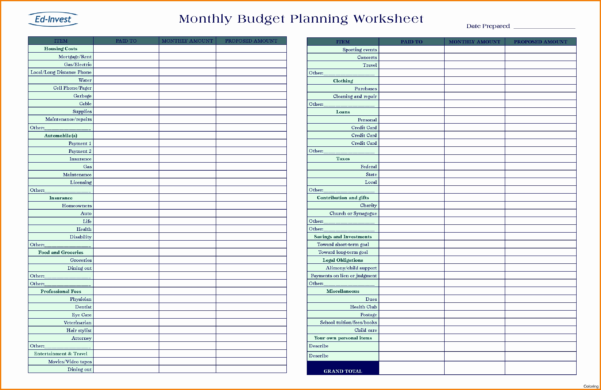

Worksheets Worksheet 1– Your Retirement Lifestyle 5 Worksheet 2– Estimated Annual Cost of Living 6 Worksheet 3– Estimated Changes in Spending After Retirement 9 Worksheet 4– Estimated Annual Cost of Living 10 Years After Retirement 12 Worksheet 5– Large Future Irregular Expenses 13 Worksheet 6– How Much Are You Worth? 14

Worksheet Notes: This worksheet may be used to help create your strategy for managing income in retirement. It will help you outline expected income and expenses during retirement so you can identify any gaps in your plan. And while this worksheet can help you budget for essential and

This retirement planning worksheet is provided for educational purposes only and is not meant as legal, tax, estate planning or investment advice. You may want to review your overall plan with a financial advisor or tax professional. The results of these calculations are estimates based solely on user input and the assumptions of the worksheet.

If you're planning on retiring soon, you might want to look at a few of them. The One-Person Social Security Breakeven Spreadsheet and the Pension Option Analysis Spreadsheet are two excellent sheets that can help you analyze your future income. Crunching the numbers is one reason many people avoid planning for retirement.

This worksheet is designed to assist you and your advisor with the process of estimating your retirement income needs. Please take a few minutes to fill in as much information as possible and make note of any special situations, priorities or questions for discussion.

Current At retirement Subtotal Gifts and donations. Holiday gifts Birthdays Charity - tax deductible ... Income Planning Worksheet. Total income: Surplus/deficit: Location. The information you provide for this profile may conflict with and does not supersede the information on your account statements and/or trade confirmations, which are

My retirement income Use this worksheet to estimate your total retirement income from various sources. First, check off the ones you expect to have when you retire. Then enter the amount of money you expect to receive in each category below. Step 4: Compare your projected income with your estimated needs.

A photo of my Filofax Original Nude in personal size for my Instagram page. Planning, in order to be productive, is very important to me and I find that it would be important for most professionals to use a similar system in order to free up headspace, to be more calm and less busy.

Set your retirement goals and determine how much savings you need with this accessible retirement financial planner template. Enter your age, salary, savings, and investment return information, as well as desired retirement age and income, and the retirement planning template will calculate and chart the required earnings and savings each year to achieve your goals.

A streamlined financial worksheet that follows the principles of the program. Gives your clients 'homework' to help initiate the income planning process. ... retirement planning, portfolio guidance, brokerage, benefits outsourcing, and other financial products and services to institutions, financial intermediaries, and individuals. ...

Retirement Income Worksheet Retirement income worksheet As your retirement draws closer, it pays to be prepared. Use this interactive worksheet to estimate your total monthly income in retirement and determine if you're on track meeting your financial needs. Rest assured, your data won't be saved online. Taxes and expenses

List everything that has the potential to make you additional income during retirement on this income planning worksheet. Part : 4: TDA 50098 02/20 *Consider including the surrender value or cash value of any life insurance and annuities, if applicable. Also, note in the Account name or description column how much

It is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, consult with a qualified tax advisor, CPA, financial planner, or investment manager.

The retirement expense worksheet is to include the expenses planned. And this expenditure is for retirement and afterward. When you have the plan with you then you can make proper expenses later on. There are the plan and the worksheet to write down the expenses in it.

0 Response to "41 retirement income planning worksheet"

Post a Comment