39 capital gains tax worksheet

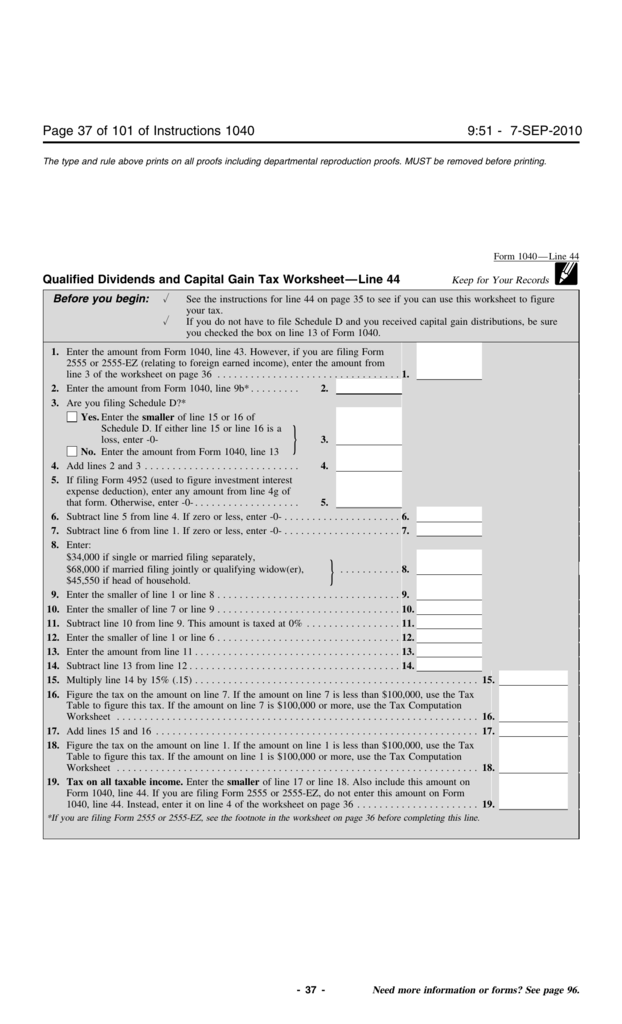

Where Is The Qualified Dividends And Capital Gain Tax ... The Qualified Dividends and Capital Gains worksheet uses taxable income as the starting point for calculating taxes. Where are the qualified dividends reported on Form 1099-DIV? All regular dividends you received will be reported in Box 1a of Form 1099-DIV. Qualified dividends can be found in Box 1b. Capital Gain Tax Worksheet - Diy Color Burst If Schedule D tax worksheet or Qualified Dividends and Capital Gain Tax worksheet was used in the return to calculate the tax on Form 1040 then the foreign source qualified dividends andor capital gains are multiplied by 04286 for the amount included on line 1. Qualified Dividends and Capital Gain Tax Worksheet.

Qualified Dividends and Capital Gains Worksheet.pdf ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Capital gains tax worksheet

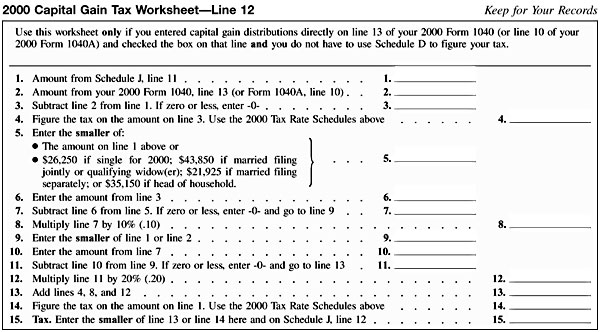

PDF Capital Gain Worksheet - efirstbank1031.com Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) ... Tax Due at Maximum Capital Gains Rate - 25% rate gain x 25% (line 9 x 25%) $ (12) 15% rate gain x 15% (line 10 x 15%) (13) ... 2021 Qualified Dividends And Capital Gains Worksheet and ... Qualified Dividends and Capital Gain Tax WorksheetLine 11a. File Form 1041 for 2021 by March 1 2022 and pay the total tax due. For tax year 2021 the 20 rate. Fill in all of the requested fields they are marked in yellow. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms. More › Should I file Qualified Dividends and Capital Gain Tax ... What is the qualified dividends and Capital Gain Tax worksheet for? The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts.

Capital gains tax worksheet. IRS Capital Gains 2022 Worksheet | Capital Gains Tax Rate 2022 IRS Capital Gains 2022 Worksheet - Capital Gains Tax Rate 2022 - It is commonly accepted that capital gains are gains that are earned through the sale of assets, like stock real estate, stock, or a corporation — and these earnings are tax-deductible income. Capital Gains Tax Worksheet 1-1 Form IRS Instruction 1 Line 1 Fill Online, Printable Throughout Capital Gains Tax Worksheet The audit worksheet is ready within the gentle of the auditing of assorted objects included in the worksheet. The worksheet is prepared at the finish of the accounting period before the preparation of economic statements. Self Assessment forms and helpsheets for Capital Gains Tax ... How to Calculate Capital Gains Tax | H&R Block Answer The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it for—adjusting for commissions or fees. Depending on your income level, your capital gain will be taxed federally at either 0%, 15% or 20%.

Capital Gain Tax Worksheet (PDF) - IRS tax forms If you don’t have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. Enter the amount from Form 1040, line 10. However, if you are filing Form 2555 or 2555-EZ (relating to foreign earned income), enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a*..... 2. 3. Diy Qualified Dividends And Capital Gain Worksheet - The ... Lines 1-5 of this worksheet calculate your total qualified income line 4 and your total ordinary income line 5 so they can be taxed at their different rates. An Alternative to Schedule D. Qualified Dividends And Capital Gains Worksheet 2016. Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf. Enter the amount from Form 1040 line 43. 'Qualified Dividends And Capital Gain Tax Worksheet' - A ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […] Capital Gains Tax Calculation Worksheet 2021 - Real Estate ... Discover Capital Gains Tax Calculation Worksheet 2021 for getting more useful information about real estate, apartment, mortgages near you.

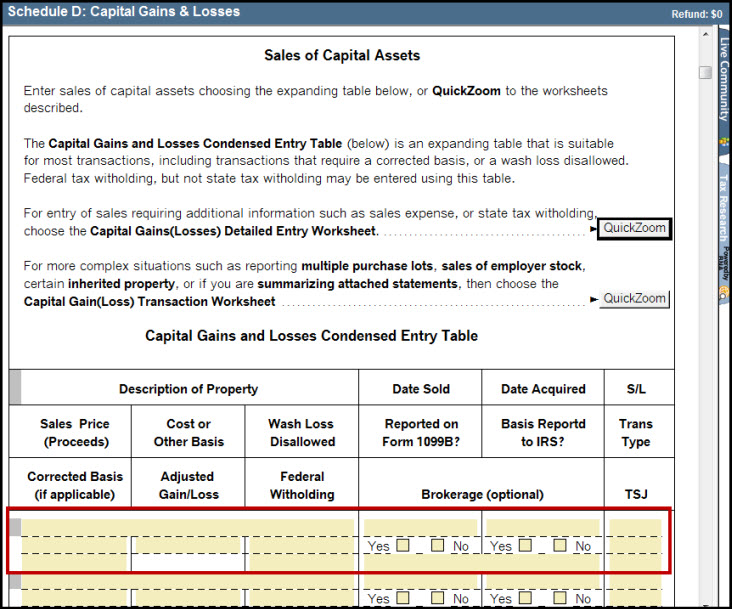

Brilliant Capital Gains Tax Spreadsheet Procurement ... Capital Gains Worksheet - 2021 Capital Gains Tax worksheet. Temporary non-residents and Capital Gains Tax Self Assessment helpsheet HS278 6 April 2021. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. So in effect you pay a 12 4 x 30 tax on your total capital. Capital Gains Tax Calculation Worksheet - Sixteenth Streets Jan 23, 2022 · Capital Gains Tax Calculation Worksheet. It calculates both long term and short term capital gains and associated taxes. If the amount on line 1 is less than $100,000, use the tax table to figure the tax. Qualified dividends and capital gain tax worksheet—line 11a. Figure the tax on the amount on line 7. 2021-22 Capital Gains Tax Rates and Calculator - NerdWallet In 2021 and 2022, the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains tax rates on most assets held for less than a year correspond to... SCHEDULE D Capital Gains and Losses - IRS tax forms Capital Gains and Losses Attach to Form 1040, 1040-SR, or 1040-NR. Go to for instructions and the latest information. Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2021. Attachment Sequence No. 12. Name(s) shown on return . Your social security number

Using the capital gain or loss worksheet | Australian ... The Capital gain or capital loss worksheet (PDF 143KB) calculates a capital gain or capital loss for each separate capital gains tax (CGT) event. Remember that: you show the type of CGT asset or CGT event that resulted in the capital gain or capital loss, and if a capital gain was made, you calculate it using the indexation method

When To Use Qualified Dividends And Capital Gain Tax ... When To Use Qualified Dividends And Capital Gain Tax Worksheet? By The Money Farm Team The worksheet is intended for taxpayers who only have dividend income or capital gains distributions recorded in boxes 2a or 2b on Form 1099-DIV from mutual funds, other regulated investment companies, or real estate investment trusts, respectively.

2021 Capital Gains Tax Worksheet and Similar Products and ... In 2021, long-term capital gains will be taxed at 0%, 15%, or 20%, depending on the investor's taxable income and filing status, excluding any state or local capital gains taxes. For assets held less than one year, short-term gains are taxed at regular income rates, which may be as high as 34% based on ... More › See more result ››

Worksheet: Calculate Capital Gains - Realtor Magazine A Special Real Estate Exemption for Capital Gains Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale.

42 qualified dividends and capital gain tax worksheet ... How Capital Gains and Qualified Dividends Are Taxed There are 4 advantages to taxpayers of capital gains taxes over the taxation of income earned from work To receive the preferential tax treatment for long-term capital gains, the taxpayer must use the Qualified Dividends and Capital Gains Tax Worksheet in the Form 1040 instructions. img1.wsimg ...

and Losses Capital Gains - IRS tax forms Capital Gain Distributions. These distributions are paid by a mutual fund (or other regulated investment company) or real estate investment trust from its net realized long-term capital gains. Distributions of net realized short-term capital gains aren't treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary divi-dends.

Qualified Dividends And Capital Gains Tax Worksheet A worksheet is a multiple-column kind that's utilized in making ready and adjusting monetary statements. Qualified Dividends And Capital Gains Tax Worksheet Thereafter debit and credit columns of changes are totaled for assuring their agreement. Columns of the worksheet are drawn primarily as per necessity.

1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. Ordinary Dividends. Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on line 3b. This amount should be shown in box 1a of Form(s ...

Forms and Publications (PDF) - IRS tax forms Capital Gains and Losses and Built-in Gains 2021 12/09/2021 Inst 1120-S (Schedule D) Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains 2021 01/07/2022 Form 2438: Undistributed Capital Gains Tax Return 1220 11/30/2020 Form 2439

PDF WORKSHEET Calculate Capital Gains - whitneyrealtyma.com WORKSHEET Calculate Capital Gains When you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for the sale. The same holds true in home sales, but there are other considerations. How to Calculate Gain Your home's original sales price when you bought it (not what you brought to closing).

How the 0% Tax Rate Works on Capital Gains In tax year 2021, the 0% tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to $80,800, and to single tax filers with taxable incomes up to $40,400. 3. There can be years when you'll have less taxable income than in others. You can sometimes make a low-tax year occur on purpose in retirement by ...

Capital Gains Tax Calculation Worksheet - The Balance Feb 23, 2022 · There are two types of capital gains taxes: long and short. Short-term gains from investments held for one year or less are taxed at your income tax rate. Long-term gains from investments held for more than a year receive a more favorable tax rate of either 0% (individuals earning up to $40,400), 15% (individuals earning up to $445,850), or 20% (individuals earning more than $445,850) as of tax year 2021.

Should I file Qualified Dividends and Capital Gain Tax ... What is the qualified dividends and Capital Gain Tax worksheet for? The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV that were received from mutual funds, other regulated investment companies, or real estate investment trusts.

2021 Qualified Dividends And Capital Gains Worksheet and ... Qualified Dividends and Capital Gain Tax WorksheetLine 11a. File Form 1041 for 2021 by March 1 2022 and pay the total tax due. For tax year 2021 the 20 rate. Fill in all of the requested fields they are marked in yellow. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms. More ›

PDF Capital Gain Worksheet - efirstbank1031.com Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis - Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3) ... Tax Due at Maximum Capital Gains Rate - 25% rate gain x 25% (line 9 x 25%) $ (12) 15% rate gain x 15% (line 10 x 15%) (13) ...

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-907066380-0867bbed74914d3eab8d7d0c318a7577.jpg)

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

0 Response to "39 capital gains tax worksheet"

Post a Comment