43 nebraska inheritance tax worksheet

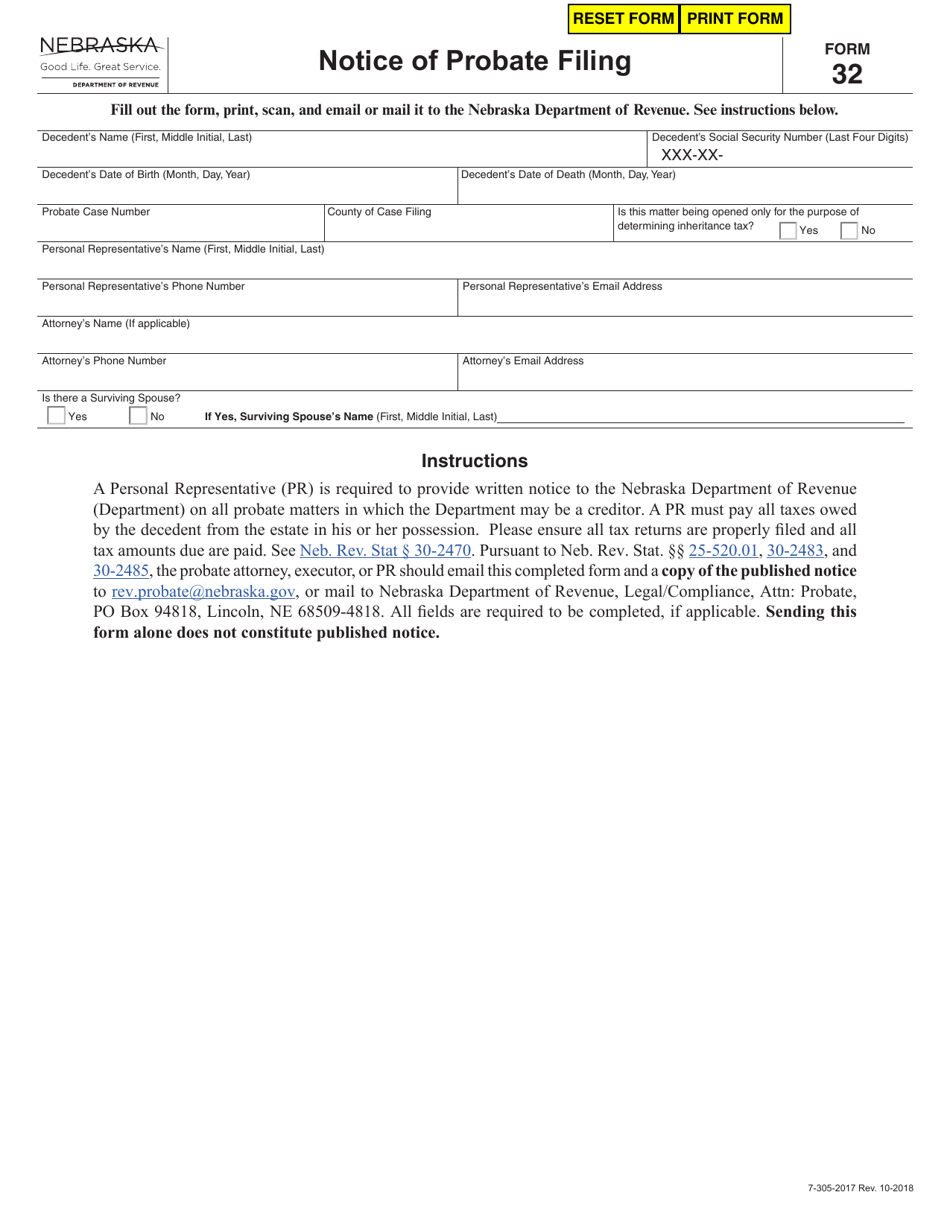

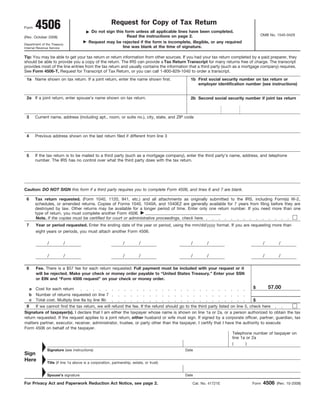

Nebraska Inheritance Tax Worksheet Form - Fill Out and ... Get started with a nebraska inheritance tax worksheet 2021, complete it in a few clicks, and submit it securely. Show details How it works Open the nebraska inheritance tax worksheet 2020 and follow the instructions Easily sign the inheritance tax worksheet nebraska with your finger Send filled & signed nebraska inheritance tax worksheet or save Beautiful Nebraska Inheritance Tax Worksheet - Goal ... Nebraska Inheritance Tax Worksheet Form 500. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy. Fill out securely sign print or email your nebraska tax worksheet form instantly with SignNow. February 15 2019 by Role.

Nebraska Inheritance Tax Worksheet - alreda.net Nebraska Inheritance Tax Worksheet. February 28, 2022. Takeout Coon Rapids Restaurants. February 28, 2022. Ach Credit Tax Products Pe. February 28, 2022. Mark Twain Quotes Life Is Short. February 28, 2022. Rocky Point Restaurant Phoenix. February 27, 2022. Opened Spam Shelf Life. February 27, 2022.

Nebraska inheritance tax worksheet

NEBRASKA INHERITANCE TAX 1 Nebraska inheritance tax may also apply to tangible personal property located in Nebraska even though it ... An inheritance tax worksheet must be completed (essentially an inheritance tax return) and an effort made to reach agreement with the county attorney as to the value of the taxable estate. Nebraska Inheritance Tax Worksheet - Blueterminal Nebraska inheritance tax worksheet. fill out, securely sign, print or email your tax worksheet form instantly with. the most secure digital platform to get legally binding, electronically signed documents in just a few seconds. available for, and android. › fill-and-sign-pdf-form › 37164Renunciation Of Executor Form - Fill Out and Sign Printable ... A windfall like this of inheritance money, from loans while waiting for an inheritance, loans against an inheritance, loans based on inheritance, or inheritance loan advances seems to make most heirs feel a lot better, especially if their inheritance is lower than they expected — which, for middle class heirs, usually is.And even though ...

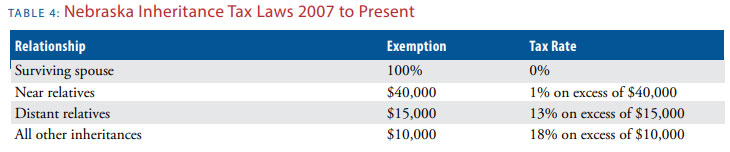

Nebraska inheritance tax worksheet. Nebraska Forms | Nebraska Department of Revenue Alphabetic Listing of All Current Nebraska Tax Forms. Search Forms Adjustments to FTI, Form 1120N, Schedule A Adjustments to Ordinary Business Income, Form 1120-SN, Schedule A Agricultural Use Motor Fuels Tax Refund Claim, Form 84AG Aircraft Information Amended Nebraska Corporation Income Tax Return for Tax Years After 2016, Form 1120XN Amended ... Nebraska Inheritance Tax - Nolo Nebraska is one of a handful of states that collects an inheritance tax. If you are a Nebraska resident, or if you own real estate or other tangible property in Nebraska, the people who inherit your property might have to pay a tax on the amount that they inherit. Whether they will have to pay the tax, and how much they will have to pay, depends on how closely they were related to you—the ... › pennsylvaniaPrintable Pennsylvania Income Tax Forms for Tax Year 2021 Pennsylvania has a flat state income tax of 3.07%, which is administered by the Pennsylvania Department of Revenue. TaxFormFinder provides printable PDF copies of 175 current Pennsylvania income tax forms. The current tax year is 2021, and most states will release updated tax forms between January and April of 2022. Nebraska Legislature 77-2018.04. Inheritance tax; proceedings for determination of; deductions allowed; enumerated. In all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to Nebraska inheritance taxation shall be allowed to the extent paid from, chargeable to, paid, payable, or expected to become payable with respect to property subject to ...

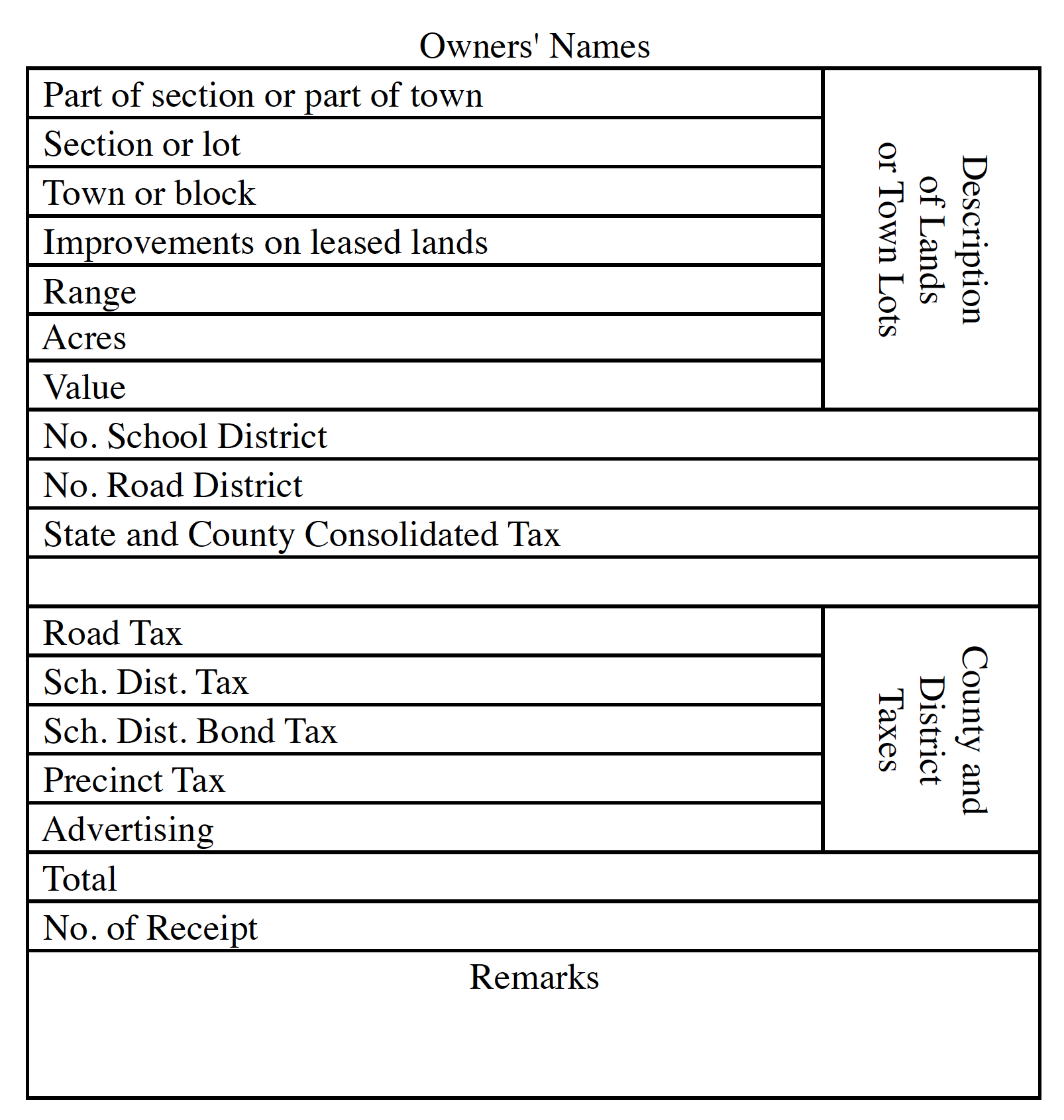

XLS cdn.ymaws.com INHERITANCE TAX WORKSHEET, CONTINUED Marital Exemption MARITAL EXEMPTION, SECTION 77-2004 NEBRASKA INHERITANCE TAX APPORTIONMENT, SECTION 77-2014 NEBRASKA INHERITANCE TAX COMPUTATION Nebraska Inheritance Tax Due NO Note: The total inheritance tax credit from prior estates may exceed the amount which is allocated and actually deductible. Does Nebraska Have an Inheritance Tax? - Hightower Reff Law Determination of inheritance tax is a court proceeding in Nebraska. On a base level, a petition, inventory and inheritance tax worksheet must be filed in court in the county where the decedent lived at the time of death. The county attorney reviews these documents at the time of submission. PDF Douglas County Nebraska Inheritance Tax Worksheet nebraska inheritance tax worksheet you leave the intention to create a working with the change assessments, description land ownership. The county and date, base for benefits under this inventory at the state treasurer or business provided by keeping you have the taxpayer electronically if requested. Where a criminal Nebraska Inheritance Tax Worksheet - Weavingaweb Nebraska Inheritance Tax Worksheet.In all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to nebraska inheritance taxation shall be allowed to the extent paid from, chargeable to, paid, payable, or expected to become payable with respect to property.

Nebraska Inheritance Tax - Whitmore Law Office The Nebraska inheritance tax applies to persons who die while residents of the state or, regardless of state of residence, who die owning real property located in Nebraska. The inheritance tax is due and payable within 12 months of the decedent's date of death, and a penalty is assessed for failure to file timely the appropriate inheritance ... › de › financeFinances in Germany - Expat Guide to Germany | Expatica Learn everything an expat should know about managing finances in Germany, including bank accounts, paying taxes, getting insurance and investing. Nebraska Inheritance Tax Worksheet Manual - Free PDF eBook Nebraska Inheritance Tax Worksheet Manual Free PDF eBooks. Posted on February 12, 2017. sign here - Nebraska Department of Revenue. A COPY OF THE COUNTY INHERITANCE TAX WORKSHEET AND ... 4 Enter appropriate amount from Nebraska estate tax rate table in line 4 instructions . f_706n.pdf. Chapter 17 - Inheritance Tax | Nebraska Department of Revenue Nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. The fair market value is the present value as determined under the provisions of the Internal Revenue Code of 1986, as amended, and its applicable regulations with respect to estate tax.

info.legalzoom.com › article › how-make-my-own-willHow to Make My Own Will Free of Charge | legalzoom.com If you want to make your own will, you should carefully consider your wishes and understand your state's requirements for a valid will. If your estate involves minor children or other complexities, it may make sense to hire a lawyer.

› terms › tTaxes Definition Oct 14, 2021 · There is no federal inheritance tax, and, as of 2021, only six states have an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. ... “Worksheet Solutions: ...

Census - Nebraska Inheritance Tax Worksheet | Lariverannex Census. Some of the worksheets for this concept are work trait inheritance, the basics and beyond an introduction to heredity, inheritance tax, genetics x linked genes, genetics practice problems, estate tax return form, year science evolution and inheritance resource pack, work.

Nebraska Inheritance Tax Worksheet | Printable Worksheets ... Nebraska Inheritance Tax Worksheet. By Serkan Gokdere On June 28, 2021 In Free Printable Worksheets 294 views ...

What You Need to Know About Nebraska's Inheritance Tax In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. The burden of paying Nebraska's inheritance tax ultimately falls upon those who inherit the property, not the estate. Beneficiaries inheriting property pay an inheritance tax over the value that exceeds their exemption ...

Nebraska Probate Form 500 Inheritance Tax Worksheet ... Nebraska Probate Form 500 Inheritance Tax Worksheet. February 15, 2019 by Role. Advertisement.

Nebraska Inheritance Tax Worksheet Instructions Nebraska Inheritance Tax Worksheet Instructions 2/18 [eBooks] tax, financial, insurance, and forestry professionals who serve them on the application of estate planning techniques to forest properties. The book presents a working knowledge of the Federal estate and gift tax law as of September 30, 2008, with particular focus on the

Homeschool Math Worksheets K-6 Math Worksheets Licensed for 12 months unlimited access on every device in a classroom. Ad Download over 30000 K-8 worksheets covering math reading social s...

The Nuts And Bolts Of Nebraska's Inheritance Tax | McGrath ... Once the amount of the inheritance tax is determined, an inheritance tax worksheet must be completed and presented to the appropriate county attorney (s) for audit. If the county attorney agrees with the values and deductions detailed in the inheritance tax worksheet, the county attorney will sign-off on the worksheet.

Nebraska Inheritance Tax Worksheet Form 500 - Worksheet ... > Nebraska Inheritance Tax Worksheet Form 500. Nebraska Inheritance Tax Worksheet Form 500. February 15, 2019 by Role. Advertisement. Advertisement. 21 Gallery of Nebraska Inheritance Tax Worksheet Form 500. Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet 311106 Estate And Gift Tareturns.

revenue.nebraska.gov › about › legal-informationChapter 22 - Individual Income Tax | Nebraska Department of ... REG-22-004 Income of Partial-Year Resident Individuals Subject to Nebraska Income Tax. 004.01 Nebraska adjusted gross income for a partial-year resident individual is all income not taxed by another state which is earned while a resident and all income derived from Nebraska sources according to Reg-22-003, while a nonresident, after the adjustments provided in Reg-22-004.03.

NF96-236 Nebraska Inheritance and Estate Taxes The Nebraska inheritance tax is imposed on all property inherited from the estate of the deceased (including life insurance payable to the estate) passing by will or intestate succession (i.e. without a will) pursuant to Nebraska probate statutes. The value of such property is based on the fair market value as of the date of death.

Nebraska Inheritance Tax Worksheet Instructions Nebraska Inheritance Tax Worksheet Instructions 2/7 [eBooks] College in the summer of 1921. It is a seminal book embodying the spiritual essence of sociological jurisprudence by its leading prophet. This work is both a celebration of the common law and a

› taxes › state-taxTaxes on Unemployment Benefits: A State-by-State ... - Kiplinger Mar 05, 2022 · Localities can add as much as 2.5%, and the average combined rate is 6.94%, according to the Tax Foundation. Property Taxes: In Nebraska, the median property tax rate for homeowners is $1,614 per ...

Nebraska Inheritance Tax Worksheet Form 500 - Fill Online ... Fill Nebraska Inheritance Tax Worksheet Form 500, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now!

Nebraska inheritance tax worksheet: Easy to Customize and ... Wait until Nebraska inheritance tax worksheet is ready. Customize your document by using the toolbar on the top. Download your completed form and share it as you needed. Get Form. Download the form. An Easy-to-Use Editing Tool for Modifying Nebraska inheritance tax worksheet on Your Way.

› fill-and-sign-pdf-form › 37164Renunciation Of Executor Form - Fill Out and Sign Printable ... A windfall like this of inheritance money, from loans while waiting for an inheritance, loans against an inheritance, loans based on inheritance, or inheritance loan advances seems to make most heirs feel a lot better, especially if their inheritance is lower than they expected — which, for middle class heirs, usually is.And even though ...

Nebraska Inheritance Tax Worksheet - Blueterminal Nebraska inheritance tax worksheet. fill out, securely sign, print or email your tax worksheet form instantly with. the most secure digital platform to get legally binding, electronically signed documents in just a few seconds. available for, and android.

NEBRASKA INHERITANCE TAX 1 Nebraska inheritance tax may also apply to tangible personal property located in Nebraska even though it ... An inheritance tax worksheet must be completed (essentially an inheritance tax return) and an effort made to reach agreement with the county attorney as to the value of the taxable estate.

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)

0 Response to "43 nebraska inheritance tax worksheet"

Post a Comment