41 1031 like kind exchange worksheet

1031 Exchange Examples | 2022 Like Kind Exchange Example What is a 1031 Exchange? eBook Download The Ron and Maggie Story Let's take an example couple, Ron and Maggie 1, who purchased a small apartment building in California 10 years ago for $1,500,000. They invested $500,000 of their own money and financed the rest with a $1,000,000 mortgage. Purchase Price Step 1 Determine Adjusted Basis Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Unless Microsoft is able to satisfy Sony’s aggressive demands and appease the CMA, it now looks like the U.K. has the power to doom this deal like it did Meta’s acquisition of Giphy. The CMA is focusing on three key areas: the console market, the game subscription market, and the cloud gaming market. The regulator’s report, which it ...

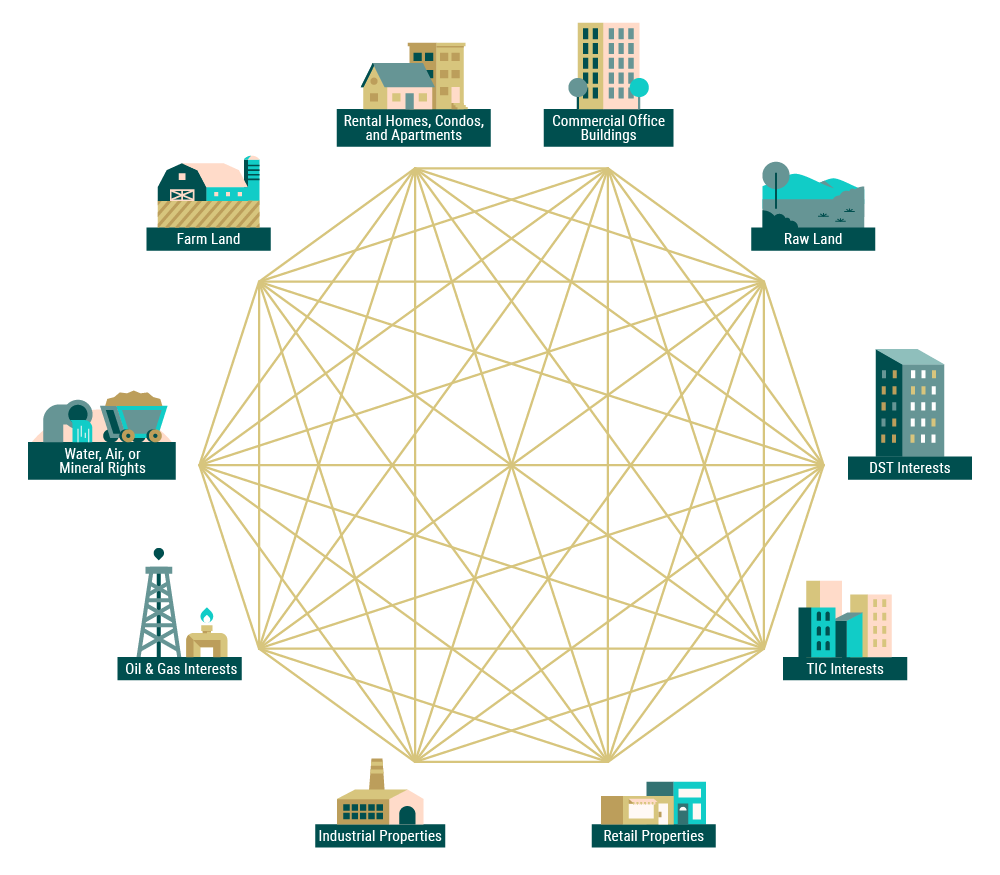

Like-Kind Exchanges Under IRC Section 1031 - IRS … as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

1031 like kind exchange worksheet

WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 1031 exchange worksheet Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet . midwest irs. 1031 exchange analysis sample worksheet for irs form 8824 (cont. Section 1031 exchange: the ultimate guide to like-kind exchange. 1031 exchange forms tax form. Random Posts. 100 Days Printable Worksheets; 8th Grade Writing Exercises; 2nd Grade ... IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn We constantly effort to show a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for people who seek an image according specific categories, you will find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

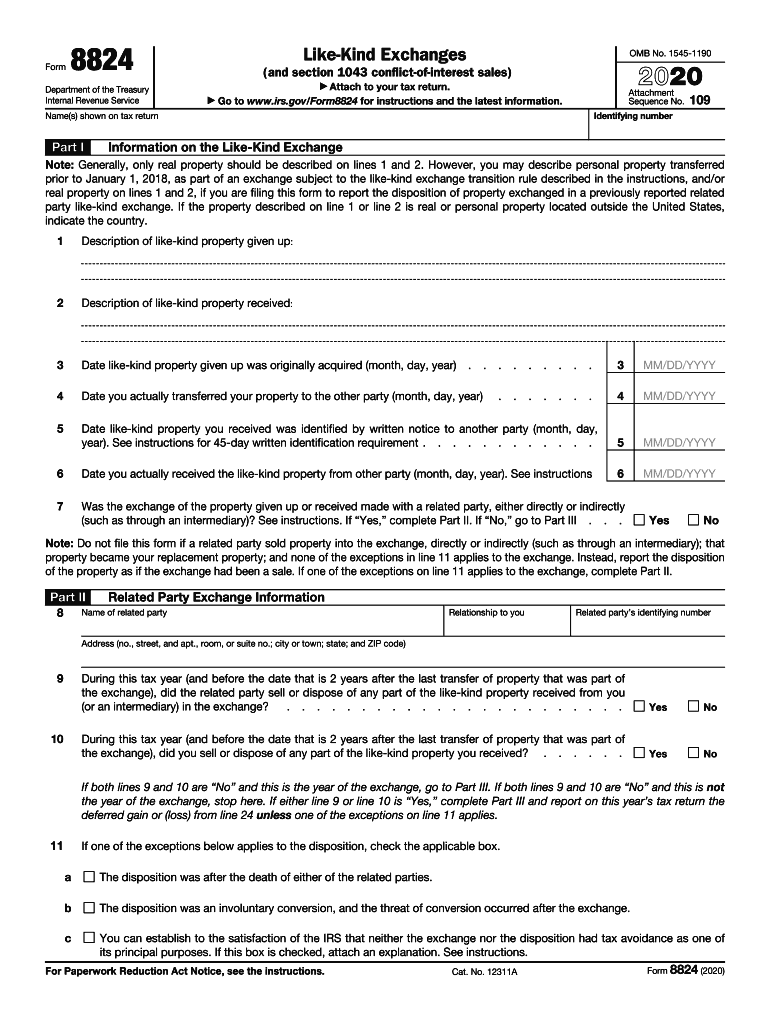

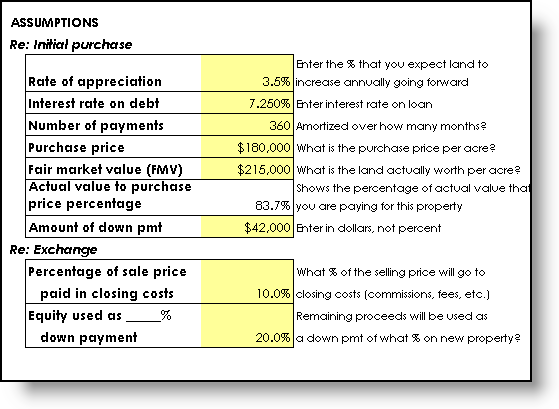

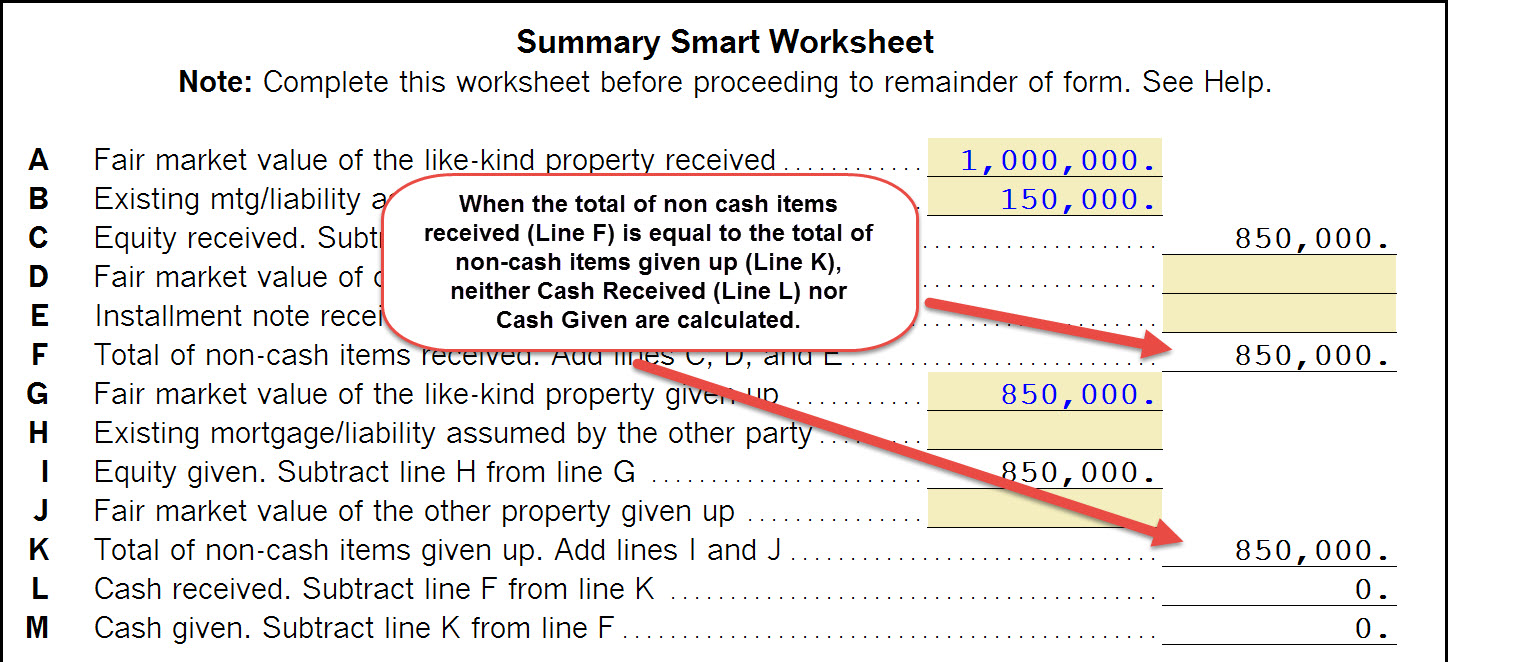

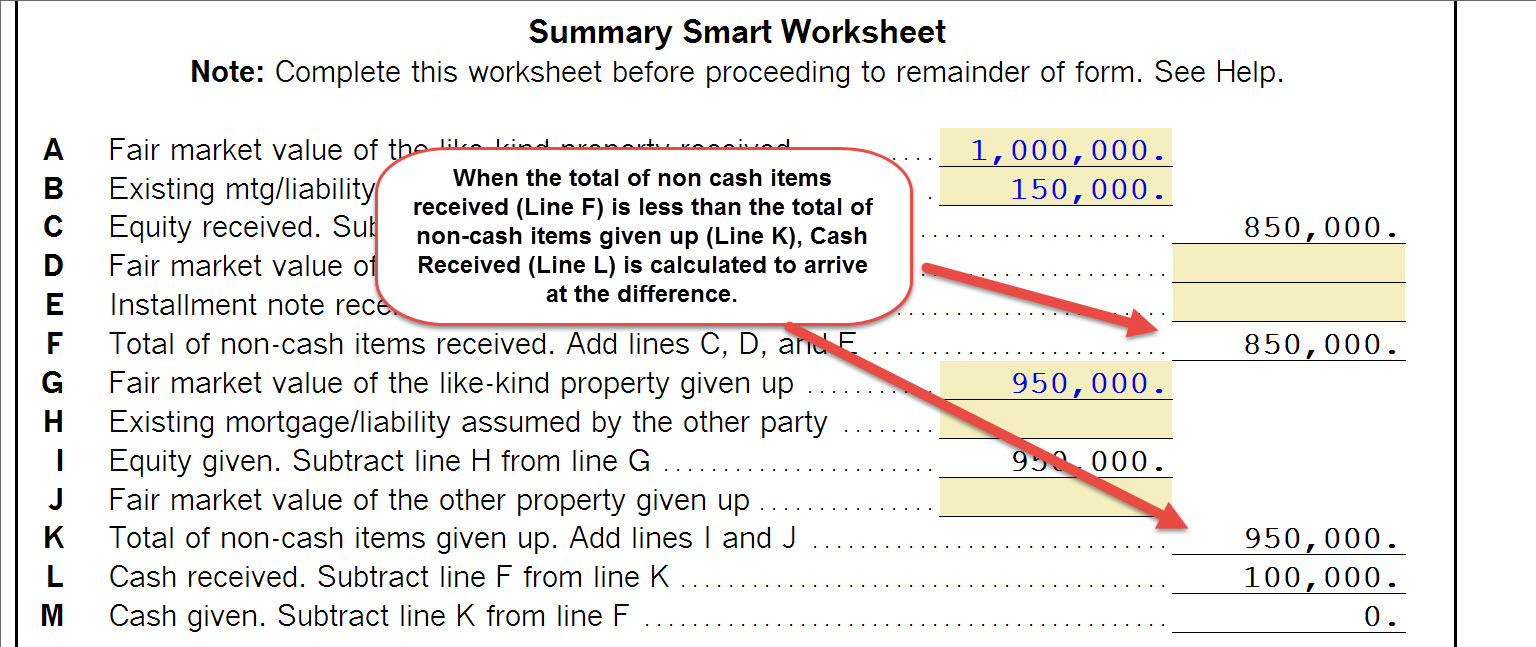

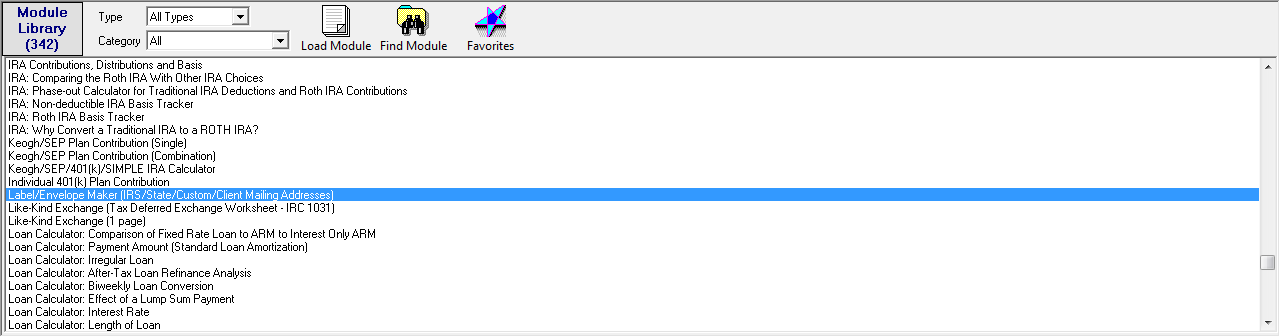

1031 like kind exchange worksheet. IRC 1031 Like-Kind Exchange Calculator Exchange vs. Sale A 1031 arrangement allows you to defer all of your capital gains taxes. And this amounts to getting a long-term and interest-free loan from the Internal Revenue Service. The real advantage is not just in tax savings - investors who take advantage of 1031 provisions can acquire much more investment real estate than those who don't. Instructions for Form 8824 (2022) | Internal Revenue Service Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Use Part III to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, use Part III to figure the basis of the like-kind property received. XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031 Corporation Exchange Professionals - Qualified Intermediary for ... 1031worksheet - Learn more about 1031 Worksheet In a 1031 Exchange, Section 1031 of the Internal Revenue Code (IRC) allows taxpayers to defer capital gain taxes by exchanging qualified, real or personal property (known as the "relinquished property") for qualified "like-kind exchange" property (replacement property). The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property ...

FORM 8824 WORKSHEET Worksheet 1 Tax Deferred … Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 exchange if the exchangor transferred AND received more than one group of like-kind properties, or cash or other non-like property. Few real estate exchanges are multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and Form 8824. To complete Part III starting ... Reporting the Like-Kind Exchange of Real Estate … kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ... 1031 Like Kind Exchange Calculator - Excel Worksheet - Pinterest Nov 27, 2019 - Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Pinterest. Today. Watch. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with ...

1031 exchange calculation worksheet Like Kind Exchange Worksheet | 1031 Exchange Calculator Excel . exchange 1031 calculator worksheet capital kind realized gains tax excel gain state rate laptop rates section experts investing difficult giving. 1031 exchange worksheet and 1099 misc worksheet sickunbelievable. Exchange irs partial. 1031 exchange example Publication 550 (2021), Investment Income and Expenses ... Gain or loss from exchanges of like-kind investment property Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Like-Kind Exchanges - Real Estate Tax Tips | Internal … PDF 2019 Exchange Reporting Guide - 1031 Corp Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6

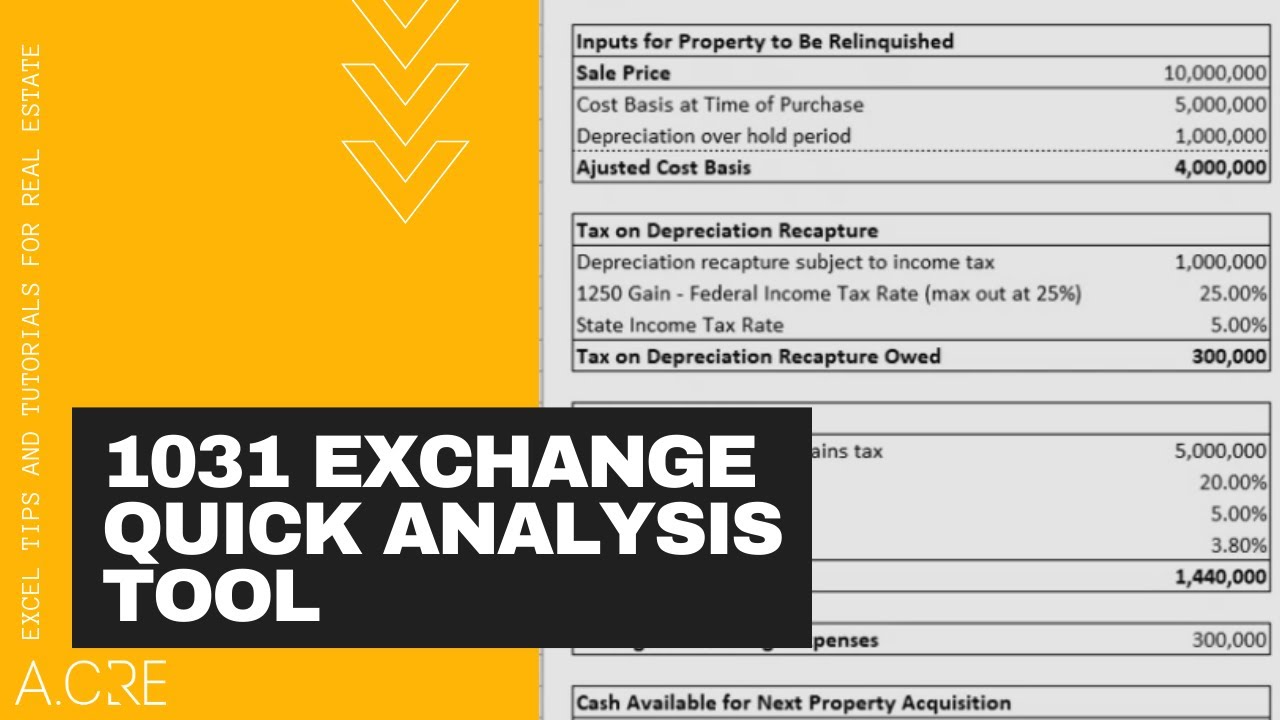

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

Replacement Property Basis Worksheet - efirstbank1031.com Replacement Property Basis Worksheet. ... Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf). Contact Us. Mail: Phone: Fax: Email: 1031 Corporation 1707 N Main St Longmont, CO 80501. 888-367-1031. 303-684-6899. 1031 Team. Resources. 1031 Exchange Manual; 1031 Exchange Manual; Escrow Services; What is a 1031 ...

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) The new property you've targeted is only priced at $750,000. You're now undertaking a partial 1031 exchange, since you're not reinvesting all the proceeds from the sale of your relinquished property. That excess $250,000 is considered cash boot, and is subject to capital gains taxes as well as depreciation recapture.

Reporting the Like-Kind Exchange of Real Estate … Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), …

PDF Home - Realty Exchange Corporation | 1031 Qualified Intermediary Home - Realty Exchange Corporation | 1031 Qualified Intermediary

How Do I Avoid Capital Gains Tax When Selling a House? Aug 31, 2021 · Swap properties using a 1031 exchange. A 1031 exchange allows you to defer paying capital gains taxes when you sell one investment property and use the proceeds to buy another. The other property must be of “like-kind,” which generally means any piece of real estate can be exchanged for another piece of real estate, as long as they’re ...

1031 Exchange Calculator | Calculate Your Capital Gains 1031 Exchange Calculator | Calculate Your Capital Gains Capital Gains Calculator Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged, and to calculate the reinvestment requirements for a tax-free exchange.

1031 Like Kind Exchange Worksheet And Form 8824 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template Worksheet April 17, 2018 We tried to get some great references about 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template for you. Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here.

Publication 523 (2021), Selling Your Home | Internal Revenue ... You acquired or are relinquishing the home in a like-kind exchange. See Like-kind/1031 exchange. You used the entire property as a vacation home or rental after 2008 or you used a portion of the home, separate from the living area, for business or rental purposes. See Business or Rental Use of Home.

Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200.

IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn We constantly effort to show a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for people who seek an image according specific categories, you will find it in this site. Finally all pictures we've been displayed in this site will inspire you all.

1031 exchange worksheet Like Kind Exchange Worksheet Excel And Irs 1031 Exchange Worksheet . midwest irs. 1031 exchange analysis sample worksheet for irs form 8824 (cont. Section 1031 exchange: the ultimate guide to like-kind exchange. 1031 exchange forms tax form. Random Posts. 100 Days Printable Worksheets; 8th Grade Writing Exercises; 2nd Grade ...

WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

0 Response to "41 1031 like kind exchange worksheet"

Post a Comment