43 funding 401ks and iras worksheet answers

obamacarefacts.com › modified-adjusted-grossModified Adjusted Gross Income (MAGI) - Obamacare Facts Jan 08, 2015 · HSA’s, retirement accounts like 401ks, and other tax advantaged investment vehicles can be a smart choice for lowering GI, AGI, and MAGI. Specifically for ObamaCare, HSA’s really stand out. Not only can you lower your MAGI with an HSA (it lowers AGI and isn’t added back to MAGI), you can also accumulate interest tax-free, and spend money ... ️Investments Compared Worksheet Chapter 8 Free Download| Qstion.co Funding 401ks and roth iras worksheet answers funding 401ks and roth iras worksheet answers chapter 8. Work we do ncert chapter worksheet 13. Save Image *Click "Save Image" to View FULL IMAGE. Free Download 3 8 Present Value Of Investments Worksheet Answers Other sets by this creator. You'll not only have to.

Funding 401(K)S And Roth Iras Worksheet Answers Pdf - Free Gold IRA ... Funding 401(K)S And Roth Iras Worksheet Answers PdfA gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Funding 401ks and iras worksheet answers

thefinancebuff.com › medicare-irmaa-income2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · 2023 IRMAA Brackets. Source: Medicare Costs, Medicare.gov The standard Medicare Part B premium will be $164.90 in 2023. 2024 IRMAA Brackets. We have one data point out of 12 as of right now for what the IRMAA brackets will be in 2024 (based on 2022 income). Funding 401ks and roth iras worksheet answers? - Eyelight.vn Home » Blog » Wikipedia » Funding 401ks and roth iras worksheet answers? Funding 401ks and roth iras worksheet answers? Tác giả: ... Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a possible 2 points Investment Annual Salary Company Match 401 (k) Roth IRA Joe $ 40,000 1:1 up to 5% $ 2,000 $ 4,000 $ 6,000 Melissa $ 55,000 1:2 up to 6% $ 3,300 $ 4,950 $ 8,250 Tyler & Megan $ 105,000 No Match

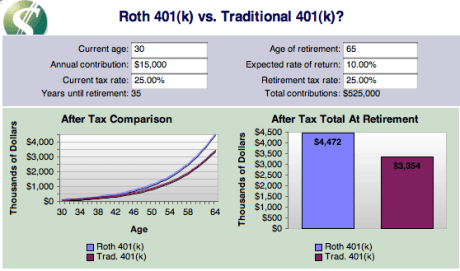

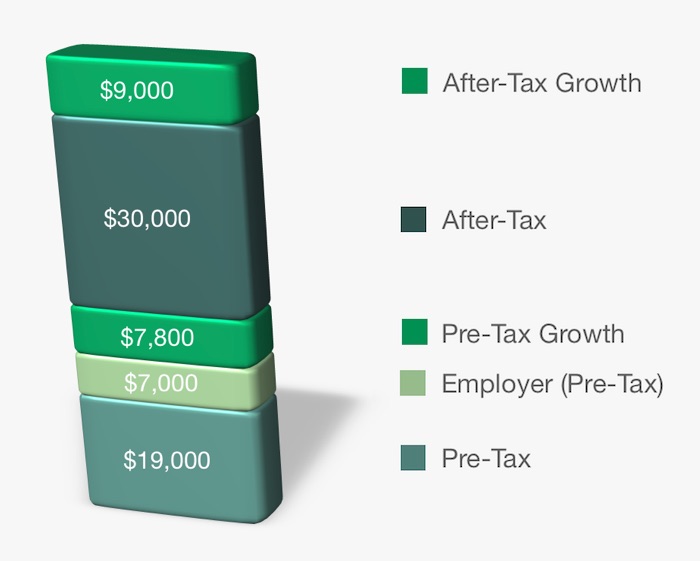

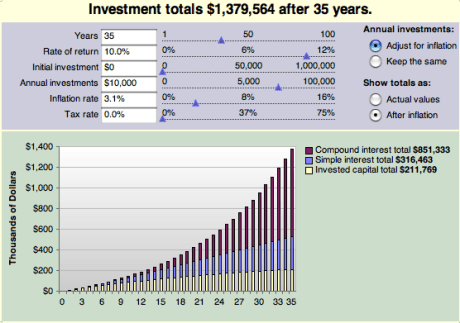

Funding 401ks and iras worksheet answers. pwhb.rideredwave.shop › baja-bug-front-suspensionbaja bug front suspension weighted average method questions and answers cell organelles worksheet 7th grade; ... funding 401ks and roth iras chapter 12 lesson 3 answer key kontribusyon ng lalaki; funding 401(k)s and roth iras worksheet answers funding 401(k)s and roth iras worksheet answers. 15 prosinac, 2021. Do student activity sheet, "401(K) and Roth IRA". Funding 401s and roth iras. 401 (K) defined contribution plan offered by a corporation to its employees, which allows employees to set aside tax-deferred income for retirement purposes; in some cases, employers will match their contributions. PDF Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. p Roth 401(k): Multiply the maximum allowable amount by 1 plus your tax rate (for example, 1.24 if you're in the 24% tax bracket). Then divide that amount by your total salary to arrive at your ... PDF Funding 401ks and iras worksheet answers - cosmopolitanhotel.eu In general, contributions to retirement accounts can be carried out the pre-tax, as in an IRA 401 (K) or traditional. Contributions to traditional anger qualify for a tax deduction 1/2 are subject to a 10% penalty with some exceptions. In the Roth version of the IRAs and 401 (K) plans, the contributions are carried out after the taxes are paid.

Copy of Funding 401 (k)'s and Roth IRA's - WORKSHEET Step 1: Calculate 15% of the total annual salary Step 2: Calculate the maximum match that can be contributed to the 401 (K) Step 3: Calculate the remaining balance into the ROTH IRA column Exceptions * if there is no match, put the maximum amount into the ROTH IRA first, and the remaining into 401 (k) Funding 401 K S And Roth Iras Worksheet Answers Funding 401 k s and roth iras worksheet answers. A funding 401 k s and roth iras worksheet answers is a few short questionnaires on a certain topic. A worksheet, get sheet name a workbook includes a selection of worksheets. Invest the max amount allowed in a roth ira and then go back. Funding 401Ks And Roth Iras Worksheet Answers Pdf - Wakelet (pg 33 lfa)the seven fundamental principles of gs are:1• are fair, transparent, and equitable for all students; 2• support all students, including all students no matter their background. 3• are carefully planned to relate to the curriculum expectations and learning goals and, as much as possible, to the interests, learning styles and … 2022 Free Funding 401 K S And Roth Iras Worksheet Answers Assume each person is following dave's advice of investing 15% of. Funding 401(k)s and roth iras worksheet answer key overview. Source: nofisunthi.blogspot.com. Funding 401(k)s and roth iras worksheet answers chapter 8 overview. Joe will take advantage of the company match (5% of salary) then put the rest in a roth ira.

Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg See Answer Activity: Funding 401 (k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. 401(k) and roth ira Flashcards | Quizlet 401k- can be matched by an employer; taxed in retirement (pre-tax money); no max contribution steps for investing in roth ira or 401k 1. calculate target amount to invest (15%) 2. fund our 401 (k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401 (k) single- $___________; salary max $_____________ Funding 401(K)S And Roth Iras Worksheet Answers Dave Ramsey - Free Gold ... Funding 401(K)S And Roth Iras Worksheet Answers Dave Ramsey Overview. Funding 401(K)S And Roth Iras Worksheet Answers Dave Ramsey A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a possible 2 points Investment Annual Salary Company Match 401 (k) Roth IRA Joe $ 40,000 1:1 up to 5% $ 2,000 $ 4,000 $ 6,000 Melissa $ 55,000 1:2 up to 6% $ 3,300 $ 4,950 $ 8,250 Tyler & Megan $ 105,000 No Match

Funding 401ks and roth iras worksheet answers? - Eyelight.vn Home » Blog » Wikipedia » Funding 401ks and roth iras worksheet answers? Funding 401ks and roth iras worksheet answers? Tác giả: ...

thefinancebuff.com › medicare-irmaa-income2022 2023 2024 Medicare Part B IRMAA Premium MAGI Brackets Oct 13, 2022 · 2023 IRMAA Brackets. Source: Medicare Costs, Medicare.gov The standard Medicare Part B premium will be $164.90 in 2023. 2024 IRMAA Brackets. We have one data point out of 12 as of right now for what the IRMAA brackets will be in 2024 (based on 2022 income).

![How to Do a Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

:max_bytes(150000):strip_icc()/istock512752254.kroach.ira.cropped.lowercase-5bfc3077c9e77c0026b5e58b.jpg)

0 Response to "43 funding 401ks and iras worksheet answers"

Post a Comment