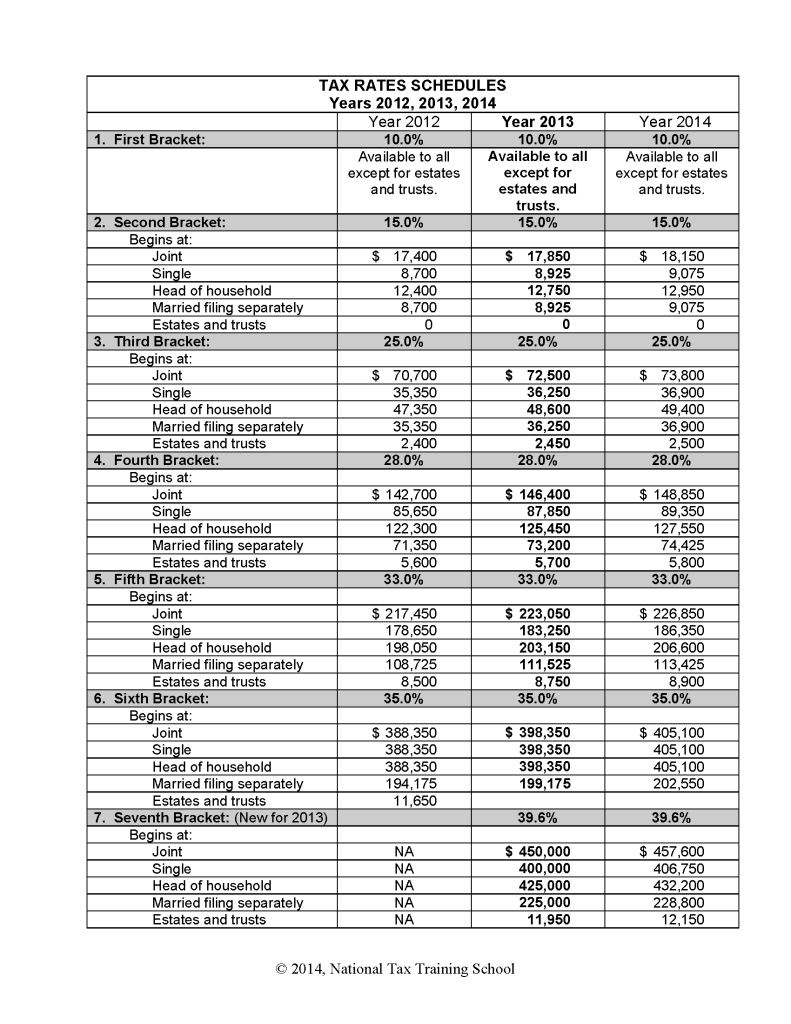

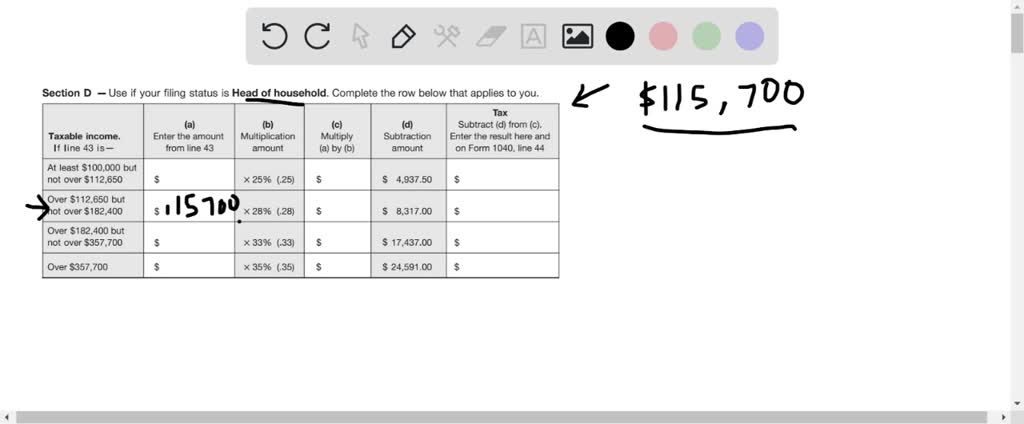

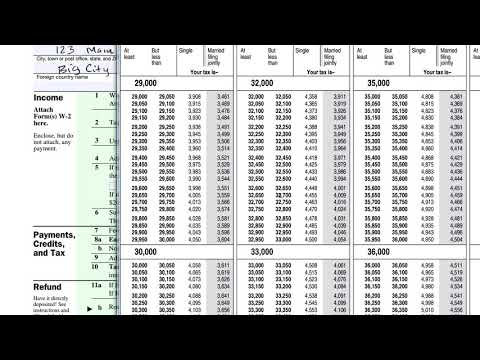

42 2014 tax computation worksheet

2014 Individual Income Tax Instructions (Rev. 9-14) - Kansas ... If line 7 is more than $100,000, you will need to use the Tax Computation. Worksheet on page 27 to compute your tax. If you are filing as a resident, skip lines ...25 pages revenue.nebraska.gov › about › 2020-income-tax-forms2020 Income Tax Forms | Nebraska Department of Revenue Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms. Form 1040XN, 2020 Amended Nebraska Individual Income Tax Return. Form. Form NOL, Nebraska Net Operating Loss Worksheet Tax Year 2020. Form. Form 1040N-ES, 2021 Nebraska Individual Estimated Income Tax Payment Voucher. Form

Instructions for Form IT-201 Full-Year Resident Income Tax ... hired and employed a qualified veteran on or after January 1, 2014. IT-643 ... Note: Keep this worksheet for future-year computations of the.72 pages

2014 tax computation worksheet

› publications › p505Publication 505 (2021), Tax Withholding and Estimated Tax ... Use Worksheet 1-1 if, in 2020, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2021 and, for 2020, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2020 › business › corporate-income-andCorporate Income and Franchise Tax Forms | DOR Apr 07, 2014 · 83-180 | Application for Automatic Six Month Extension for Corporate Income & Franchise Tax Return 83-300 | Corporate Income Tax Voucher 83-305 | Interest and Penalty on Underestimate of Corporate Income Tax › forms › 20172017 Personal Income Tax Booklet 540 | FTB.ca.gov Complete the Use Tax Worksheet or use the Use Tax Lookup Table on page 15 and 16, to calculate the amount due. Extensions to File. If you request an extension to file your income tax return, wait until you file your tax return to report your purchases subject to use tax and make your use tax payment. Interest, Penalties and Fees

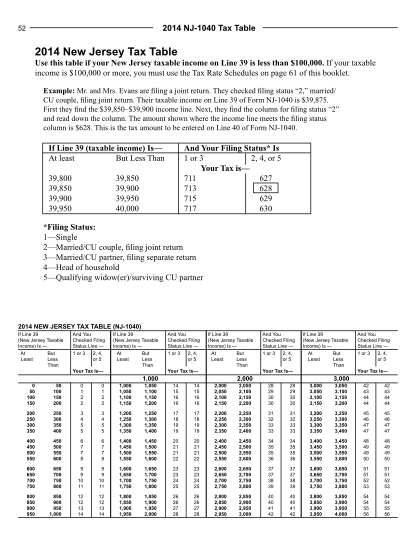

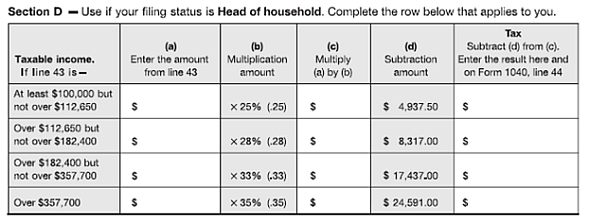

2014 tax computation worksheet. › tax-guide › state-taxesCalifornia Taxes – Tax Guide • 1040.com – File Your Taxes Online E-file your California personal income tax return online with 1040.com. These 2020 forms and more are available: California Form 540/540NR – Personal Income Tax Return for Residents and Nonresidents › tax-forms › california-form-540California Form 540 Instructions - eSmart Tax Generally, use form FTB 3800, Tax Computation for Certain Children with Investment Income, to figure the tax on a separate Form 540 for your child who was 18 and under or a student under age 24 on January 1, 2014, and who had more than $2,000 of investment income. support.taxslayerpro.com › hc › en-usSchedule K-1 (Form 1120S) - Other Information - Support This amount will automatically pull to the applicable Qualified Business Income Deduction worksheet under the Tax Computation Menu and is used in the calculation of the QBID. Line 17AA– Excess taxable income -Amounts reported in Box 17, Code AA is the excess taxable income determined by the corporation for the purpose of the limitation placed ... 2014 Instruction 1040 - Internal Revenue Service 26 Jan 2015 — Tax Table or Tax Computation. Worksheet. If your taxable income is less than $100,000, you must use the. Tax Table, later in these ...

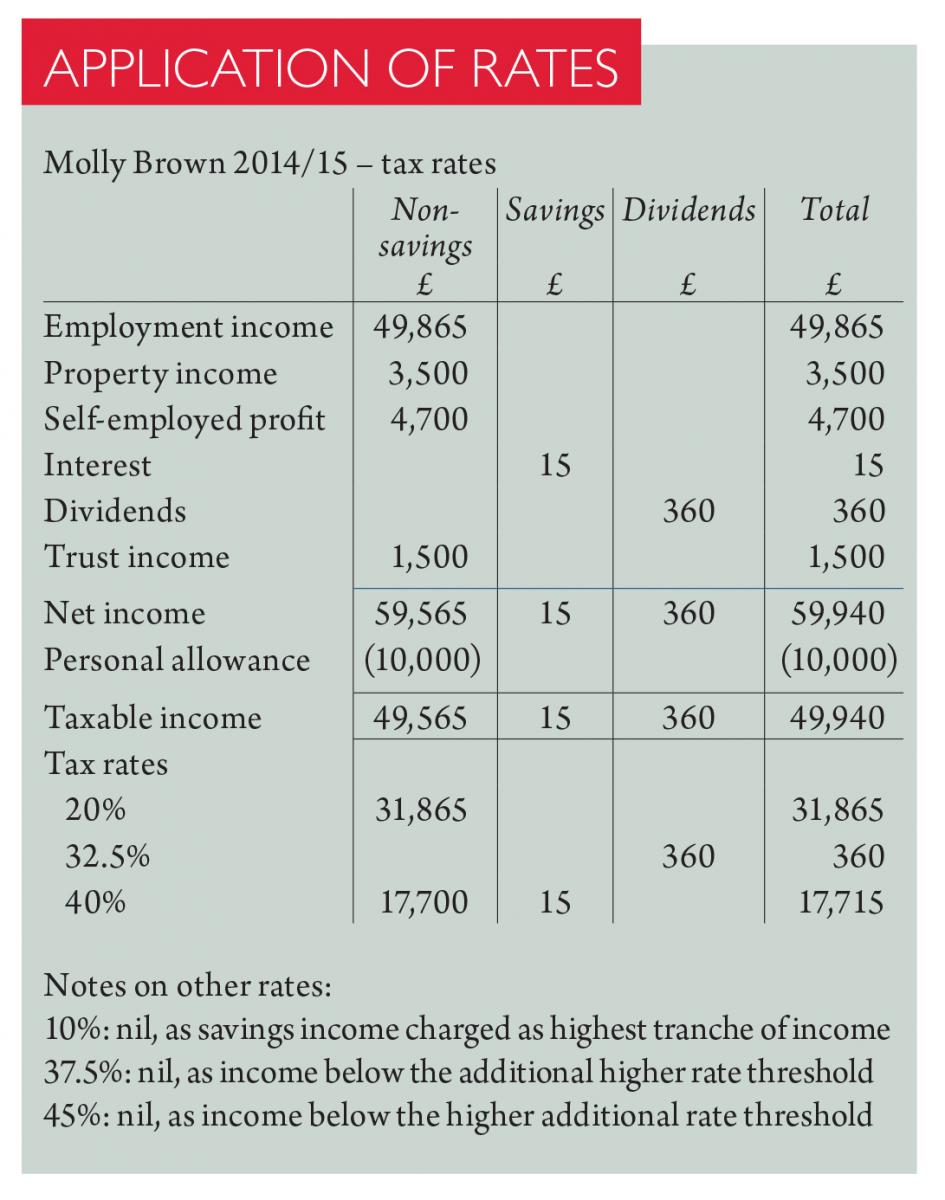

rhode island tax rate schedule 2014 RHODE ISLAND TAX COMPUTATION WORKSHEET. RHODE ISLAND TAX RATE SCHEDULE. 2014. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES. Taxable Income (line 7). › forms › 20172017 Personal Income Tax Booklet 540 | FTB.ca.gov Complete the Use Tax Worksheet or use the Use Tax Lookup Table on page 15 and 16, to calculate the amount due. Extensions to File. If you request an extension to file your income tax return, wait until you file your tax return to report your purchases subject to use tax and make your use tax payment. Interest, Penalties and Fees › business › corporate-income-andCorporate Income and Franchise Tax Forms | DOR Apr 07, 2014 · 83-180 | Application for Automatic Six Month Extension for Corporate Income & Franchise Tax Return 83-300 | Corporate Income Tax Voucher 83-305 | Interest and Penalty on Underestimate of Corporate Income Tax › publications › p505Publication 505 (2021), Tax Withholding and Estimated Tax ... Use Worksheet 1-1 if, in 2020, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2021 and, for 2020, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2020

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&ssl=1)

![Solved Exercise 7.8.25. [S][Section 7.7][Goal 7.1][Goal 7.6 ...](https://media.cheggcdn.com/study/005/0050a60e-9b5c-4a67-b863-65da22e091d8/image)

0 Response to "42 2014 tax computation worksheet"

Post a Comment