43 self employed expenses worksheet

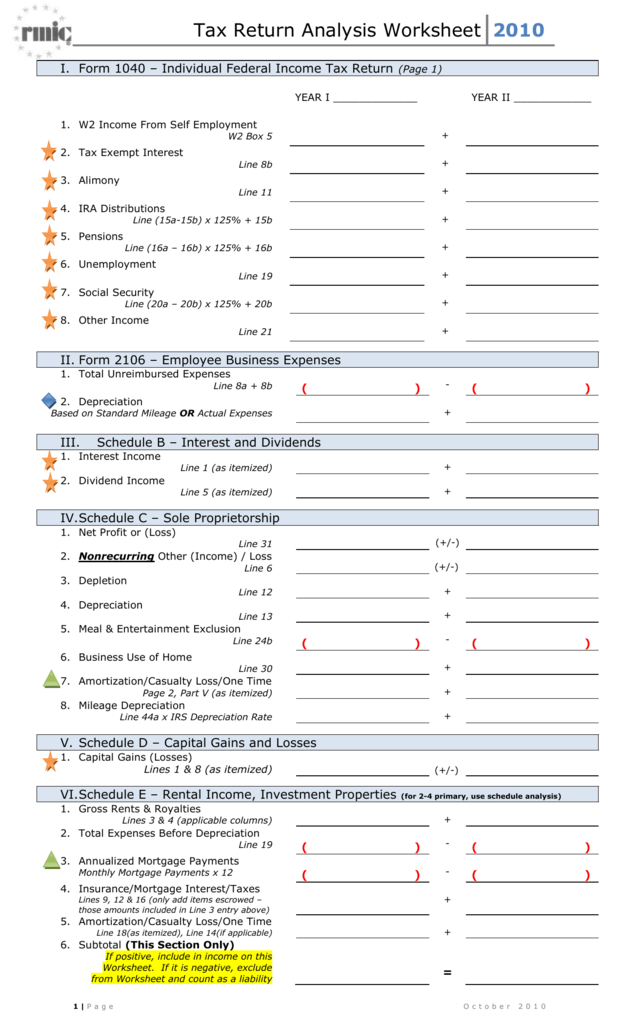

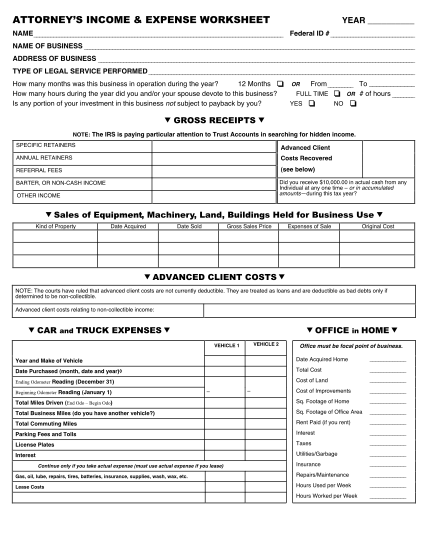

Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors IRS requires we have on file your own information to support all Schedule C’s Business Name (if any)_____ Address (if any) _____ Is this your first year in business? Yes Top 5 Self Employed Expenses Spreadsheet Templates free to... Self-employed Business Expenses (schedule C) Worksheet For For Unincorporated Businesses Or Farms. Self Employed Revenues And Expenses List Template - Rogerdeanmaidment.

Self Employed Expense Sheet Drivers › Get more: Self employed expenses pdfDetail Drivers. Complete List of Self-Employed Expenses and Tax … Details: (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business.

Self employed expenses worksheet

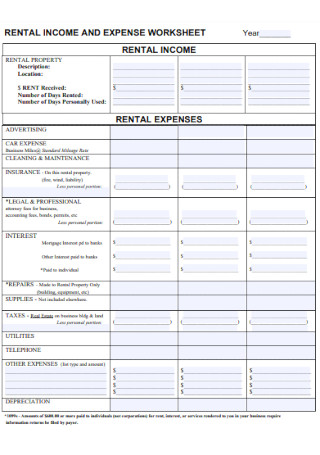

How to Categorize Common ecommerce Expenses on the Schedule... Examples of self-employed business expenses. EXAMPLES OF SELF-EMPLOYED BUSINESS EXPENSES After you have visited my website, , and read FEATURE # 3 which explains what makes an expense a business deduction, the following list. Self-employed Business, Professional, Commission... - Canada.ca Self-employed Business, Professional, Commission, Farming, and Fishing Income: Chapter 3 - Expenses. This chapter discusses the more common expenses you might incur to earn income from your activities. Incur means you paid or will pay the expense. PDF Common Unreimbursed Business Expenses Worksheet BusinessExpensesWorksheetTY19. IRS Codes. Common Unreimbursed Business Expenses Worksheet for Self-employed, Landlords, Employees Number of Personal Use Days. Employees With Business Expenses. The Miscellaneous Itemized deductions subject to 2% floor has been...

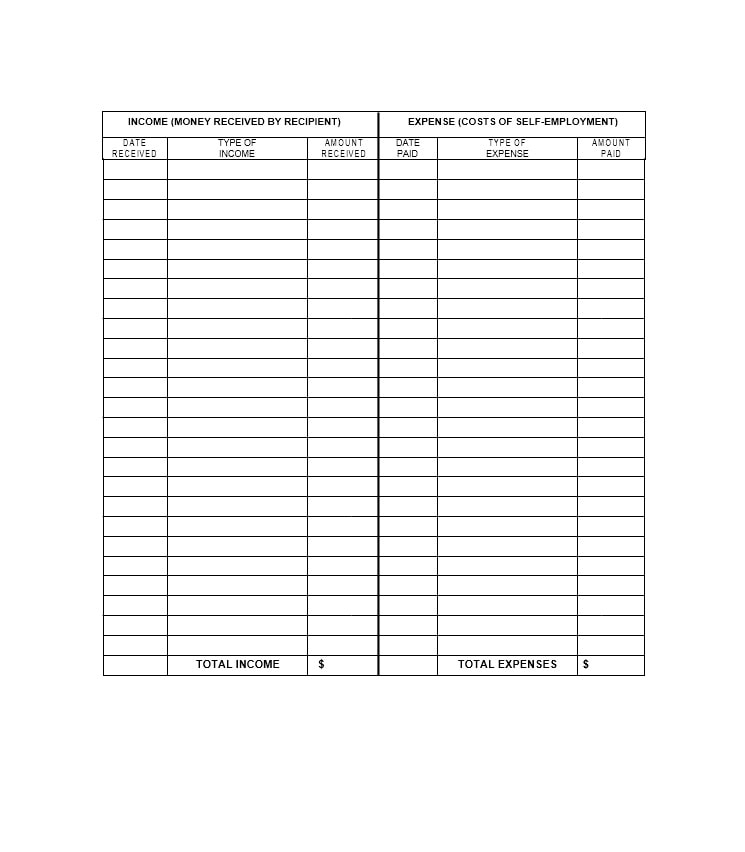

Self employed expenses worksheet. Are Medical Expenses Tax Deductible? - TurboTax Tax Tips ... 2022-02-17 · Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online & either e-filed or printed, not including returns prepared through desktop software or FFA prepared returns, 2020. Self Employed Expenses Pdf Economic Self-employment is the process of actively earning income directly from one's own business, trade or profession. Details: self employed business expenses worksheetsily create electronic signatures for signing a self employed income worksheet in PDF format. signNow has paid close attention to iOS... Schedule C or F, Self-employed Health Insurance, and ... Figure the SEHI deduction yourself and enter it on s creen 4, line 16 (line 29 in Drake18 and prior) (Self-employed health insurance deduction). Determine what should be reported on Form 8962 and use the override fields on screen 8962 to achieve the desired result. See Rev. Proc. 2014-41. Income and Expense Tracking Worksheet Income and Expense Worksheet. for Excel, Google Sheets, or PDF. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget.

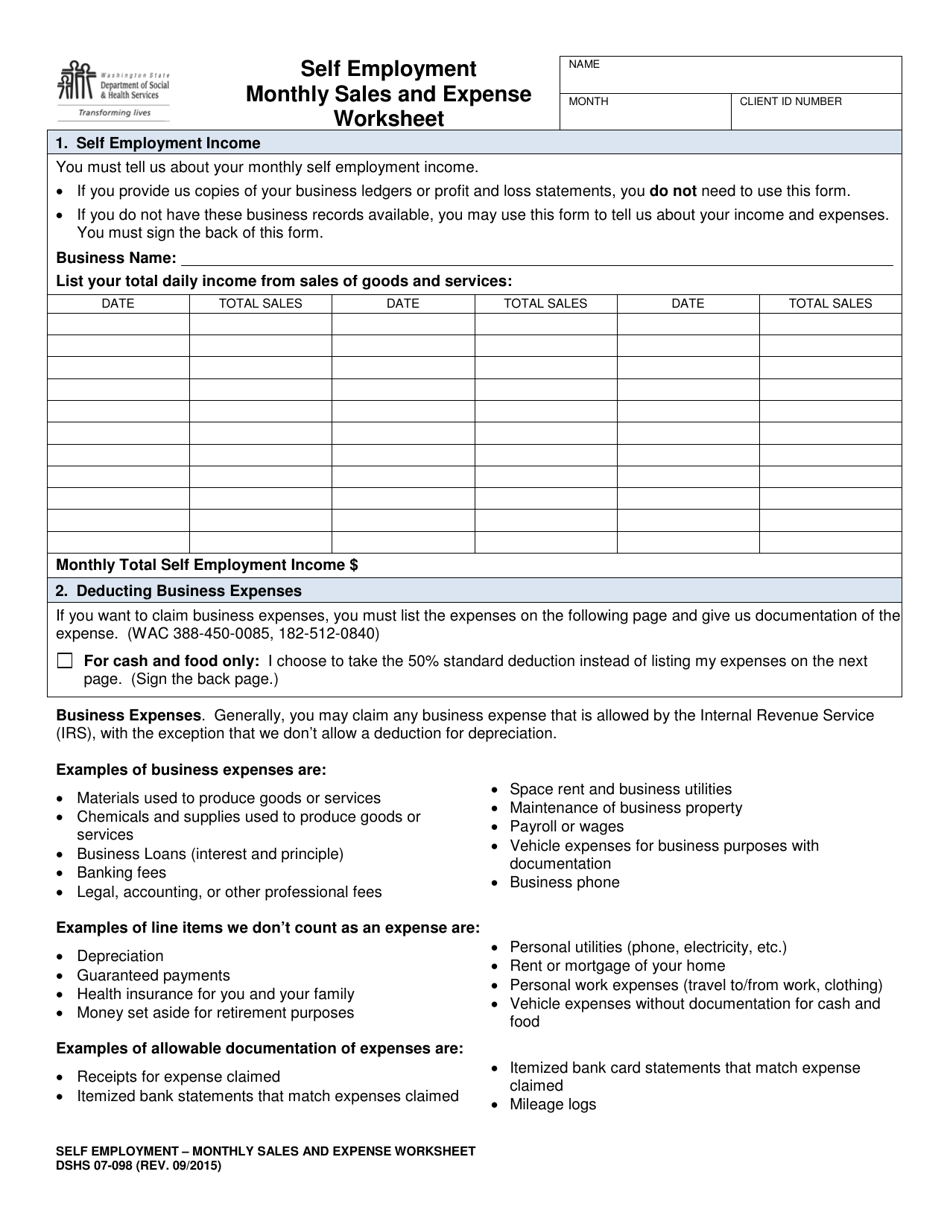

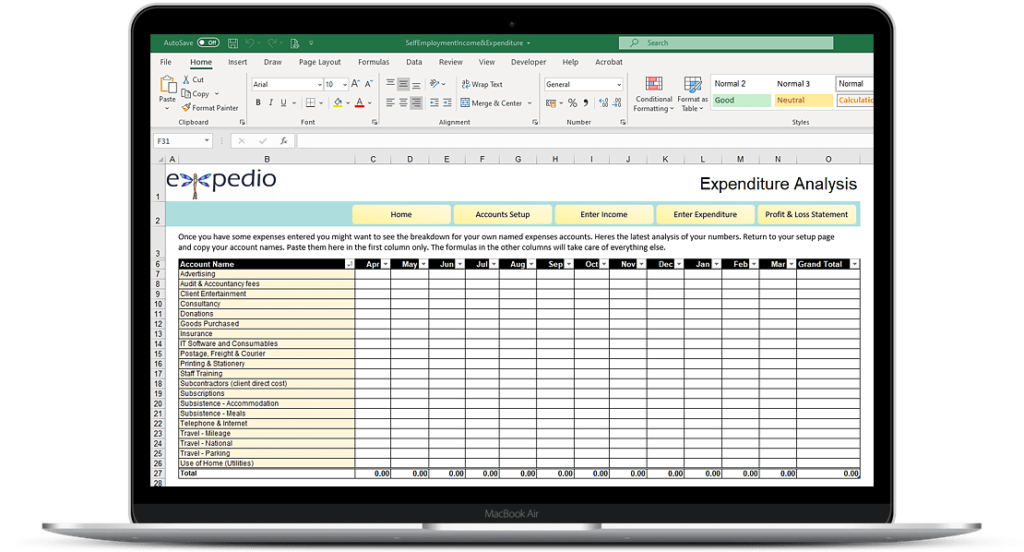

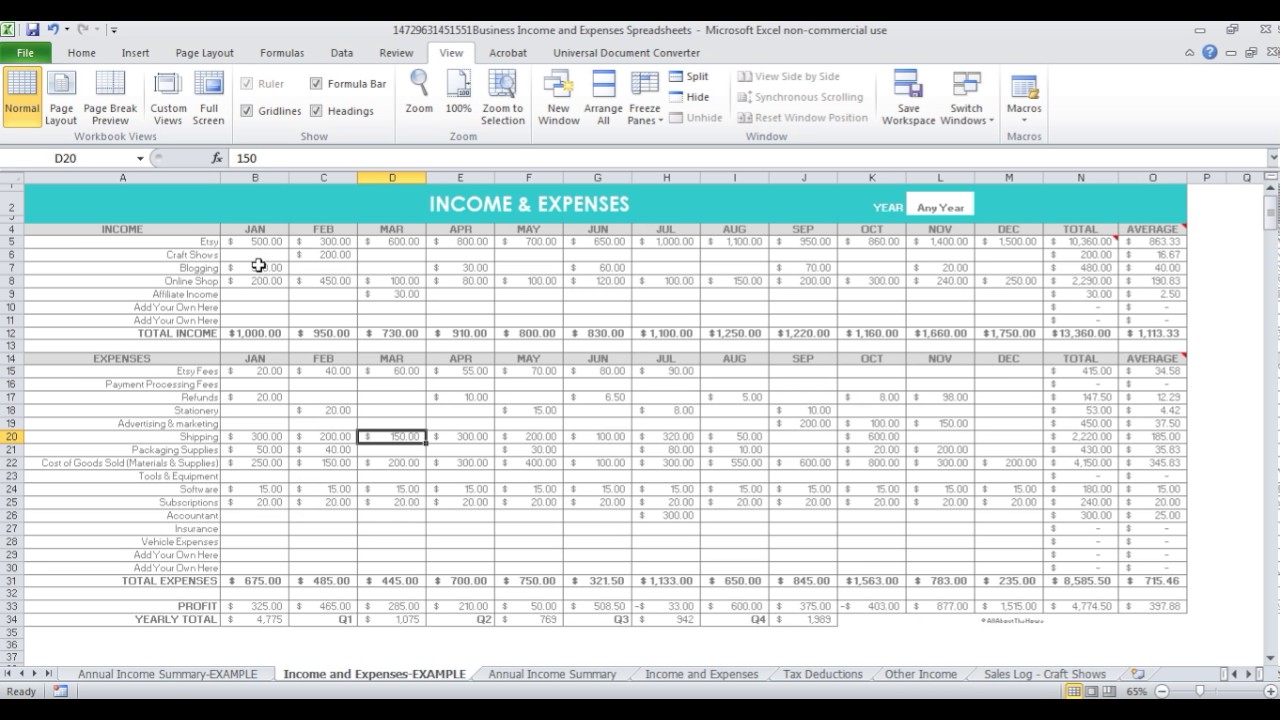

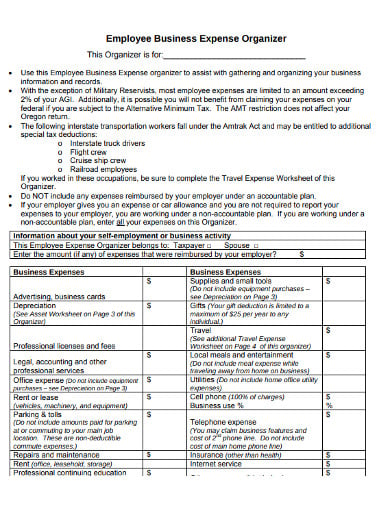

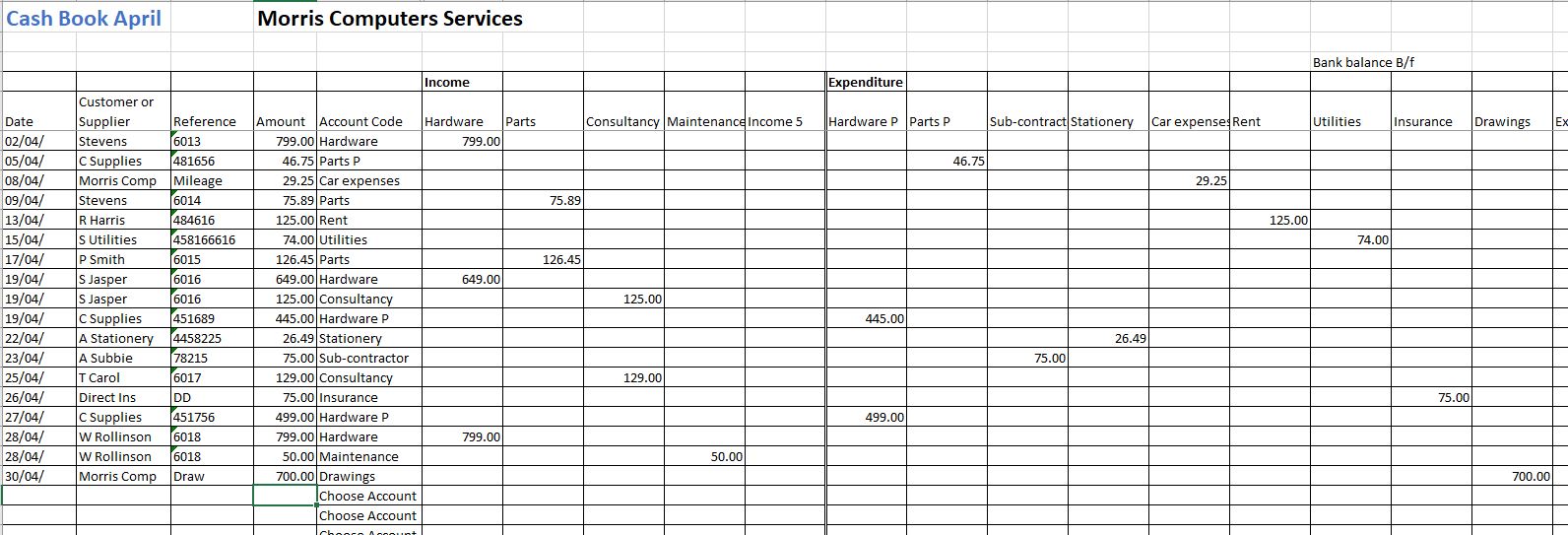

5. Self Employment Monthly Sales and Expense Worksheet 4. Self-Employed Business Expenses Worksheet. 5. Self Employment Monthly Sales and Expense Worksheet. 8. Employee Business Expenses Worksheet Template. 9. Small Business Tax Worksheet Sample. 50+ SAMPLE Expense Worksheets in PDF | MS Word 50+ Sample Expense WorksheetsWhat Is an Expense Worksheet?Who Can Use Expense Worksheets?Sample ExpensesHow to Create an Expense WorksheetFAQsWhat are the expense categories?How do you track Self-employed people also need to pay for manpower and wages. IRS Business Expense Categories List [+Free Worksheet] 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040... Free Excel Bookkeeping Templates | 3. Expense Form Template 3. Expense Form Template. This excel bookkeeping template is a cash book specifically for tracking income and expenses off a credit card. We tell you how to calculate that and include it in the template so that the total claimable is automatically worked out.

PDF Self Employment Monthly Sales and Expense Worksheet Monthly Total Self Employment Income $. 2. Deducting Business Expenses. If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense. PDF 02 - Self-Employment Organizer.xlsx | Travel Expense Worksheet Self-Employed Tax Organizer. The Self‐Employed Tax Organizer should be completed by all sole proprietors or single member LLC owners. It has been designed to help collect and organize the information that we will need to prepare the business portion of your income tax returns in the most... Self-Employment Ledger: 40 FREE Templates & Examples Self-employment is an instance in which a person works for himself instead of being employed by an employer who pays on basis of salaries or wages. A self-employed person gets his or her income by conducting profitable actions either from trade or business that he or she operates. The ultimate guide to tax deductions for the self-employed - Article Finally, self-employed individuals deduct business expenses on Schedule C of Form 1040. These expenses include advertising, utilities and other Traditional full-time employees file their taxes with a simple W-2, which includes tax withholdings. Self-employed workers use a different system.

15 Tax Deductions and Benefits for the Self-Employed Self-Employment Tax. Self Employed Contributions Act (SECA). Tax Deductions and Benefits. The self-employment tax refers to the Medicare and Social Security taxes that self-employed people In addition to the office space itself, the expenses that you can deduct for your home office include the...

Publication 502 (2021), Medical and Dental Expenses | Internal... Capital expense worksheet. Operation and upkeep. Improvements to property rented by a person with a disability. This publication also explains how to treat impairment-related work expenses, health insurance premiums if you are self-employed, and the health coverage tax credit that is available to...

Self-Employed Expense Worksheet self employed expense sheet employment tax expenses spreadsheet worksheets excel regarding sample db. Restaurant Expenses Spreadsheet regarding Self Employed ... Self-Employed Expense Worksheet Mobile DJ.

How to Create a Spreadsheet for Tracking Expenses in OS X How to Keep Track of Self-Employed Expenses. What Is the Difference Between an Expense & an Item in Quickbooks? How to Make an Employee A Microsoft Excel spreadsheet provides an ideal way to enter, categorize, sort and calculate your business expenses so you can submit them for...

Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is …

Free expenses spreadsheet for self-employed Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. We've built it to help you get peace of mind and get on with your work. You can also use Bonsai for free to automatically keep track of all your expenses online and be prepared for tax season.

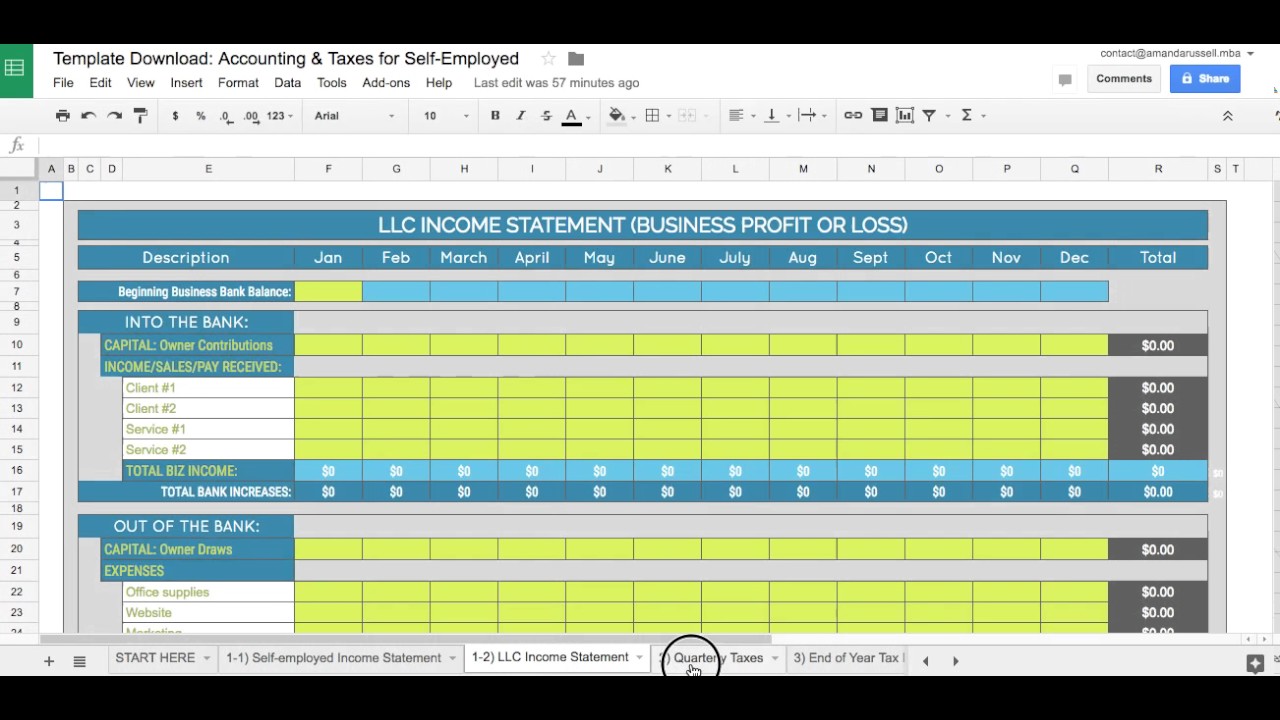

Self Employed Spreadsheet | Self Employed Bookkeeping spreadsheet Downloadable excel sheet format spreadsheets are offered online to help self-employed individuals with a user-friendly means to classify and determine their yearly expenses and incomes. I really liked this simple worksheet, there are few categories given for example.You can keep them or edit them.

Self Employment Expenses Worksheet , 02-2022 Self Employment Income Expense Tracking Worksheet Excel - We developed a sailor-shaped multiplication worksheet to make an on the internet beginning to learn more enjoyable. Self Employed Business Expenses Worksheet Printable.

Publication 560 (2021), Retirement Plans for Small ... To do this, use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed, whichever is appropriate for your plan's contribution rate, in chapter 6. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 6.

Income And Expense Worksheet For Self Employed - Spreadsheets Income And Expenses Spreadsheet Small Business. Income And Expense Worksheet For Self Employed.

Details: (Schedule C) Self-Employed Business Expenses Worksheet... Expense Sheet For Self Employed Excel! self employed individual deductions excel ,tutorial excel, step by step excel, how to use excel. Details: Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed.

12+ Business Expenses Worksheet in... | Free & Premium Templates self-employed business expenses worksheet. The management of the income and the expenses that are to be managed and kept records of in the Then add on the formulas in the worksheet of the business expenses so that you might keep the record for it. Step 4: Comparing Income to the...

Business Mileage Spreadsheet for the Self-Employed Self Employed Mileage Allowance Explained. Claiming Business Travel When You're Self-Employed. Tags Self Employed Expenses. Post navigation.

PDF Microsoft Word - Monthly_Expenses_Worksheet.doc Monthly Expenses Worksheet. How do you typically spend your money? Other. If self-employed, business expense. Calculate Your Total Monthly Expense: Total from Column A

1099 Excel Template [Free Download] It is like Quickbooks self-employed but better. If you want to learn more about their services, you can read my review of why they Whenever you have a business expense, you only need to fill out at least the first four column text boxes. If you keep a good record all year long on this worksheet you can run...

Use Of Home As An Office | Claiming Home Office Expenses If you are self-employed and use the home as an office, you can claim expenses. There are two methods of calculating your claim. Our home office deduction worksheet in Excel is an easy to use template. The download is available at the bottom of this page.

PDF Common Unreimbursed Business Expenses Worksheet BusinessExpensesWorksheetTY19. IRS Codes. Common Unreimbursed Business Expenses Worksheet for Self-employed, Landlords, Employees Number of Personal Use Days. Employees With Business Expenses. The Miscellaneous Itemized deductions subject to 2% floor has been...

Self-employed Business, Professional, Commission... - Canada.ca Self-employed Business, Professional, Commission, Farming, and Fishing Income: Chapter 3 - Expenses. This chapter discusses the more common expenses you might incur to earn income from your activities. Incur means you paid or will pay the expense.

How to Categorize Common ecommerce Expenses on the Schedule... Examples of self-employed business expenses. EXAMPLES OF SELF-EMPLOYED BUSINESS EXPENSES After you have visited my website, , and read FEATURE # 3 which explains what makes an expense a business deduction, the following list.

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

![Free Household Budget Worksheet [Excel, Word, PDF] - Best ...](https://www.bestcollections.org/wp-content/uploads/2021/04/household-budget-worksheet-for-wisconsin-works.jpg)

0 Response to "43 self employed expenses worksheet"

Post a Comment