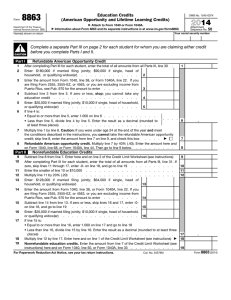

40 student loan interest deduction worksheet 1040a

› forms-pubs › about-form-1040About Form 1040, U.S. Individual Income Tax Return Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses. Schedule 1 PDF Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an excess advance premium tax credit ... › tax-form › 10402021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Student Loan Interest Deduction Worksheet Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are often published later in January to include any last minute legislative changes.

› main › OLTFreeOLT Free File Supported Federal Forms Student Loan Interest Deduction Worksheet: Worksheet Form 6251-Schedule 2, Line 1: Exemption Worksheet for Form 6251 line 5: ... (Form 1040 or 1040A) Top:

Student loan interest deduction worksheet 1040a

› modified-adjusted-grossModified Adjusted Gross Income (MAGI) - Your Roth IRA First, start with your adjusted gross income (AGI) as shown on your tax return. This is line 21 on IRS Form 1040A (U.S. Individual Income Tax Return). From your AGI, subtract the following items if applicable... 1) Roth IRA Conversions - This includes any amounts listed on Form 1040, line 15b; Form 1040A, line 11b; or Form 1040NR, line 16b. revenue.nebraska.gov › about › legal-informationChapter 22 - Individual Income Tax | Nebraska Department of ... 003.02I Student Loan Interest. A nonresident individual shall be allowed this deduction only to the extent of the ratio of the Nebraska adjusted gross income to federal adjusted gross income after Nebraska adjustments. 003.02J Tuition and fees. › pub › irs-pdf2021 Instruction 1040 - IRS tax forms Have any deductions to claim, such as student loan inteest, r self-employment tax, or educator expenses. Can claim a efundable cr redit (other than the eaned income r credit, American opportunity cedit, refundable child tax credit, r additional child tax cedit, or recovery rebate credit), such as the r

Student loan interest deduction worksheet 1040a. smartasset.com › taxes › all-about-irs-form-1040ezIRS Form 1040EZ - See 2020 Eligibility ... - SmartAsset Jan 07, 2022 · This law consolidated the forms 1040, 1040A and 1040EZ into a single redesigned Form 1040 that all filers can use. For your 2021 taxes, which you file in 2022, you will continue to use this new Form 1040. › pub › irs-pdf2021 Instruction 1040 - IRS tax forms Have any deductions to claim, such as student loan inteest, r self-employment tax, or educator expenses. Can claim a efundable cr redit (other than the eaned income r credit, American opportunity cedit, refundable child tax credit, r additional child tax cedit, or recovery rebate credit), such as the r revenue.nebraska.gov › about › legal-informationChapter 22 - Individual Income Tax | Nebraska Department of ... 003.02I Student Loan Interest. A nonresident individual shall be allowed this deduction only to the extent of the ratio of the Nebraska adjusted gross income to federal adjusted gross income after Nebraska adjustments. 003.02J Tuition and fees. › modified-adjusted-grossModified Adjusted Gross Income (MAGI) - Your Roth IRA First, start with your adjusted gross income (AGI) as shown on your tax return. This is line 21 on IRS Form 1040A (U.S. Individual Income Tax Return). From your AGI, subtract the following items if applicable... 1) Roth IRA Conversions - This includes any amounts listed on Form 1040, line 15b; Form 1040A, line 11b; or Form 1040NR, line 16b.

0 Response to "40 student loan interest deduction worksheet 1040a"

Post a Comment