38 home daycare tax worksheet

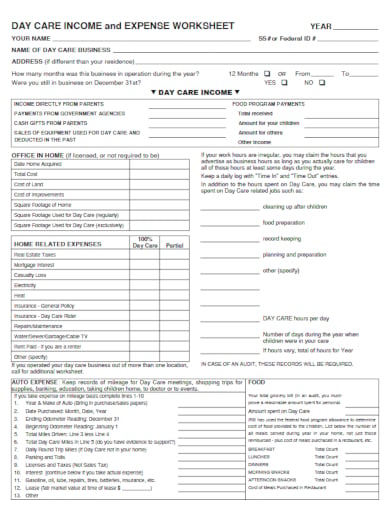

Page 1 of 35 18:11 - 10-Feb-2022 of Your Home Business Use Worksheet To Figure the Deduction for Business Use of Your Home. Worksheets To Figure the Deduction for Business Use of Your Home \(Simplified Method\) How To Get Tax Help. Exhibit A.Family Daycare Provider Meal and Snack Log. Index. Using the Simplified Method List of Tax Deductions for an In-Home Daycare Provider The IRS uses the time and space formula to determine the deductible portion of any shared expenses for a daycare in your home. This is based on the number of hours you spend operating the daycare and the percentage of space the daycare takes up in your home compared to the home's total square footage.

Home Daycare Tax Deductions for Child Care Providers 09.02.2017 · Home daycare is a unique business and because of this, you can write of things that beginning providers easily miss. Below you will find my list of common home daycare tax deductions. There are so many deductions you can take but please remember that not all may apply to every home daycare and/or there may be some that I have missed. This is ...

Home daycare tax worksheet

The Home Office Deduction - TurboTax Tax Tips & Videos 28.02.2022 · Key Takeaways • You may qualify for the home office deduction if you use a portion of your house, apartment, condominium, mobile home, boat or similar structure for your business on a regular basis. • Generally, your home office must be either the principal location of your business or a place where you regularly meet with customers or clients, and you usually … Home Daycare Tax Worksheet | Daycare business plan, Starting a daycare ... Home Daycare Tax Worksheet. Preparers say their audience generally acquisition new deductions or old deductible costs aloof by combing through their day planners, arrangement calendars, and analysis registers. You ability remember, for example, active to the abutting canton to advice a alms clean a house. Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the …

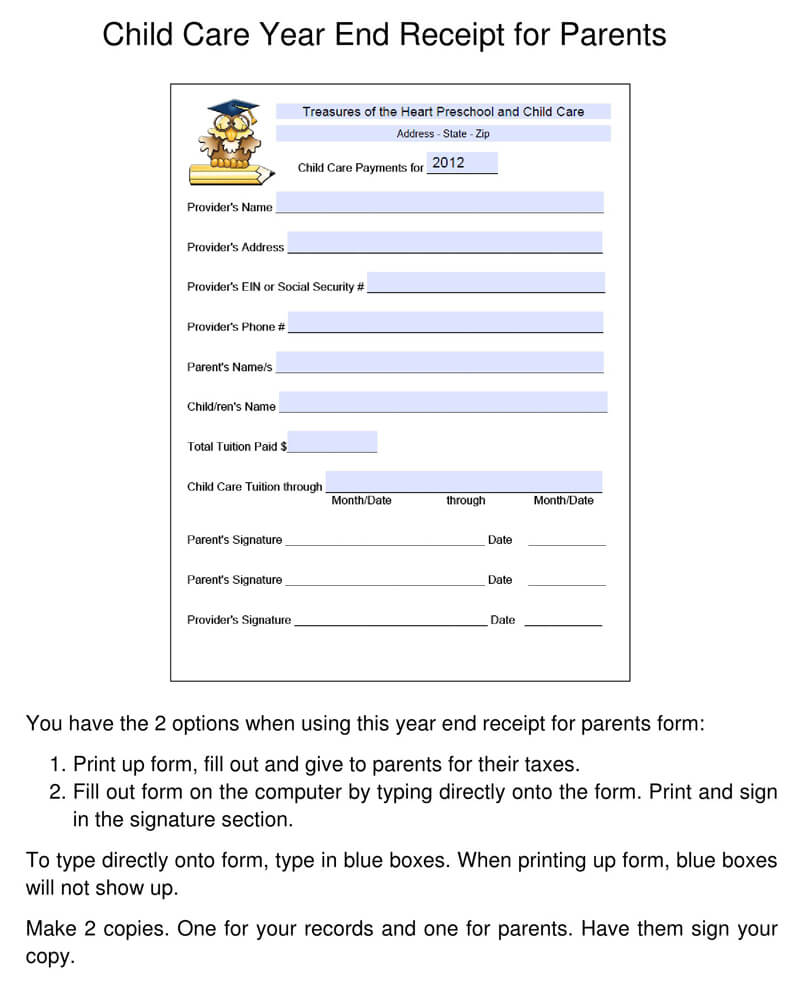

Home daycare tax worksheet. 21+ Daycare Receipt Templates - PDF, DOC | Free & Premium … Daycare centers take care of small kids while their parents are busy working in the office. A daycare center uses daycare receipt templates to confirm and acknowledge the payments made to them by the parents. Different types of daycare receipt templates, available in the internet, are easily downloadable and can be obtained in a standard format. You can also visit Invoice … MONTHLY BUDGET WORKSHEET - Navy Federal Credit Union tax-advantaged 529 plan. • As a general rule of thumb, you’ll need 70% to 80% of your current annual income for each year of retirement. For tips on planning for retirement, visit makingcents.navyfederal.org. Regular Expenses Food • Plan ahead! Make a detailed food plan every week and buy only what you can store or use within that time ... texflex.payflex.comHome | TexFlex IRS Resources. Medical and Dental Expenses - IRS Publication 502; Dependent Care Expenses - IRS Form 2441; Dependent Care Expenses - Instructions for IRS Form 2441 Maryland Child Support Calculator | AllLaw Home Legal Information Legal Calculators Child Support Calculators. Calculate Child Support Payments in Maryland . The calculator below will estimate your monthly child support payment based on Maryland's child support guidelines. Disclaimer: Please remember that these calculators are for informational and educational purposes only. Maryland Child Support Calculator. …

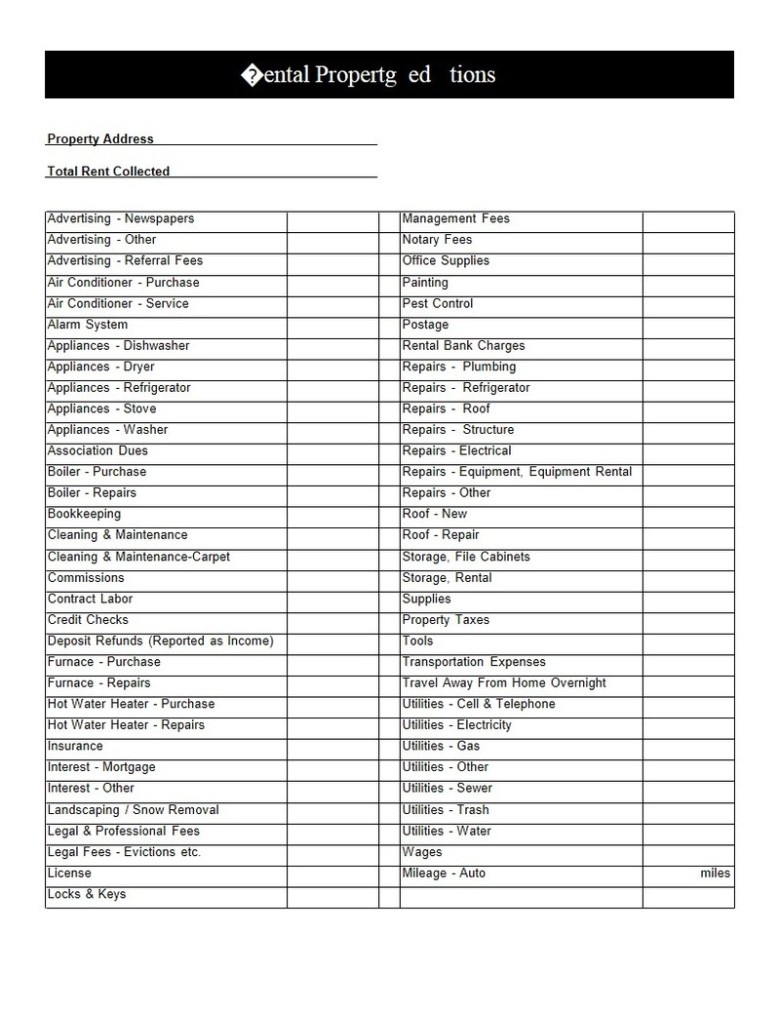

› pub › irs-pdf10-Feb-2022 of Your Home Business Use - IRS tax forms to the IRS Interactive Tax Assistant page at IRS.gov/ Help/ITA where you can find topics by using the search feature or viewing the categories listed. Getting tax forms, instructions, and publications. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. Ordering tax forms, instructions, and publications. Filing a Tax Return for Your In-Home Daycare - 2022 TurboTax® Canada Tips Filing Your Tax Return. Report the income from your daycare business on line 162 of your general income tax return. Then, deduct your business expenses to arrive at your net self-employment income on line 162. One of the easiest ways to calculate your daycare income and expenses is by using the CRA's Form T2125, Statement of Business Activities. turbotax.intuit.com › tax-tips › small-businessThe Home Office Deduction - TurboTax Tax Tips & Videos Feb 28, 2022 · Prior to the Tax Cuts and Job Acts (TCJA) tax reform passed in 2017, employees could deduct unreimbursed employee business expenses, which included the home office deduction. However, for tax years 2018 through 2025, the itemized deduction for employee business expenses has been eliminated. Welcome to atmTheBottomLine! 01.10.2013 · HOME; TAX BASICS. TYPE OF BUSINESS; SOLE PROPRIETORSHIPS; DEDUCTIONS; EXPENSE FORMS. Clergy Expense Worksheet; Daycare Expense Worksheet; Outside Sales Expense Worksheet ; Real Estate Professional Expense Worksheet; ABOUT US. ABOUT US; STAFF. JohnTravis; CONTACT US; LOG-IN; 1711 Woodlawn Ave., Wilmington, …

The BIG List of Common Tax Deductions for Home Daycare Aug 7, 2017 - The big list of home daycare tax deductions for family child care businesses! A checklist of tax write-offs that all child care providers should know about! Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe ... Completing the application online is easy, fast and secure. in home. 7. 2021 Property Tax. 4. Current MarketValue. 11. 2021 Rental Expenses (if not a single family dwelling) SECTION 10 Assets and Expenses – Real Estate other than Home 1. Number ofProperties 2. PurchasePriceofallProperties 5. Amount Owed for all Properties 6. TotalMonthly Loan/Mortgage Payment 7. 2021 Gross Property Income: List the Home | TexFlex PayFlex is excited to be the administrator of the TexFlex Flexible Spending Accounts for Plan Year 2022. If you have a TexFlex FSA, you can set up your online account.Health care and limited-purpose FSA participants — be sure to have your TexFlex debit card nearby. › graphics › budgetworksheetMONTHLY BUDGET WORKSHEET - Navy Federal Credit Union tax-advantaged 529 plan. • As a general rule of thumb, you’ll need 70% to 80% of your current annual income for each year of retirement. For tips on planning for retirement, visit makingcents.navyfederal.org. Regular Expenses Food • Plan ahead! Make a detailed food plan every week and buy only what you can store or use within that time ...

Daycare Budget Template: Tips for Budgeting Child Care 2. Take Advantage of Tax Credits. There are plenty of expenses that are tax-deductible, including daycare costs. The tax credit for dependents can allow you to claim up to 35% of your daycare costs up to a maximum of $3,000 (for one qualifying person) or at $6,000 (for two or more qualifying persons).

Day Care Meal Rates - CrossLink Tax Tech Solutions Below is our available day care meals rate worksheet: If you qualify as a family daycare provider, you can use either the standard meal and snack rates or actual costs to calculate the deductible cost of food provided to eligible children in the family daycare for any particular tax year. If you choose to us the standard meal and snack rates ...

› publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... Instructions for the Worksheet To Figure the Deduction for Business Use of Your Home Partners. Part 1—Part of Your Home Used for Business Lines 1-3. Part 2—Figure Your Allowable Deduction Line 4. Lines 5-7. Taxpayers claiming the standard deduction. Casualty losses reported on line 5. Casualty losses reported on Schedule A. Excess casualty losses.

Child Care Provider Taxes | H&R Block Answer. The IRS usually considers childcare providers as independent contractors. Since independent contractors are self-employed, you should report your income on Schedule C. Also, if your income minus expenses from self-employment is more than $400, you must file Schedule SE. This will determine your taxes for childcare. However, if a state ...

Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the …

Home Daycare Tax Worksheet | Daycare business plan, Starting a daycare ... Home Daycare Tax Worksheet. Preparers say their audience generally acquisition new deductions or old deductible costs aloof by combing through their day planners, arrangement calendars, and analysis registers. You ability remember, for example, active to the abutting canton to advice a alms clean a house.

The Home Office Deduction - TurboTax Tax Tips & Videos 28.02.2022 · Key Takeaways • You may qualify for the home office deduction if you use a portion of your house, apartment, condominium, mobile home, boat or similar structure for your business on a regular basis. • Generally, your home office must be either the principal location of your business or a place where you regularly meet with customers or clients, and you usually …

0 Response to "38 home daycare tax worksheet"

Post a Comment