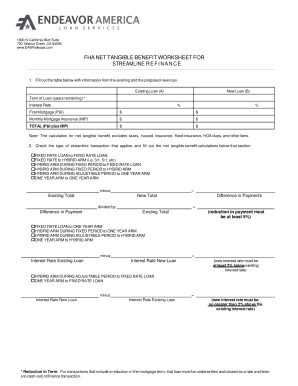

43 interest rate reduction refinancing loan worksheet

In this example, a loan of up to 80 percent of the appraised value of the home would be permissible ($350,000 x .80 = $280,000). When subtracting the amount that is still owed on the existing mortgage ($250,000) leaves a maximum “cash-out” amount of … Starting a new loan is a very big decision. Comparing interest rates and deciding if monthly payments are affordable can make your head spin, but there are valuable resources that can help. A personal loan calculator is a (usually) free too...

Low-interest rates have made things very difficult for savers over the last decade since the economic crash of 2008. Banks paid very low rates on savings due to an environment in which the benchmark rates were around zero for most of the ti...

Interest rate reduction refinancing loan worksheet

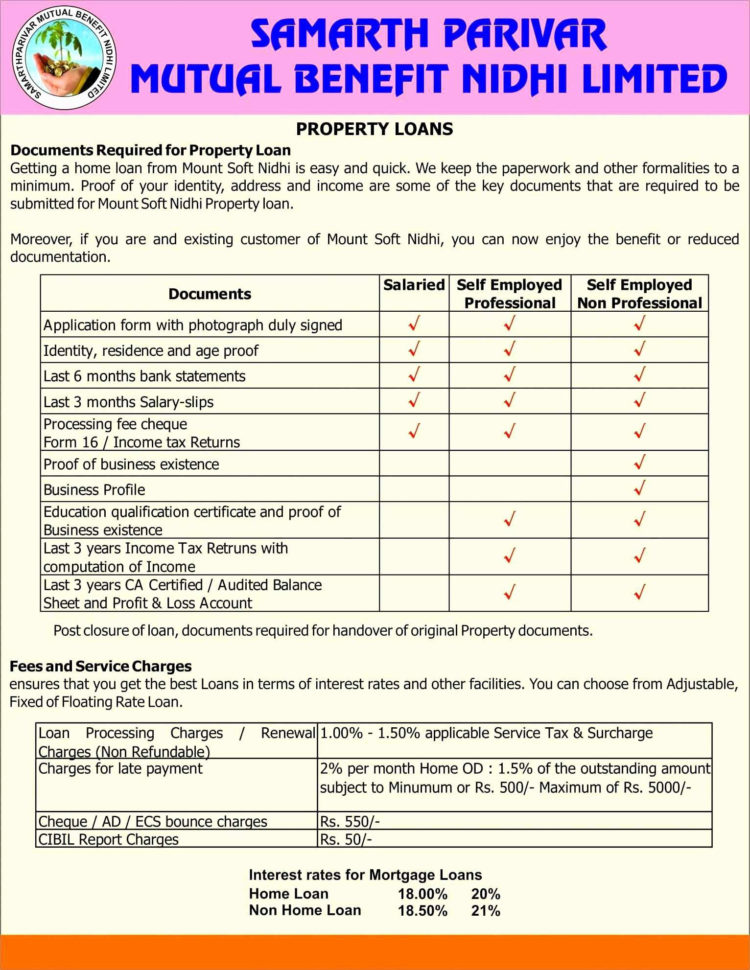

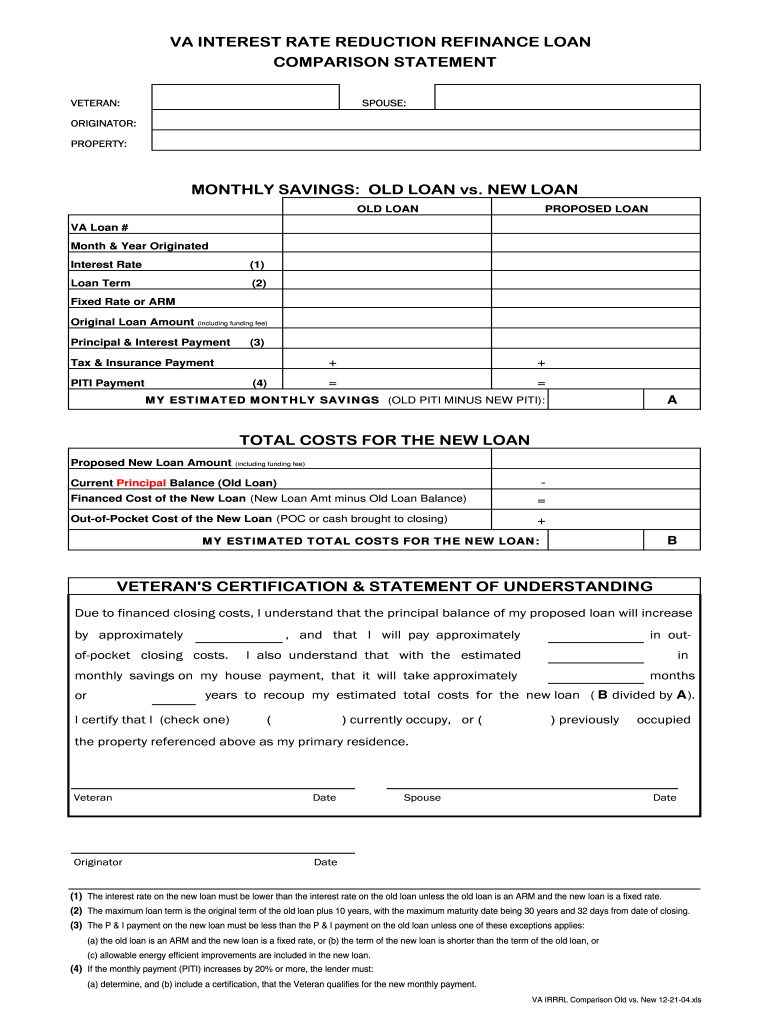

You've probably heard that the VA Interest Rate Reduction Refinance Loan is the most popular refinance option for VA home loans. You might have also heard about the VA IRRRL worksheet. The IRRRL worksheet is a tool generally used by lenders and is not something the typical borrower or veteran would get much use out of completing. VA Interest Rate Reduction Refinance Loan (IRRRL) Program Guidelines ... Always use VA Form 26-8923, IRRRL Worksheet, to calculate the maximum loan amount. Maximum Base Loan Amount by Program: Program Units Contiguous U.S. Alaska and Hawaii Conforming/non-Jumbo 1-4 $417,000 $625,500 INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET Veterans Affairs Interest Rate Reduction Worksheet SECTION II - PRELIMINARY LOAN AMOUNT VA LOAN NUMBER ... Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. JUNE 2009 26-8923 NAME OF LENDER SIGNATURE AND TITLE OF OFFICER OF LENDER SECTION III - FINAL ...

Interest rate reduction refinancing loan worksheet. See section 8 of chapter 8 for information on exemptions. 4 If the loan amount has increased beyond the amount indicated on the Certificate of Commitment, an updated VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet. 5 VA Form 26-1820, Report and Certification of Loan Disbursement. 6 HUD-1, settlement statement. The term “inflation” has been all over the news lately — and it won’t be the last time we hear it either. Even though it’s a fairly common term, what, exactly, does “inflation” mean? And how does it relate to interest rates? Here, we’ll bre... Policy Guidance for VA Interest Rate Reduction Refinance Loans (IRRRL) 1. Purpose. The purpose of this Circular is to inform lenders of new policy guidance on IRRRL disclosures. 2. Background. VA Pamphlet 26-7, Lenders Handbook, Chapter 6, Refinancing Loans, Section 1d, did not inform lenders when the Veteran's statement and lender's ... Aug 17, 2021 · Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision. Abstract: VA is revising this information collection to incorporate regulatory collection requirements previously captured under OMB control number 2900-0601. The purpose is to consolidate information collection requirements applicable only for interest rate reduction refinance loans (IRRRLs) under one information collection package.

Abstract: Lenders are required to submit VA Form 26-8923, to request a guaranty on all interest rate reduction refinancing loan and provide a receipt as proof that the funding fee was paid or evidence that a claimant was exempt from such fee. VA uses the data collected to ensure lenders computed the funding fee and the maximum permissible loan ... VA Form 22-8923 is used by lenders for completing the funding fee and maximum permissible loan amounts for interest rate reduction refinancing loans to veterans (38 U.S.C. 3729(a), 3710(a)(8), or 3712(a)(1)(F)). Information is used by VA loan examiners to assure that the above requirements are met prior to issuing guaranty. You may want to refinance your mortgage to take advantage of lower interest rates, to change your type of mortgage, or for other reasons. These resources will help you learn more about refinancing your mortgage: is... You only repay the loan when you sell your home or permanently leave it. Read more .Federally Insured Reverse... You work hard for your money, and you want your money to work hard for you. Here are some of the banks with the best interest rates for consumers. The best savings accounts should come with great customer service, higher-than-average intere...

In an ideal world, we would all find a way to make our money that is sitting in our banks work for us rather than, well, just sit there. One of the ways we can do that is by placing our money in accounts that offer a decent Annual Percentag... Use our paperwork to get the advantage in your dealings with government, IRS, courts and corporations. Eliminate Credit Card Debt NO BANKRUPTCY, Credit Cleanup, Fresh Credit Start, Asset Protection, B Dec 02, 2021 · Interest rate reduction: If interest rates are lower now than when you locked into your mortgage loan, you might be able to modify your loan and get a lower rate. This usually lowers your monthly payment. Loan structure changes: You may be able to modify your loan from an adjustable interest structure to a fixed-rate loan. This can be ... To do so, you provide some information about your credit, income and employment — as well as how much you want to borrow and why — and the lender will tell you the potential loan amount, rate and repayment term you could get. Because pre-qualifying triggers a soft credit pull, you can do it as many times as you want without...

interest rate must be not less than 0.50 percent (50 basis points) lower than the interest rate of the loan being refinanced. For example, if the interest rate of the loan being refinanced is 3.75 percent (fixed), then the interest rate of the refinance loan may not be greater than 3.25 percent (fixed).

An Interest Rate Reduction Refinancing Loan (IRRRL) can be done only when the veteran already has his or her entitlement used for a VA loan on the property to be refinanced. In other words, it ...

Jul 16, 2021 · About VA Form 26-8923. Form name: Interest Rate Reduction Refinancing Loan Worksheet. Related to: Housing assistance. Form last updated: July 15, 2021.

INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET ... NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4.

Publication 535 (2020), Business Expenses For use in preparing 2020 Returns Publication 535 - Introductory Material Introduction This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. The chapters... Loan refinancing. Debt-financed distribution. How to report. Interest... Worksheet 6-A. Self-Employed Health... ...

In compliance with the Paperwork Reduction Act (PRA) of 1995, this notice announces that the Veterans Benefits Administration, Department of Veterans Affairs, will submit the collection of information abstracted below to the Office of Management and Budget (OMB) for review and comment. The PRA submission describes the nature of...

That guide was authored by Vanessa Bitterman and reviewed by Jennifer Hashley, New Entry Sustainable Farming Project Director, and David DeFreest, FSA Loan Officer... Before you borrow money, you need to learn about your loan options and the process for applying for a loan. This guide will help you identify questions and... ...

Strategies like refinancing can lower the interest rate on your student loans to reduce your monthly payments or help you become debt-free faster.

If you have good or excellent credit, then you can feel confident that companies are offering you the best interest rate credit card they have. You have a solid credit history and companies want you to spend their money. However, if you hav...

INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET (2900-0386) JUSTIFICATION. Title 38, U.S. Code, section 3729(a) requires VA to collect a funding fee in . connection with all guaranteed or direct loans.

Offers personalized rate estimates via a soft credit check. International students are eligible if they apply with a co-signer who is a U.S. citizen or permanent resident. Six-month grace period extension is available.Letting borrowers qualify for co-signer release faster. Offering more than 12 months of forbearance. Allowing...

May 04, 2021 · The required debt-to-income ratio for student loan refinancing varies by lender. Many lenders look for DTIs at least less than 50%, but a DTI below 20% is excellent.

The student loan interest deduction is a federal tax deduction that lets you deduct up to $2,500 of the student loan interest you paid during the year. It reduces... Here’s the formula: Interest paid x (MAGI – MAGI CAP / $15,000 or $30,000 if you’re filing jointly) = Reduction amount Using the example above, here’s how...

interest rate than the loan it is refinancing, unless the loan it is refinanc-ing is an ARM. Down payment sources: No down payment is required; however, an IRRRL may be done with "no money out of pocket" by including all costs ... Interest Rate Reduction Refinance Loan Worksheet (VA Form 26-8923)

Some lenders offer IRRRLs as an opportunity to reduce the term of your loan from 30 years to 15 years. While this can save you money in interest over the life of the loan, you may see a very large increase in your monthly payment if the reduction in the interest rate is not at least one percent (two percent is better).

Mortgage qualification worksheet Top templates.office.com. Mortgage qualification worksheet. Use this worksheet to calculate the mortgage amount for which you qualify. Enter income and debt information, and the template will calculate ratios and qualifying monthly payment amounts.

Debt can be scary, but it’s also a fact of life when you run your own business. Small loans provide the capital that new businesses need to invest in their own success. Figuring out which loans are best, however, isn’t always easy. Fortunat...

A good interest rate varies from time to time and borrower to borrower. However, the basic rules for finding a good rate don't change. What makes an interest rate "good" varies with the type of loan, and it changes over time. At different p...

They typically have names like Direct Loan, Stafford, PLUS or Perkins. They are the most common type of student loan.Private or non-federal student loans are any other type of student loans. They can be made by a bank, a credit union, a state student loan agency or a college or university. They may have names like...

Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel. Just enter the loan amount, interest rate, loan duration, and start date into the Excel loan calculator. It will calculate each monthly principal and interest cost through the final payment. Great for both short-term and long-term loans, the loan repayment calculator in Excel can be a ...

Aug 27, 2021 · Borrowers who take out a term of 5, 7, or 10 years will have a maximum interest rate of 9%, those who take out a 15 or 20-year variable loan …

In their Circular 26-17-12 dated April 12, 2017, the Department of Veterans Affairs (VA) clarified the requirements regarding completing VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet (worksheet). According to Circular 26-17-12, there have been numerous questions regarding the correct way to complete the worksheet since the implementation of the Truth in Lending Act-Real ...

When it’s time to buy a car, there are plenty of things to take into account. You have to decide what features and options you want in a car and consider things like gas mileage and fuel efficiency. You even have to pick out the right color...

Student loan interest deduction. For 2020, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can’t claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint...

VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

Home equity loan interest. No matter when the indebtedness was incurred, you can no longer deduct the interest from a loan secured by your home to the extent the... explains how your deduction for home mortgage interest may be limited. It contains Table 1, which is a worksheet you can use to figure the limit on your deduction....

Tip: Refinancing is not the only way to decrease the term of your mortgage. By paying a little extra on principal each month, you will pay off the loan sooner and reduce the term of your loan. For example, adding $50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than $27,000 in interest costs.

regarding the completion of VA Form 26-8923, Interest Rate Reduction Refinancing Loan Worksheet, effective for all Interest Rate Reduction Refinance L oan (IRRRL) applications originated (initial Fannie Mae Form 1003 application date) on or after July 2, 2017. 2. Background. VA has received many inquiries from mortgage lenders on the proper ...

Thanks I am a mother and very busy! This helped me alot!Great! Thank you so much. Keep up the good work. You definitely come with outstanding posts. The Basics and Benefits of Refinancing – thanks for this. ...

Interest Rate Reduction Refinancing Loan Worksheet, johnny cash car in sacramento, 50 year mortgage rates, loans for credit below 600 direct lenders only

If you have an existing VA-backed home loan and you want to reduce your monthly mortgage payments—or make your payments more stable—an interest rate reduction refinance loan (IRRRL) may be right for you. Refinancing lets you replace your current loan with a new one under different terms. Find out if you’re eligible—and how to apply.

Mar 10, 2021 · Title: Interest Rate Reduction Refinancing Loan Worksheet (VA 26-8923). OMB Control Number: 2900-0386. Type of Review: Extension of a currently approved collection. Abstract: The major use of this form is to determine Veterans eligible for an exception to pay a funding fee in connection with a VA-guaranteed loan. Lenders are required to complete VA Form 26-8923 on all interest rate reduction refinancing loans and submit the form to the Veteran no later than the third business day after ...

The main reason you would refinance with an IRRRL is to lower your interest rate. If you've already qualified for a VA mortgage but want to lower your interest rate, you could lower your monthly payments and the interest you pay over the life of the loan.. You might think the Department of Veterans Affairs sets the rates because the VA backs IRRRLs.

• Mortgage must have closed 12 months prior to loan application • Mortgage must be paid as agreed for 12 months prior to loan application • Interest rate must be at or below current rate • $50 net tangible benefit must be achieved • Borrowers may be added, but not deleted 15

Are you thinking of refinancing a loan to take advantage of a more affordable interest rate? If so, then it’s worth knowing that some types of loans, especially home loans, sometimes offer borrowers the chance to buy what are called called ...

VA LOAN NUMBER. NOTE - Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. 18. EXISTING VA LOAN BALANCE (PLUS COST OF ENERGY EFFICIENT IMPROVEMENTS) $ 2. 3. SUBTOTAL $ ADD % DISCOUNT BASED ON LINE 4. LINE NO. ITEM. AMOUNT 1. $ SUBTRACT ANY CASH PAYMENT FROM VETERAN. 4. 8. $ SECTION III - FINAL COMPUTATION =

The "VA IRRRL Loan Comparison Statement" (Cx14501, renamed from "VA Refinance Loan Comparison") has been modified as follows: Updated the title at the top of the document to "VA Interest Rate Reduction Refinancing Loan Comparison Statement". Matched the labeling and format of the "Previous Loan", "Proposed Loan", and "Time ...

Nov 09, 2021 · Fixed to fixed: There needs to be interest rate reduction of at least 0.5%. Fixed to ARM: The interest rate reduction must be at least 2%. To the extent that the interest rate reduction is achieved by buying mortgage discount points, if you buy more than one point (1% on the loan amount), you have to have at least 10% equity, verified by an ...

Mar 23, 2018 · Title: Interest Rate Reduction Refinancing Loan (IRRRL) Worksheet VAF 26-8923. OMB Control Number: 2900-0386. Type of Review: Extension of a currently approved collection. Abstract: The major use of this form is to determine Veterans eligible for an exception to pay a funding fee in connection with a VA-guaranteed loan. Lenders are required to complete VA Form 26-8923 on all interest rate reduction refinancing loans and submit the form to the Veteran no later than the third business day ...

Credit Standards Forms. "Loan Analysis Form" (VA Form 26-6393) "HUD/VA Addendum to Uniform Residential Loan Application" (VA Form 26-1802a) "Verification of VA Benefits" (VA form 26-8937) "IRRRL" - Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923) "URLA" - Uniform Residential Loan Application (Fannie ...

May 17, 2021 · Title: Interest Rate Reduction Refinancing Loan Worksheet (VA Form 26-8923). OMB Control Number: 2900-0386. Type of Review: Revision of a currently approved collection. Abstract: The major use of this form is to determine Veterans eligible for an exception to pay a funding fee in connection with a VA-guaranteed loan. Lenders are required to complete VA Form 26-8923 on all interest rate reduction refinancing loans and submit the form to the Veteran no later than the third business day after ...

INTEREST RATE REDUCTION REFINANCING LOAN WORKSHEET Veterans Affairs Interest Rate Reduction Worksheet SECTION II - PRELIMINARY LOAN AMOUNT VA LOAN NUMBER ... Submit this form when requesting guaranty on an Interest Rate Reduction Refinancing Loan. JUNE 2009 26-8923 NAME OF LENDER SIGNATURE AND TITLE OF OFFICER OF LENDER SECTION III - FINAL ...

VA Interest Rate Reduction Refinance Loan (IRRRL) Program Guidelines ... Always use VA Form 26-8923, IRRRL Worksheet, to calculate the maximum loan amount. Maximum Base Loan Amount by Program: Program Units Contiguous U.S. Alaska and Hawaii Conforming/non-Jumbo 1-4 $417,000 $625,500

0 Response to "43 interest rate reduction refinancing loan worksheet"

Post a Comment