39 non cash charitable donations worksheet

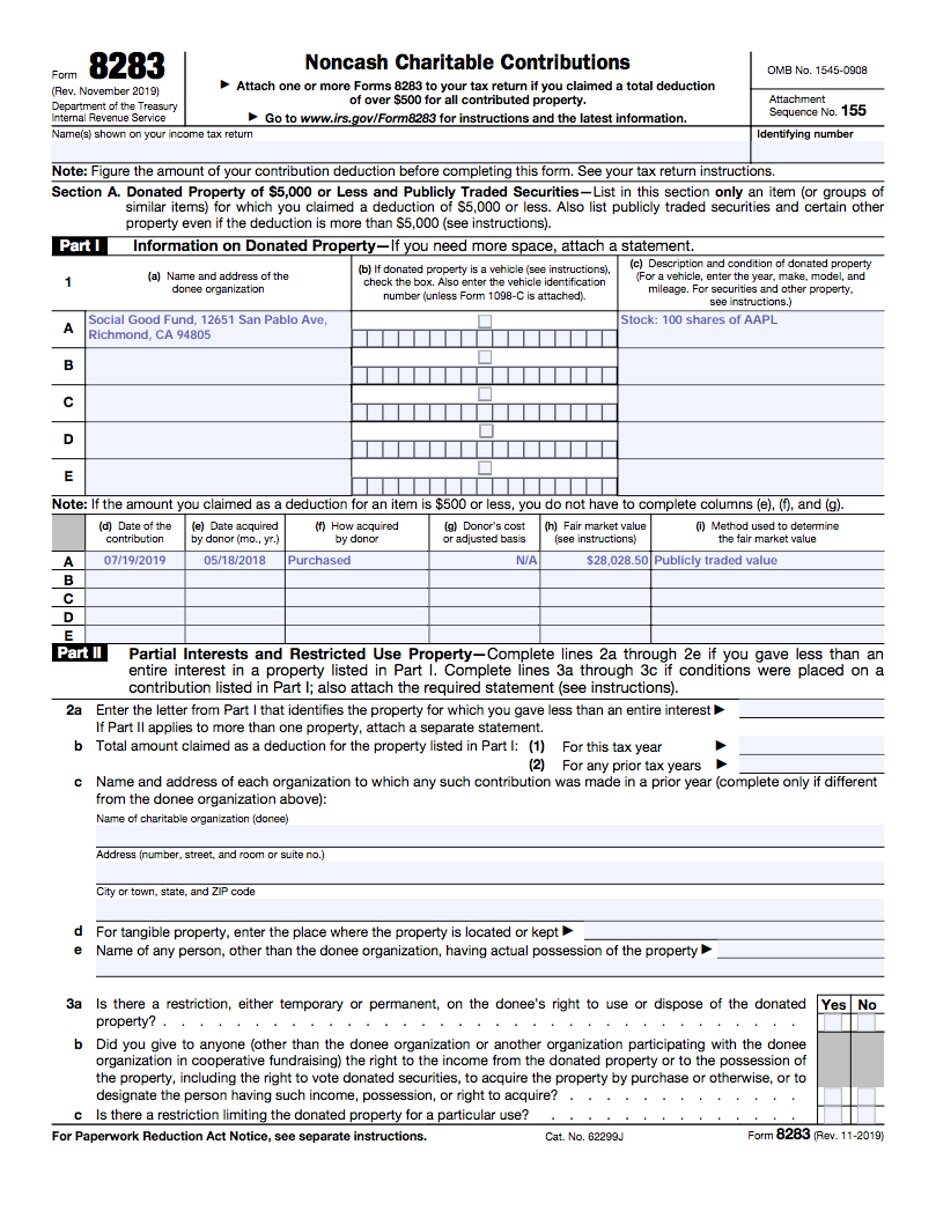

PDF 2020 Charitable Contributions Noncash FMV Guide Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions XLS Noncash charitable deductions worksheet. For more information on Charitable Contributions and Non-Cash Donations please refer to IRS Publication 526. TAXPAYERS NAME(S): description of items donated. Retain this worksheet with your receipts in your tax file. Your receipts should include a reasonably accurate

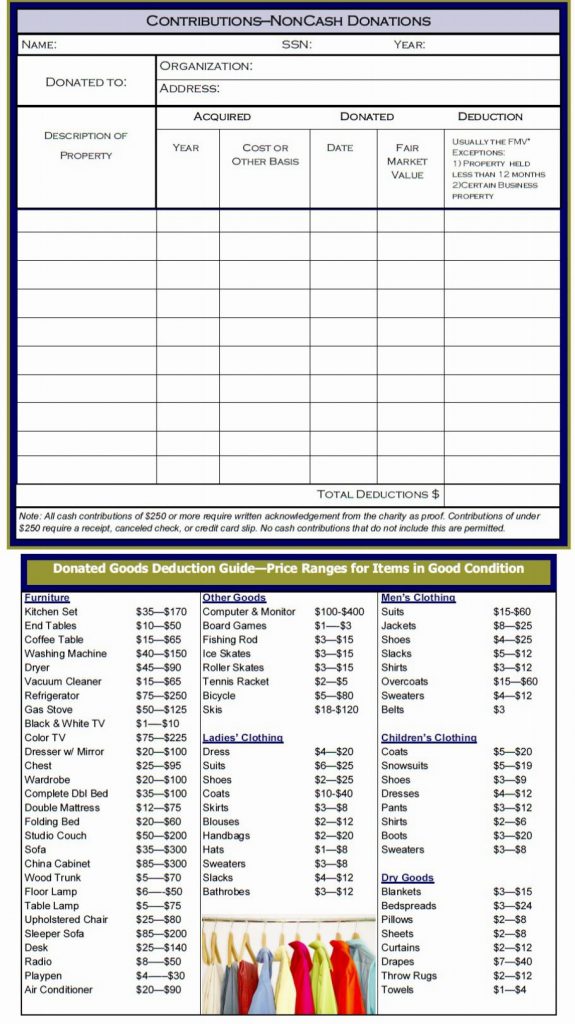

› tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations

Non cash charitable donations worksheet

Charitable Donations - H&R Block Non-cash donations of $5,000 or more. If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000. XLS Noncash charitable deductions worksheet. For more information about non cash donations see: toaster coffee maker microwave dinner plates - each saucers - each cups - each glasses - each flatware - place setting of 4 pieces soup bowls serving dishes misc. cooking utensils misc. serving utensils misc. cutting utensils under shirts / under shorts sport coats casual wear jackets: fabric Non-cash Charitable Contributions Excel Worksheet Non cash charitable contributions / donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. 20th two separate valuation reports should be made for each date. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donationsthe source.

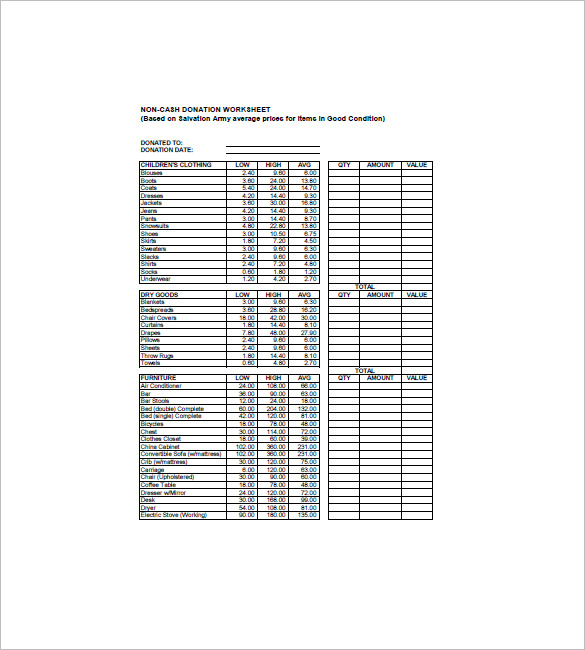

Non cash charitable donations worksheet. PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits ... › forms-pubs › about-form-8283About Form 8283, Noncash Charitable Contributions | Internal ... Aug 28, 2020 · Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. non cash charitable donations worksheet - nightlight ... 35 Non Cash Charitable Contributions Donations Worksheet - Free Worksheet Spreadsheet. Download Non Cash Charitable Contribution Worksheet for Free | Page 12 - FormTemplate. Donation Sheet Template - 9+Free PDF Documents Download | Free \u0026 Premium Templates. Non Cash Charitable Contributions Worksheet - Promotiontablecovers. › articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Jan 13, 2022 · For non-cash contributions and gifts to non-qualifying organizations—which include private non-operating foundations, supporting organizations, donor-advised funds, and other charitable ...

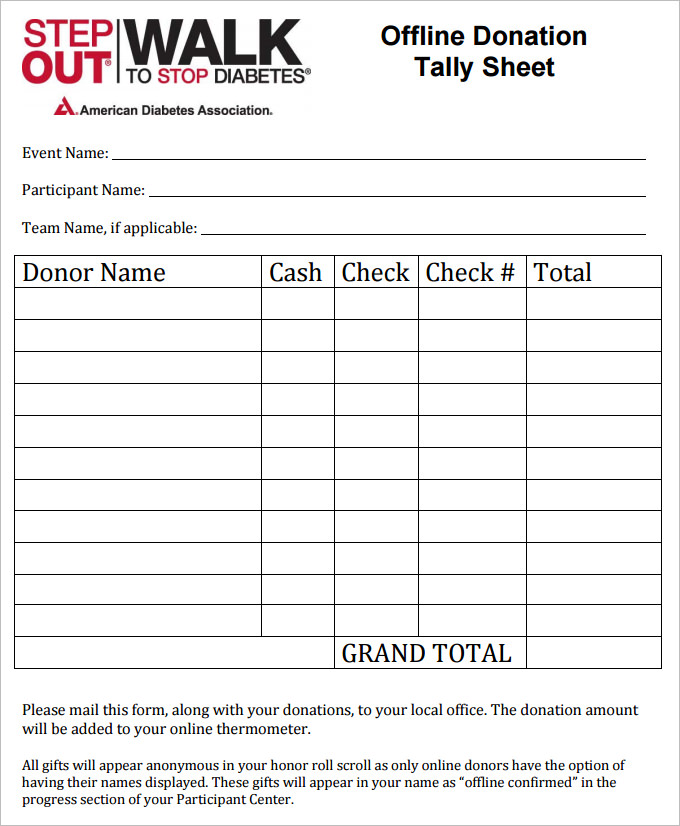

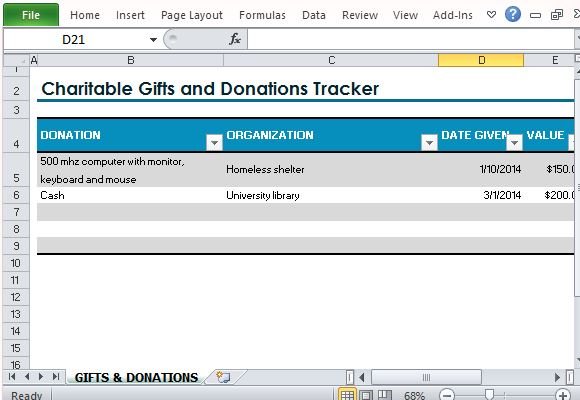

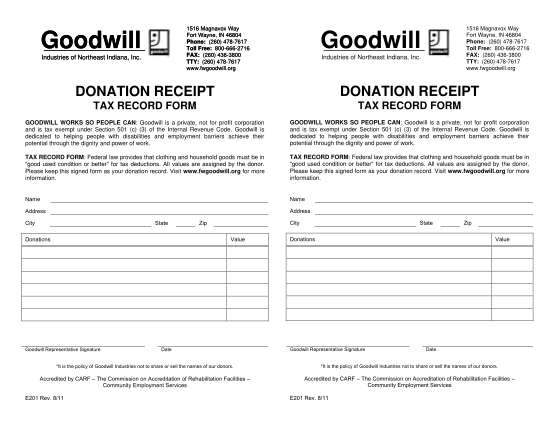

Non Charitable Donations Worksheets - Kiddy Math Non Charitable Donations - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Non cash charitable contributions donations work, Non cash charitable contributions work, The salvation army valuation guide for donated items, Non cash contribution work, Tax e form non cash charitable contribution work, Nine questions you should ask every nonprofit ... PDF Statement Noncash Charitable Contributions The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the charity Charitable gifts and donations tracker - templates.office.com Charitable gifts and donations tracker. Keep track of your donations and charitable gifts throughout the year with this accessible donations tracker template. Use this Excel donation list template to mark whether each donation is tax-deductible for easy calculation of your deductions at the end of the year. Donation Sheet Template - 9+Free PDF Documents Download ... PDF. Size: 83 KB Download. The Donation Form Templates can help you procure the details about the amount and property you've donated in charity hospitals and foundations. Generating charity and donation for the needy is a human and godly act, but keeping a track of it can be somewhat difficult. All of these documents and templates contain the ...

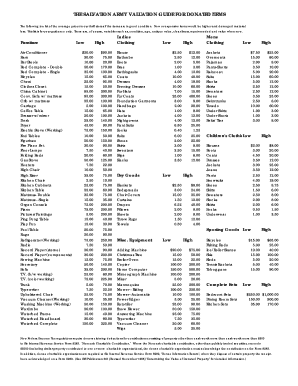

PDF Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in The Salvation Army Thrift Stores | Donation Valuation Guide 1-800-SA-TRUCK (1-800-728-7825) The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. It includes low and high estimates. Please choose a value within this range that reflects your item's relative age and quality. The Salvation Army does not set a valuation on your ... PDF Missing Information: Non-Cash Charitable Contributions ... Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00 Publication 526 (2020), Charitable Contributions ... The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can't exceed $300 ($1,000 donation - $700 state tax credit). The reduction applies even if you can't claim the state tax credit for that year.

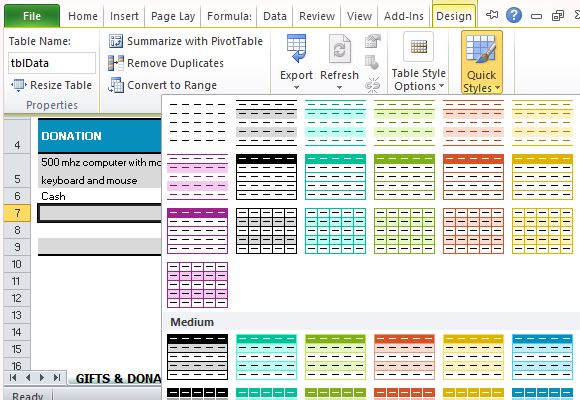

XLSX John Lebbs CPA, PLLC Non Cash Charitable Contributions Worksheet - Excel Version Author: Heather Murphy-Walker Last modified by: Aaron Kimball Created Date: 7/16/2014 8:56:26 PM Other titles: Sheet1 Sheet2 Sheet3 Sheet1!Print_Area

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Calculator Sources of Donation Valuations. We got the data from lists at websites of charities. Then we placed a short code in the source column for each donation item. For example, we coded Salvation Army as "SA". Specifically, look below to see a list of charity sites we used for values as well as a link to the source website.

Charitable Contribution Worksheet | STAC Accounting Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers ...

tax.iowa.gov › expanded-instructions › deduction-2019Deduction | Iowa Department Of Revenue Charitable Contribution Percentage Limitation: For tax year 2018 only, Iowa did not conform with the federal increase in the charitable deduction limitation for cash contributions to certain public charities from 50% to 60% of the taxpayer’s federal adjusted gross income. If an allowable deduction was limited and added back for Iowa purposes ...

PDF Non-cash Charitable Contribution Worksheet non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal

itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Describe your Donations on simple worksheets. this is space. Find the best value in the ItsDeductible database of thousands of commonly ...

PDF Non-cash Charitable Contributions / Donations Worksheet Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

Cash Contributions Limitations Worksheet - TaxAct Cash Contributions Limitations Worksheet There is a limitation for charitable contributions as an itemized deduction on Schedule A (Form 1040) Itemized Deductions . The charitable contribution amounts are reported on Schedule A, Lines 11, 12, 13, and 14.

Donation Value Guide For 2021 - Bankrate Donation value guide for 2021. Lance Davis is the senior editorial director for Bankrate. Lance leads a team responsible for creating educational content that guides people through the pivotal ...

Irs Donation Value Guide - Fill Out and Sign Printable PDF ... how do I idem eyes a donation to Goodwill a very good question most of you probably know that the charitable contributions that you make go right on your schedule a which is itemized deductions kind of right there in the middle of the form and let's go for if you if you give cash that's on that's one line of the form but if you give non-cash things like you contribute furniture or your old ...

charitable-worksheet.pdffiller.comDonation Value Guide 2020 Excel Spreadsheet - Fill Online ... A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ...

PDF The Salvation Army Valuation Guide for Donated Items ... 8283, "Non-cash Charitable Contributions." Where the non-cash charitable contribution, other than publicly traded securities, exceeds $5,000 (including "similar property" contributed to one or more charitable organizations), the donee charitable organizations are required to file Internal Revenue Service Federal Form

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

Non-cash Charitable Contributions Excel Worksheet Non cash charitable contributions / donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. 20th two separate valuation reports should be made for each date. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donationsthe source.

XLS Noncash charitable deductions worksheet. For more information about non cash donations see: toaster coffee maker microwave dinner plates - each saucers - each cups - each glasses - each flatware - place setting of 4 pieces soup bowls serving dishes misc. cooking utensils misc. serving utensils misc. cutting utensils under shirts / under shorts sport coats casual wear jackets: fabric

Charitable Donations - H&R Block Non-cash donations of $5,000 or more. If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000.

0 Response to "39 non cash charitable donations worksheet"

Post a Comment