40 1031 exchange calculation worksheet

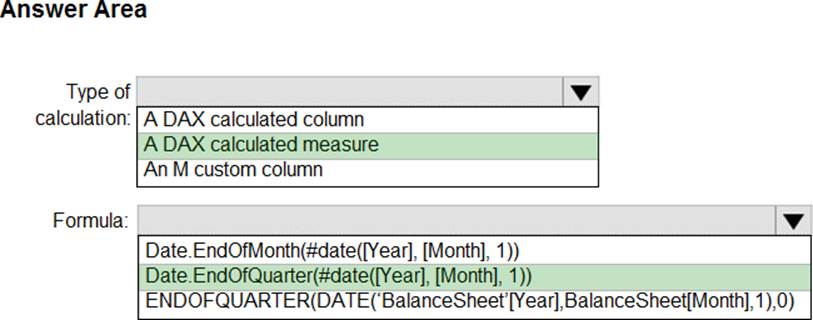

1031 Exchange Calculation Worksheet And Sec 1031 ... - Pruneyardinn We constantly attempt to show a picture with high resolution or with perfect images. 1031 Exchange Calculation Worksheet And Sec 1031 Exchange Worksheet can be beneficial inspiration for people who seek a picture according specific topic, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all. 1031 Exchange Worksheet - Pruneyardinn Worksheet April 19, 2018 18:23 The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet.

› files › WorkSheets2018WorkSheets & Forms - 1031 Exchange Experts WorkSheet #10 for Buy-Down only . KEEP: or destroy WorkSheet #1 - Calculation of Basis WorkSheet #s 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #s 4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #s 7 & 8

1031 exchange calculation worksheet

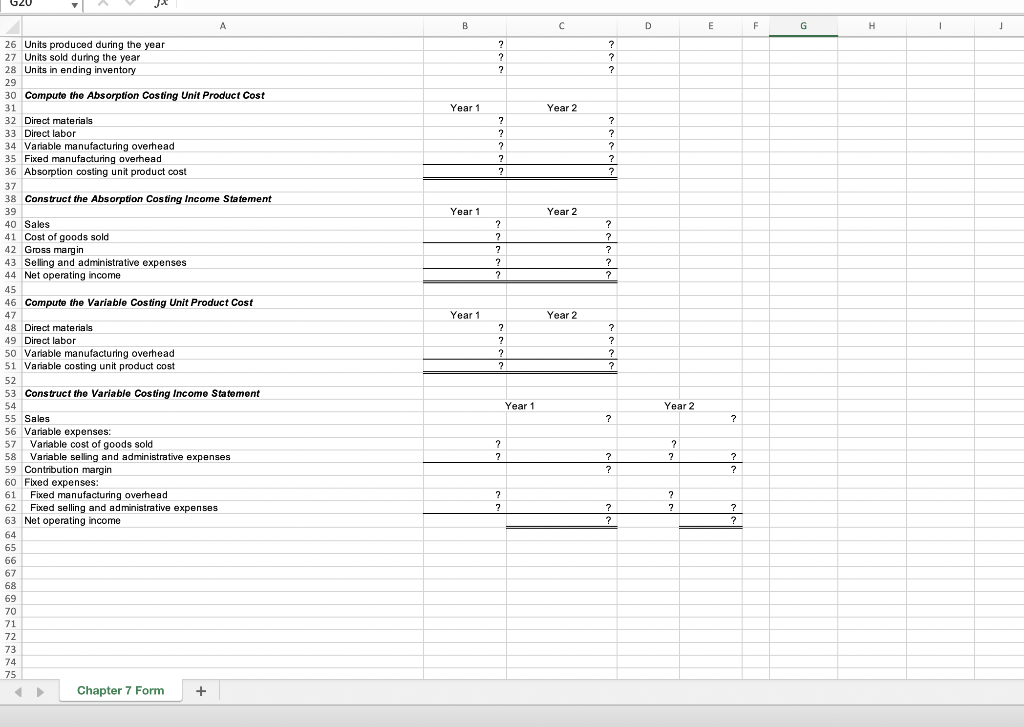

1031 Exchange Examples: Like-Kind Examples to Study & Learn From Example 1. You own a $3,000,000 investment property with a tax basis of $2,600,000 — meaning that you have a $400,000 capital gain. You would like to do a 1031 exchange into a $2,500,000 Starbucks in Clearwater, Oklahoma. You exchange your $3,000,000 property for the $2,500,000 Starbucks. Therefore, a taxable cash boot of $500,000 is realized. 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #1 - Calculation of Basis WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

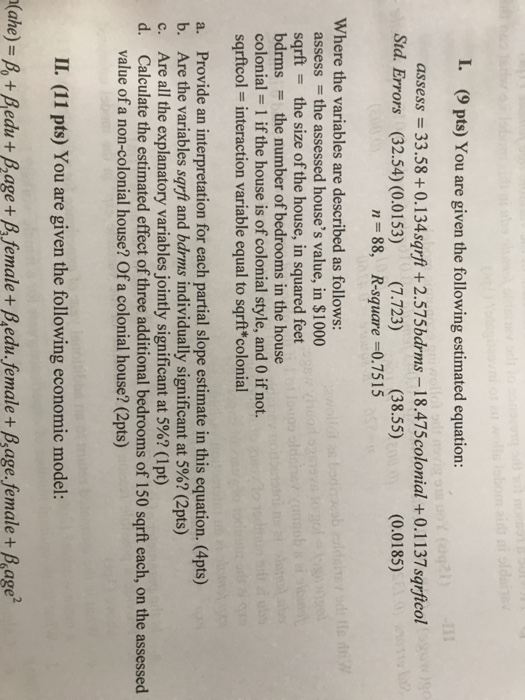

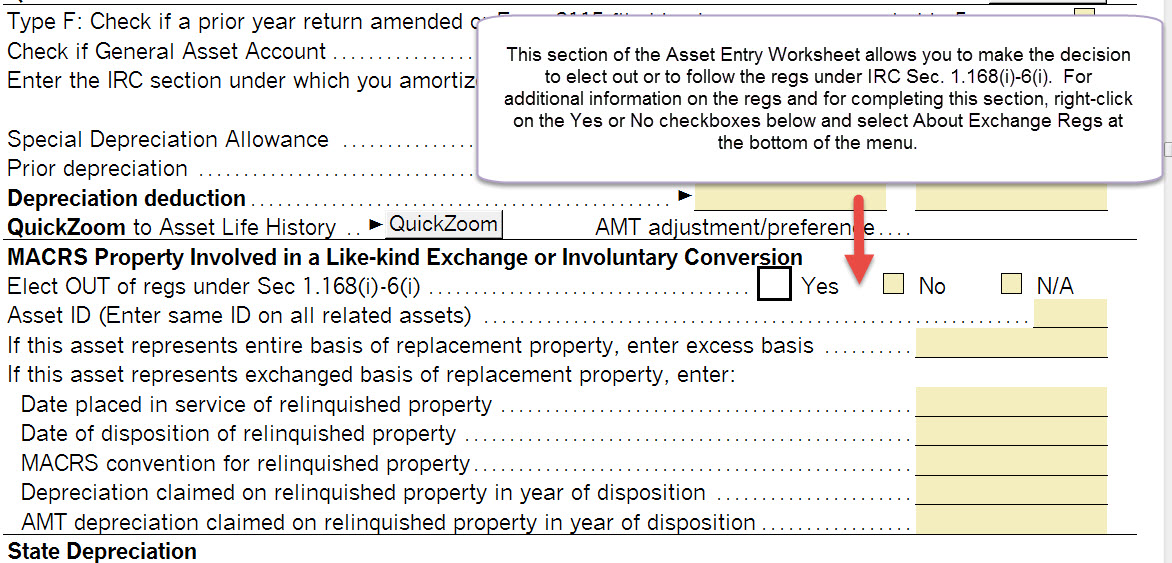

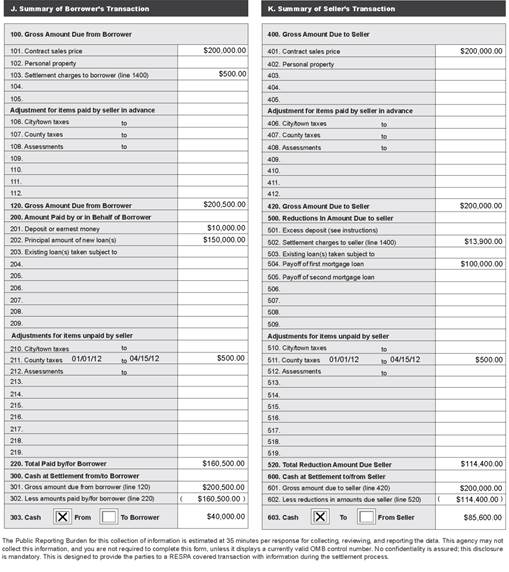

1031 exchange calculation worksheet. PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354) Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824, THE 1031 EXCHANGE FORM The combination of the HUD-1 and the information on our Capital Gains Tax page will be all that you need for the completion of the form. For review, we are dealing with the following scenario. FORM 8824 EXAMPLE Alan Adams bought a Duplex ten years ago for $200,000 cash. He assigned a value of $20,000 to the land. 1031 Exchange Calculator - Dinkytown.net This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

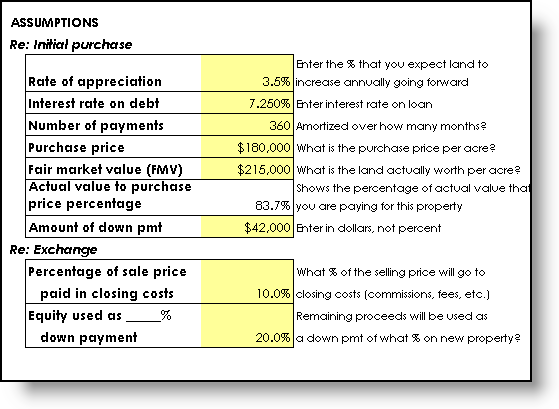

1031 Exchange Calculator | Calculate Your Capital Gains (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented. PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case › publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ... Form 8824 - 1031 Corporation Exchange Professionals We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 and herein enclose a copy. We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges.

1031 Exchange Calculator | Estimate Tax Savings & Reinvestment The 1031 Exchange Calculator above provides a simple estimation of potential taxes related to the sale of investment property and net sales proceeds available for reinvestment. These calculations are estimates for the purpose of demonstration. Many factors are involved in calculating taxes, including factors unique to each taxpayer. Like Kind Exchange Calculator Please enter a valid date for Date of Purchase. This entry is required. Enter an amount between $0 and $100,000,000. This entry is required. Enter an amount between $0 and $100,000,000. This entry is required. Enter an amount between $0 and $100,000,000. Recognized Gain and Basis Column Graph: Please use the calculator's report to see detailed ... 1031 Exchange Calculator - Penn's Grant Realty Corporation 1031 Exchange Calculator We'll be happy to help you with calculating your 1031 Exchange, please give us a call 215-489-3800. › 42074058 › Excel_2019_BIBLE(PDF) Excel ® 2019 BIBLE | Cristi Etegan - Academia.edu Enter the email address you signed up with and we'll email you a reset link.

› publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... 2018 Deferred Tax Liability calculation: 2017 Deferred Obligation: 14,000,000 – 2018 Payment received (5,000,000) 2018 Deferred Obligation: 9,000,000 x Gross Profit Percentage: 96.6670% The amount of gain that has not been recognized: 8,700,030 x Maximum capital gains tax rate: 21% 2018 Deferred Tax Liability: 1,827,006 2018 Section 453A ...

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis.

1031 Exchange for Dummies: What Investors NEED to Know! 1. Properties must be "like-kind". To qualify for a 1031 exchange, the relinquished property and the replacement property must be "like-kind.". This sounds like they need to be similar in type, but the IRS defines like-kind broadly. In practice, virtually any two types of real estate are like-kind.

IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Redmond mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates

› issues › 2020The built-in gains tax Dec 01, 2020 · A tax-deferred, like-kind exchange of an asset does not trigger the built-in gain inherent in that asset, except to the extent of boot received in the exchange. Rather, the unrecognized built-in gain and the unexpired portion of the recognition period transfers to the asset received in the exchange (Sec. 1374(d)(8); Regs. Sec. 1. 1374-8).

Capital Gains Calculator - 1031 Exchange Experts Equity Advantage Capital Gains Calculator. If the investor does not move forward with an exchange, then the transfer of property is a sale subject to taxation. An investor that holds property longer than 1 year will be taxed at the favorable capital gains tax rate. Otherwise, the sales gain is taxed at the ordinary income rate.

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) Partial 1031 exchange boot calculator This calculator will use your information, including your 1031 exchange boot tax rate, to tell you how much boot you can anticipate having — and how big of a tax bill you can expect. Partial 1031 exchange boot examples Let's look at two examples to illustrate how cash boot and mortgage boot work.

› understanding-depreciationUnderstanding Depreciation Recapture Taxes on Rental Property Apr 03, 2020 · our depreciation recapture is 66,507. Turbotax and IRS sort of “fill-in” that $43,846, i.e., $77,200 – 33,354 = $43,846 which goes on Schedule D worksheet and is taxed at an ordinary income tax rate of 12%. I don’t see any logic to that calculation, but I like the tax rate so great so far.

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

1031 Exchange Analysis Calculator - Inland Investments This calculator is designed to assist when exchanging into multiple real estate options with potentially different leverage points. PROPERTY DETAILS EXCHANGE OPTIONS SUMMARY Step 1: Enter Relinquished Property Details Enter the relinquished property details for the property that the owner (exchanger) wants to sell (relinquish).

1031 Exchange Tool Kit Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

1031 Exchange Examples | 2022 Like Kind Exchange Example Purchase Price Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000.

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

1031 Exchange Calculator with Answers to 16 FAQs! IRC Section 1031 (a) (1) states as under : "No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment, if such real property is exchanged solely for real property of like-kind which is to be held either for productive use in a trade or business or for investment.".

PDF §1031 Basis Allocation Worksheet - Irex received in exchange for the property sold.....$ _____ 4. Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost ... §1031 BASIS ALLOCATION WORKSHEET Replacement Property Depreciation Analysis (Supplement to §1031 Recapitulation Worksheet Form 354)

› forms › 22_formsMARYLAND Application for Certificate of FORM Full or Partial ... Tax-Free Exchange for purposes of §1031 of the Internal Revenue Code. Transferor/seller is receiving zero proceeds from this transaction because proceeds are going to another seller/ owner (ex. cosignor). Transfer is pursuant to an installment sale under §453 of the Internal Revenue Code. Transfer of inherited property is occurring within 6 ...

0 Response to "40 1031 exchange calculation worksheet"

Post a Comment