40 itemized deductions worksheet 2015

PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre- An Overview of Itemized Deductions - Investopedia Itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Types of itemized deductions include mortgage interest, state or local income taxes,...

Itemized deductions: a beginner's guide - Money Under 30 Anyways, for the tax year 2021 (aka the taxes you file in April, 2022), the standard deductions are as follows, based on your filing status: $12,550 for single filers and married filing separately, $26,900 for joint filers, and. $19,400 for head of household. So if you make $60,000, and you choose the standard deduction amount of $12,550, your ...

Itemized deductions worksheet 2015

Publication 535 (2021), Business Expenses | Internal Revenue … Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Instructions for Form 6251 (2022) | Internal Revenue Service Investment interest expense that isn’t an itemized deduction. If you didn’t itemize deductions and you had investment interest expense, don’t enter an amount on Form 6251, line 2c, unless you reported investment interest expense on Schedule E (Form 1040), Supplemental Income and Loss. If you did, follow the steps above for completing Form ... How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

Itemized deductions worksheet 2015. Publication 536 (2021), Net Operating Losses (NOLs) for Individuals ... Individuals—You subtract your standard deduction or itemized deductions from your adjusted gross income (AGI). Estates and trusts—You combine ... certain deductions are not allowed. He uses Worksheet 1 to figure his NOL. The following items are not allowed on Worksheet 1. Nonbusiness net short-term capital loss: $1,000: Nonbusiness deductions Publication 501 (2021), Dependents, Standard Deduction, and ... The standard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2021 than it was for 2020. The amount depends on your filing status. You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction. Charitable contribution deduction. PDF Itemized Deductions Worksheet-Line 15 2016 - 1040.com No. Stop. Your deduction is not limited. Enter the amount from line 1 above on Schedule A, line 15. Yes. Subtract line 6 from line 5 Multiply line 7 by 3% (.03) Enter the smaller of line 4 or line 8 Total itemized deductions. Subtract line 9 from line 1. Enter the result here and on Schedule A, line 15 WK_A_NR.LD Name(s) as shown on return Tax ... Itemized Deductions: 2022 Complete List and Impact on Taxes If the value of your deductible expenses exceeds the standard deduction (as noted above, for the tax year 2022 these are: $12,950 for single taxpayers and married couples filing separately; $25,900 for married couples filing jointly; and $19,400 for heads of households), then you should consider itemizing your deductions.

What Are Itemized Tax Deductions? Definition and Impact on Taxes An itemized deduction is an expense that can be subtracted from adjusted gross income (AGI) to reduce your tax bill. Itemized deductions must be listed on Schedule A of Form 1040. 1 Most... Itemized deduction - Wikipedia Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and is claimable in place of a standard deduction, if available.. Most taxpayers are allowed a choice between the itemized deductions and the standard deduction. After computing their adjusted gross income (AGI ... Publication 526 (2021), Charitable Contributions | Internal ... You cannot claim the deduction on Form 1040 or 1040-SR, line 12b, and file Schedule A (Form 1040). You may benefit from itemizing deductions if your itemized deductions are greater than the standard deduction. If you have a choice, you should generally use the method that gives you the lower tax. Deductions | FTB.ca.gov - California If someone else claims you on their tax return, use this calculation. 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction 2. $1,100 3. Enter the larger of line 1 or line 2 here 3. 4. Enter amount shown for your filing status:

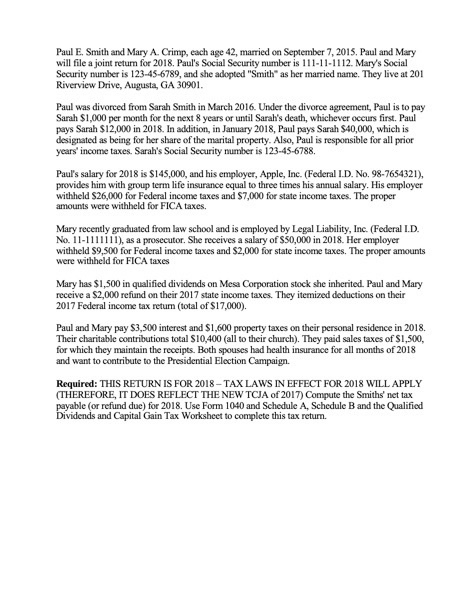

PDF 2015 ITEMIZED DEDUCTIONS WORKSHEET - saralandtax.com 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might ... 2015 ITEMIZED DEDUCTIONS - FINAL as of 9-18-2015.pub Author: Joe Created Date: 12/22 ... Publication 3 (2021), Armed Forces' Tax Guide Publication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. Examples of Itemized Deductions - FreshBooks Itemized deductible medical expenses include: Prescriptions, doctor's fees/co-pays, insurance premiums, necessary surgery (non-cosmetic), physical handicap costs, and transportation to a medical facility. You can also deduct 24 cents for every mile you drove for medical care. Charitable Contributions Publication 529 (12/2020), Miscellaneous Deductions Miscellaneous itemized deductions are those deductions that would have been subject to the 2%-of-adjusted-gross-income (AGI) limitation. You can still claim certain expenses as itemized deductions on Schedule A (Form 1040), Schedule A (1040-NR), or as an adjustment to income on Form 1040 or 1040-SR. This publication covers the following topics.

PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

Publication 590-B (2021), Distributions from Individual Retirement ... Jim decides to make a qualified charitable distribution of $6,500 for 2022. Jim completes his 2022 QCD worksheet by entering the amount of the remainder of the aggregate amount of the contributions he deducted in 2020 and 2021 ($4,000) on line 1. This amount is figured on his 2021 QCD worksheet and is entered on line 1 of his 2022 QCD worksheet.

2021 Schedule A (Form 1040) Itemized Deductions Keywords: Fillable Created Date: 12/20/2021 6:31:50 AM ...

Itemized Deduction Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Schedule A Itemized Deductions 2. Deductions (Form 1040) Itemized - 3. Itemized Deductions Worksheet 4. Itemized Deduction Worksheet TAX YEAR 5. PERSONAL ITEMIZED DEDUCTIONS WORKSHEET - 6. ITEMIZED DEDUCTION WORKSHEET (14A) $178,150 or more ... 7. Itemized Deductions Limitation Worksheet - 8.

home office deduction worksheet 2021 30 Itemized Deductions Worksheet 2015 - Worksheet Information. 17 Pics about 30 Itemized Deductions Worksheet 2015 - Worksheet Information : Simplified Method Worksheet, How To Claim A Home Office Tax Deduction - Asbakku and also Home Office Expense Spreadsheet Printable Spreadsheet home office tax.

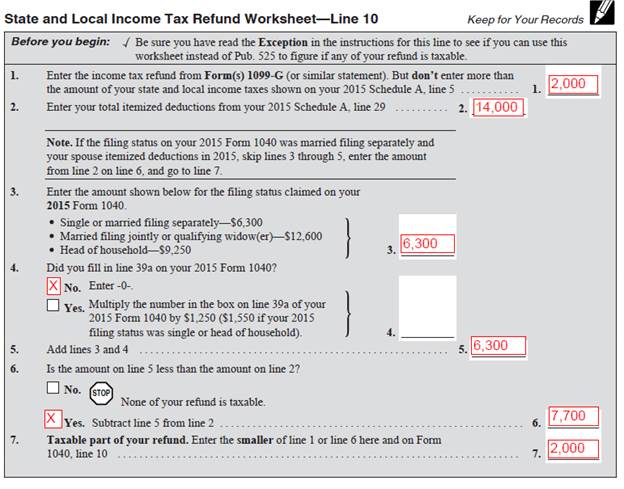

Publication 525 (2021), Taxable and Nontaxable Income Overall limitation on itemized deductions no longer applies. Worksheet 2a. Computations for Worksheet 2, lines 1a and 1b; Worksheet 2. Recoveries of Itemized Deductions; Unused tax credits. Subject to AMT. Nonitemized Deduction Recoveries. Total recovery included in income. Total recovery not included in income. Negative taxable income. Unused ...

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

PDF Attach to Form 1040. - IRS tax forms Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

Publication 907 (2021), Tax Highlights for Persons With ... If you file Form 1040 or 1040-SR, to lower your taxable income, you can generally claim the standard deduction or itemize your deductions, such as medical expenses, using Schedule A (Form 1040). For impairment-related work expenses, use the appropriate business form (1040 Schedules C, E, and F; or Form 2106, Employee Business Expenses).

Solved: Itemized deduction worksheet? - Intuit June 1, 2019 5:05 PM. TurboTax will automatically select the type of deduction that brings you the most tax benefit based off of your entries within the program. You can view your Scheule A: Itemized Deductions by taking the following steps: 1.) In the upper right-hand corner, click Forms.

North Carolina Standard Deduction or North Carolina Itemized Deductions ... Use the chart below to determine the amount of your N.C. standard deduction based on your filing status: If your filing status is: Your standard deduction is: Single. $10,750. Married Filing Jointly/Qualifying Widow (er)/Surviving Spouse. $21,500. Married Filing Separately. Spouse does not claim itemized deductions.

Download Itemized Deductions Calculator Excel Template Whereas the itemized deductions are actual amounts of deductions claimed. When deciding between standard and itemized deductions the following points must be considered: Total of the all the itemized deductions should be higher than the standard deduction amount. You must have proper documents to support the claim whenever demanded by the IRS.

2021 Instructions for Schedule A - IRS tax forms 2021 Instructions for Schedule AItemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and

Get Printable Yearly Itemized Tax Deduction Worksheet - US Legal Forms The tips below can help you fill out Printable Yearly Itemized Tax Deduction Worksheet easily and quickly: Open the document in our full-fledged online editing tool by hitting Get form. Complete the necessary fields which are yellow-colored. Hit the green arrow with the inscription Next to move from field to field.

Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) On average this form takes 18 minutes to complete The Form 2015: Itemized Deductions Dental Medical (Form 1040) (IRS) form is 1 page long and contains: 0 signatures 5 check-boxes 70 other fields Country of origin: US File type: PDF

2021 Instructions for Schedule CA (540) | FTB.ca.gov - California Part II Adjustments to Federal Itemized Deductions. Important: If you did not itemize deductions on your federal tax return but will itemize deductions on your California tax return, first complete federal Schedule A (Form 1040), Itemized Deductions. Then check the box at the top of Schedule CA (540), Part II and complete line 1 through line 30.

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance

What Is an Itemized Deduction? - The Balance You can deduct the portion that exceeds 7.5% of your AGI for 2021 taxes. For instance, if your AGI were $55,000, and you had $7,000 in qualifying medical expenses, your deduction would be limited to $3,375—the amount that exceeds $4,125 (7.5% of your AGI). 2 State, Local, and Real Estate Taxes

1040 (2021) | Internal Revenue Service - IRS tax forms Line 12a Itemized Deductions or Standard Deduction. Itemized Deductions; Standard Deduction. Exception 1—Dependent. Exception 2—Born before January 2, 1957, or blind. Exception 3—Separate return or dual-status alien. Exception 4—Increased standard deduction for net qualified disaster loss. Standard Deduction Worksheet for Dependents ...

How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

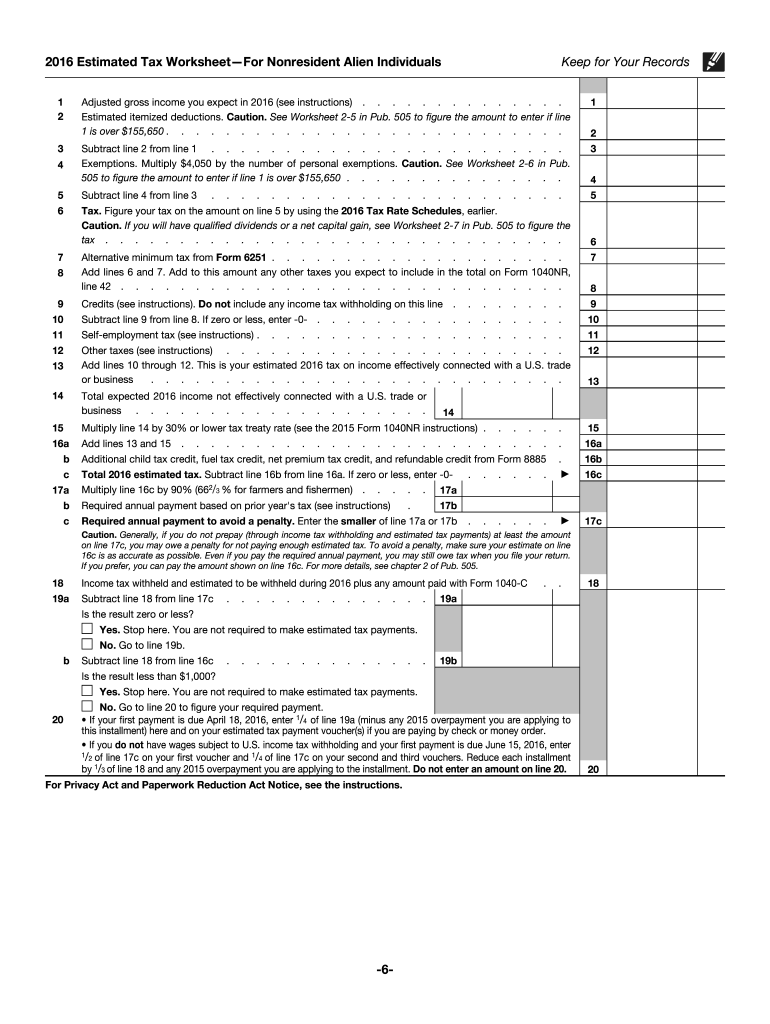

Instructions for Form 6251 (2022) | Internal Revenue Service Investment interest expense that isn’t an itemized deduction. If you didn’t itemize deductions and you had investment interest expense, don’t enter an amount on Form 6251, line 2c, unless you reported investment interest expense on Schedule E (Form 1040), Supplemental Income and Loss. If you did, follow the steps above for completing Form ...

Publication 535 (2021), Business Expenses | Internal Revenue … Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

0 Response to "40 itemized deductions worksheet 2015"

Post a Comment