41 self employed business expenses worksheet

Freelance Taxes 101 - Ramsey The Schedule SE tax form helps you calculate your self-employment tax, which you'll then report on your standard Form 1040. You might also be able to deduct the employer-equivalent portion (50%) of your self-employment tax on your 1040. Remember, the self-employment tax is in addition to your regular income tax rate. That's why Dave ... Budget Spreadsheet: Financial Tool to Manage Your Money Whether you want to use a free budget worksheet or paid forecasting tool, it's up to you. Focus on what matters to you and pick the option. Generally, you have 4 possible ways to set up your financial tracking spreadsheet. You can use: a free app. a spreadsheet (Google Docs or Excel) a paid tool. a pen and a paper.

Self-Employed Individuals Tax Center | Internal Revenue Service WebSelf-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. In general, the wording "self-employment tax" only refers to Social …

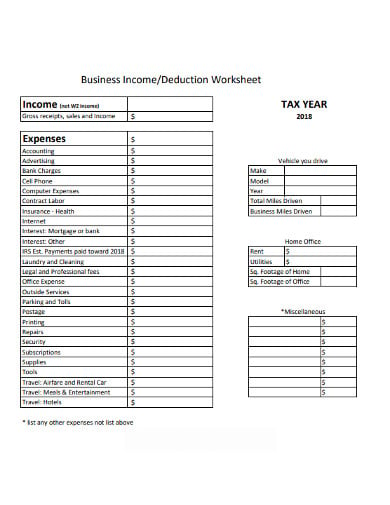

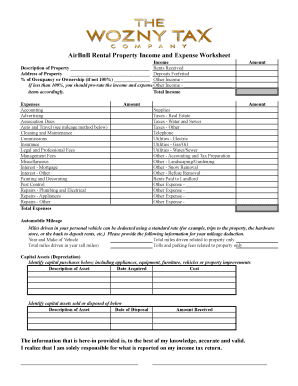

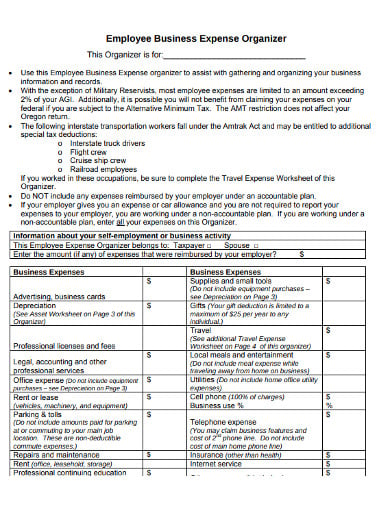

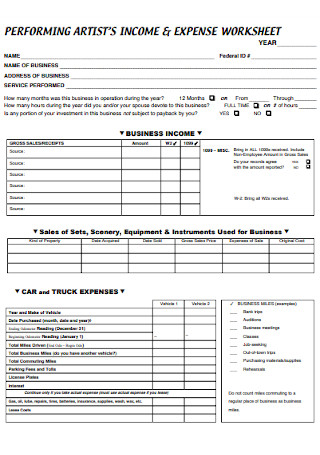

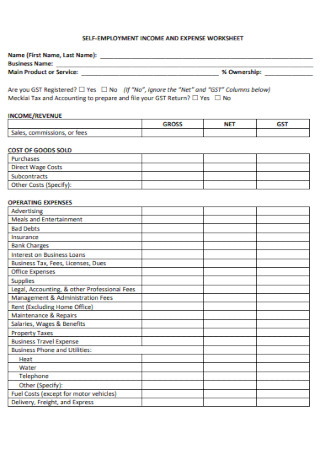

Self employed business expenses worksheet

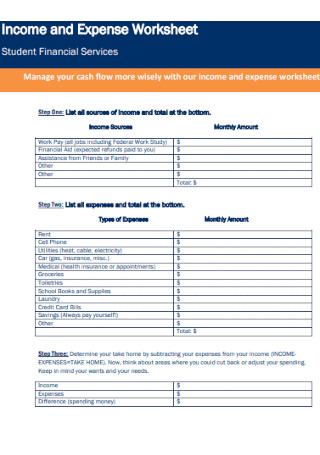

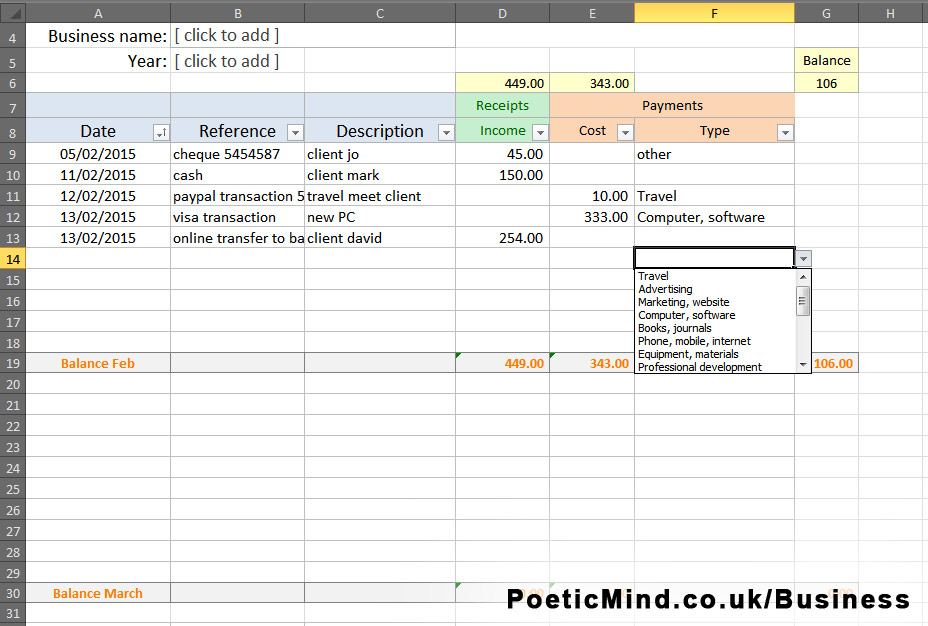

Self-Employed: Definition, Financial & Tax Impact [2022] Therefore they tax at a higher rate. The Self-Employment Tax (SE tax) is a Social Security and Medicare tax for individuals who work for themselves. Self-employed people pay the entire SE tax, whereas an employer would pay some. The current SE tax rate is 15.3%. What Is a Self-Employment Ledger and How to Track Your Expenses Open a spreadsheet or download a self-employment ledger template Step 2. Create a column for Income (money you've received) and Expenses (cost of running your business) Step 3. Under Income add three columns: Date, Invoice, and Service/Product Step 4. Under Expenses, add four columns: Date, Cost, Type of Expense, Intent Step 5. › articles › tax16 Tax Deductions and Benefits for the Self-Employed Nov 15, 2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

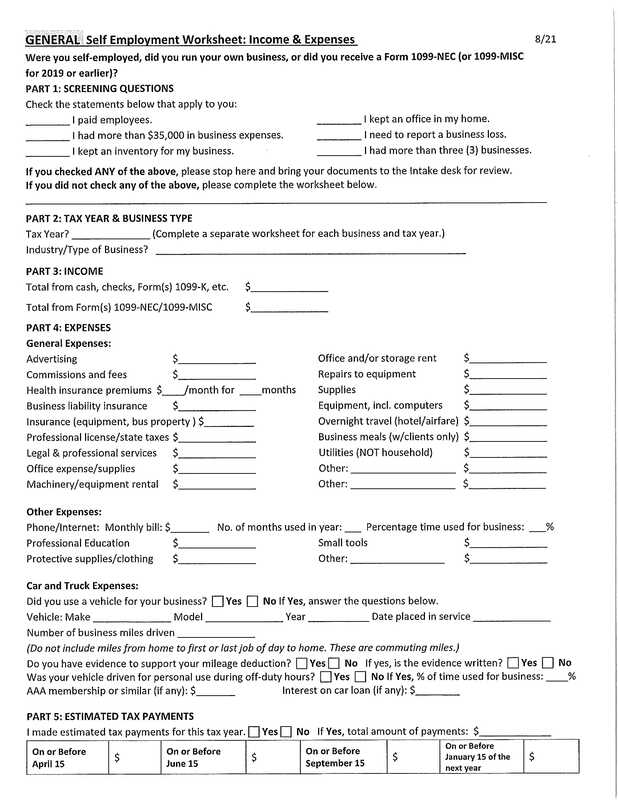

Self employed business expenses worksheet. Taking Business Tax Deductions - TurboTax Tax Tips & Videos You can deduct insurance expenses for your business as long as they're ordinary and necessary. Common examples include: Casualty and theft insurance Professional liability or malpractice insurance Accident and health insurance Coverage for vehicles used in your business There are a few types of insurance costs that you may not deduct. Deducting Health Insurance Premiums If You're Self-Employed Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2021. Actual results will vary based on your tax situation. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. › obamacare › self-employedSelf-employed health insurance deduction | healthinsurance.org Mar 25, 2022 · Assuming the employer isn’t subsidizing any portion of the cost, it’s possible that the premiums could be deducted based on your wife’s self-employment. But the sticking point, in my mind, would be the requirement that the coverage for the self-employed person has to be established in the name of the self-employed person or their business. Self Employed - VITA Resources for Volunteers SETO--Self-employment information and worksheets to share with clients (2 different English versions) 2 different Spanish versions Educate client how to use-have them fill out before appointment and at end of appointment - give them a copy (blank) to complete before next year's tax appointment. Thank you for sharing this Pati!

› faqs › small-business-self-employedSmall Business, Self-Employed, Other Business | Internal ... Sep 07, 2022 · If you are a statutory employee (box 13 of Form W-2 checked), report your expenses using the same rules as self-employed persons on Schedule C (Form 1040). Additional Information: Publication 587 Business Use of Your Home When Self Employed How Do You Pay Taxes - TaxesTalk.net Base rate:The self-employment tax rate is 15.3% of net income from self-employment, but the Social Security portion of this tax is capped at the Social Security maximum income each year. You must pay self-employment tax and file Schedule SE if your net earnings from self-employment are $400 or more during the year. FHA Loan Guidelines Self Employed Buyers - FHA Mortgage Source This is accomplished in two different ways, with paycheck stubs and W2s and the lender sending a Verification of Employment, or VOE form, to the individual's employer. The lender completes the VOE and returns it to the requesting party. The VOE will show how much the employee makes each month along with a running year-to-date total. Self-Employment - Overview, How It Works, Types Types of Self-Employment. The three types of self-employed individuals include: 1. Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs. Since they are not considered employees, they are not subject to workers' compensation.

What is Self-Employment Tax? (2022-23 Rates and Calculator) Self-employed taxpayers can estimate the amount they need to pay using the worksheet on page 8 of Form 1040-ES. These tax forms will help you determine the amount you'll owe for the year, divide it by four, and pay in equal installments by the due dates mentioned above. The form also includes vouchers to include when mailing your payment. Small Business Taxes: What to Expect in 2022 If your business had a net operating loss in 2018, 2019 or 2020 that is being carried forward into 2021, it will be limited to 80% of taxable income. For example, if a business had taxable... 2022 Form 1040-ES - IRS tax forms Webself-employment tax payments you owe for 2020, don't use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. Select the "balance due" reason for payment or, if … 16 Tax Deductions and Benefits for the Self-Employed Web15/11/2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

› publications › p560Publication 560 (2021), Retirement Plans for Small Business For this reason, you determine the deduction for your own contributions indirectly by reducing the contribution rate called for in your plan. To do this, use either the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed in chapter 5. Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in ...

Self-Employed Individuals – Calculating Your Own Retirement … Web25/10/2022 · If you are self-employed (a sole proprietor or a working partner in a partnership or limited liability company), you must use a special rule to calculate retirement plan contributions for yourself.. Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each …

ttlc.intuit.comTax Support: Answers to Tax Questions | TurboTax® US Support Education Business expenses Charitable donations Family and dependents Healthcare and medical expenses ... TurboTax Live Self-Employed Full Service; CD/Download Products.

The Musician's Guide to Taxes: Top Tax Deductions - TurboTax Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2021. Actual results will vary based on your tax situation. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

How To Reduce Your Self-Employment Tax - The Balance Small Business Net self-employment income is your income after deducting business expenses, such as marketing expenses, store rent, or purchased inventory. You would next adjust your net self-employment by multiplying it by 92.35%, which allows you to subtract out 7.65% as a business expense.

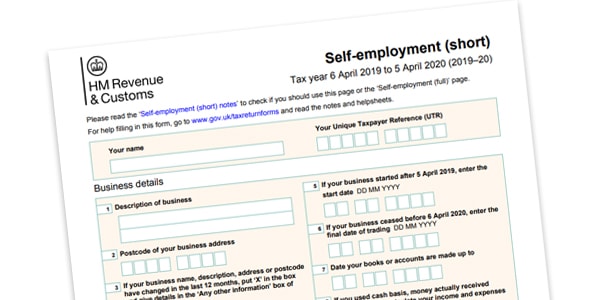

The Differences Between Employed vs. Self-Employed - The Balance Careers If you're self-employed, you are responsible for paying your own taxes to the Internal Revenue Service (IRS) and to your state tax department. 1 Even if you do not owe any income tax, you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax.

How Do I Calculate Estimated Taxes for My Business? You can calculate your estimated business taxes using IRS Schedule C, which you must submit with your Form 1040 tax return when you file it. Include all sources of income in addition to your business income and self-employment tax, including: Salary Tips Pension Dividends Alternative minimum tax Winnings, prizes, and awards

Self-employed health insurance deduction | healthinsurance.org Web25/03/2022 · The deduction – which you’ll find on Line 17 of Schedule 1 (attached to your Form 1040) – allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. You’ll find the deduction on your personal income tax form, and you can file for it if you were self-employed and …

› self-employed-individuals-tax-centerSelf-Employed Individuals Tax Center | Internal Revenue Service What are My Self-Employed Tax Obligations? As a self-employed individual, generally you are required to file an annual return and pay estimated tax quarterly. Self-employed individuals generally must pay self-employment (SE) tax as well as income tax. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Small Business Tax Deductions for 2022 [LLC & S Corp Write Offs] Wages and salary expenses As a boss, the payments that you make to your employees are tax-deductible. So are sums that you spend on employee benefit programs. For example, if you provide your workers with money in the form of education assistance, you can claim a write-off. As usual, there are specific conditions that have to be met.

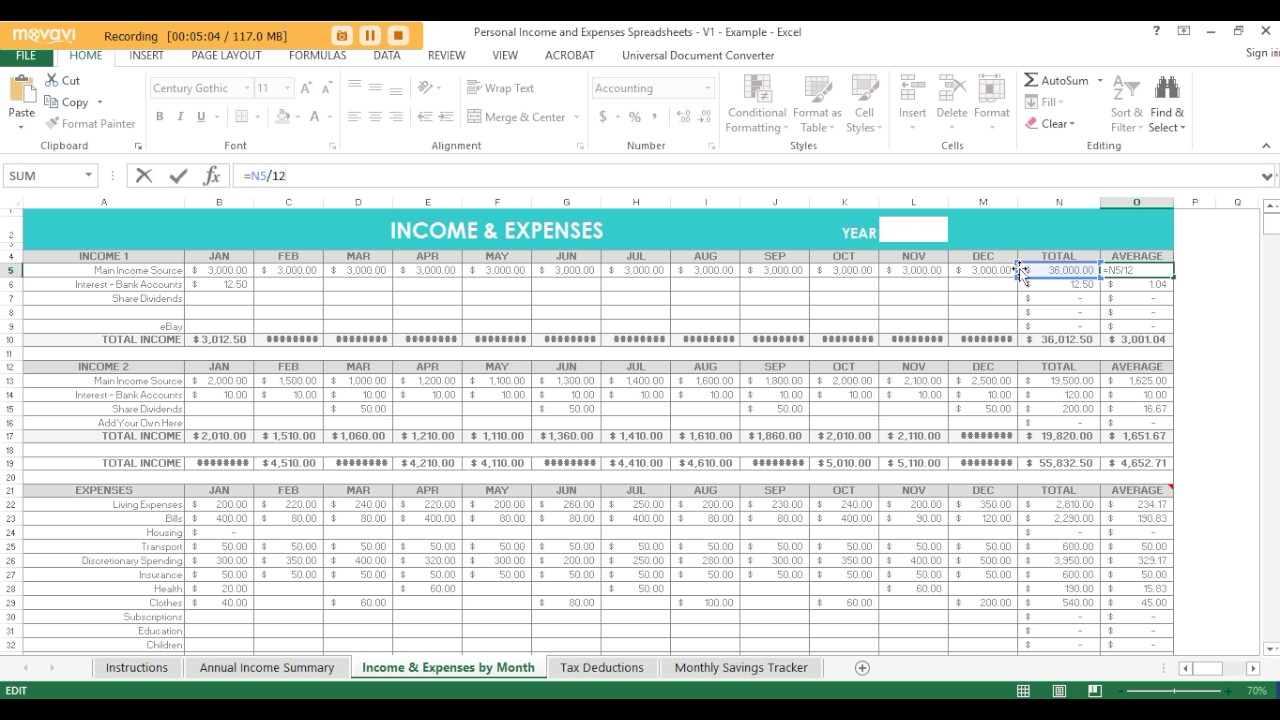

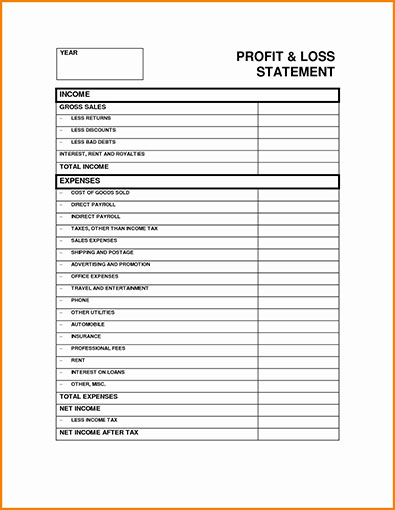

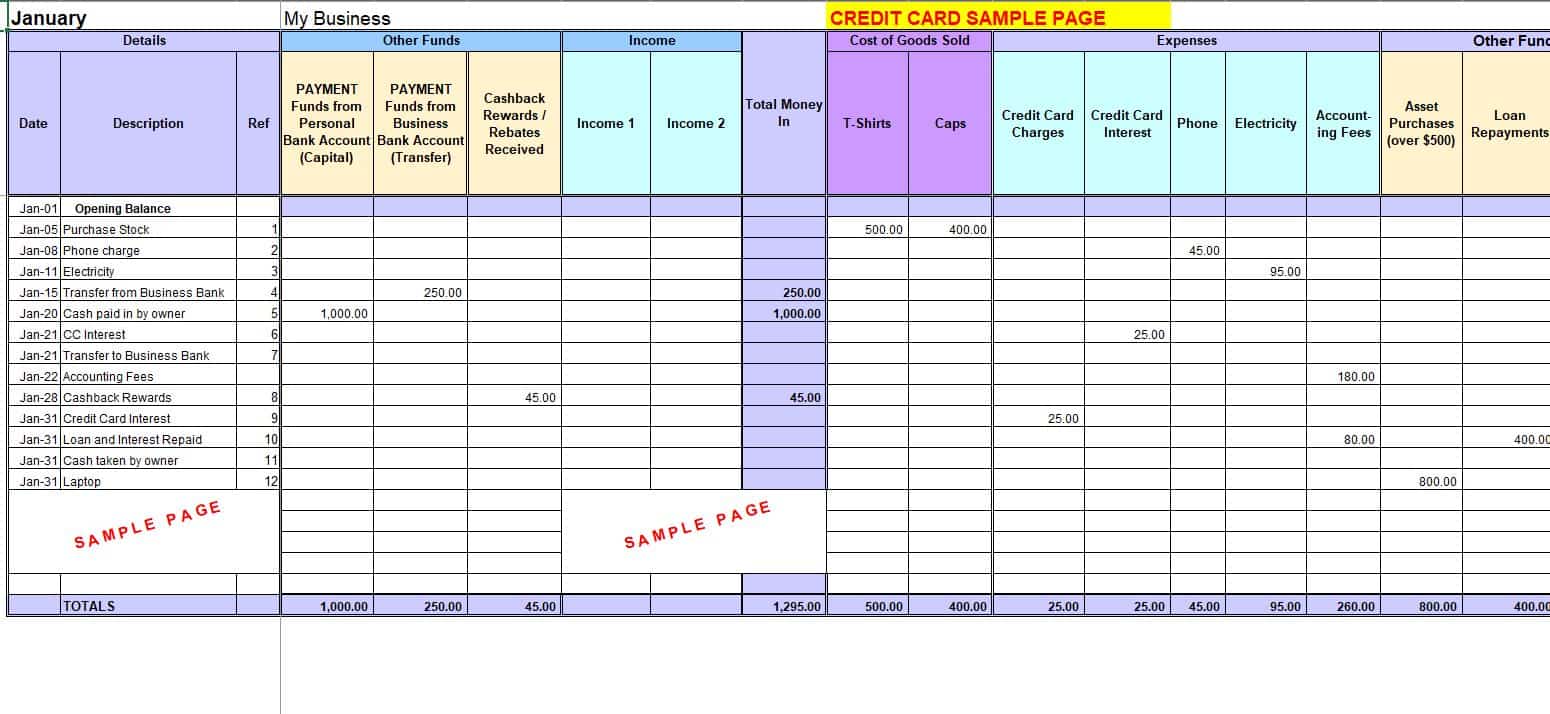

Profit and Loss Template - Free Monthly & Annual P&L Template xls Download CFI's free Profit and Loss template (P&L template) to easily create your own income statement. After downloading the Excel file, simply enter your own information in all of the blue font color cells which will automatically produce a monthly or annual statement as the output. The downloadable Excel file includes four templates.

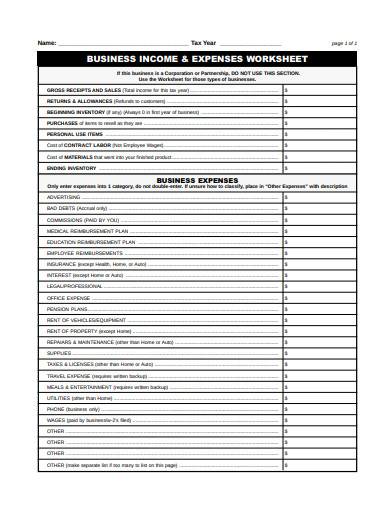

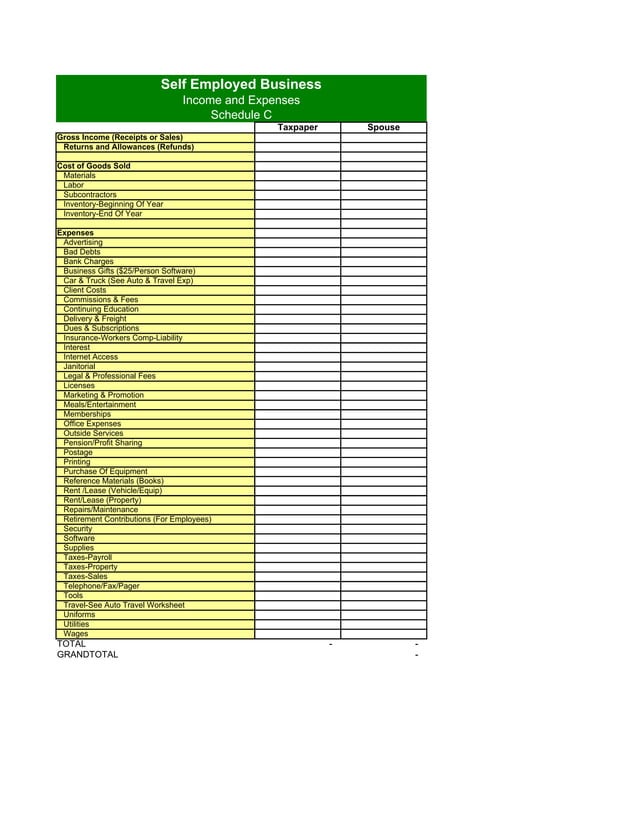

How To Complete Schedule C, Step by Step - The Balance Small Business Step 1: Gather Information. You will need three types of financial detail about your business to complete the form: business income, cost of goods sold, and business expenses. Business income: Collect detailed information about the sources of your business income. Include returns and allowances.

Self-Employment Tax: How To Calculate And File For 2022 As an example, if you earned $40,256 - $86,375 and are filing your taxes as a single filer, you'll fall into the 22% tax bracket, meaning you'll pay 22% of your income in income taxes, in addition to the 15.3% self-employment tax. If you earned $81,051 - $172,750 as a married couple filing jointly, you'll again fall into the 22% tax bracket.

Self-Employment Income - SNAP (Food Stamps) If a self-employment business has been in operation for at least 12 months, use the gross receipts and costs of doing business for the past 12 months. Then divide this amount by 12. If a business has been in operation less than 12 months, compute the average for the number of months the operation has been in business to determine a monthly average.

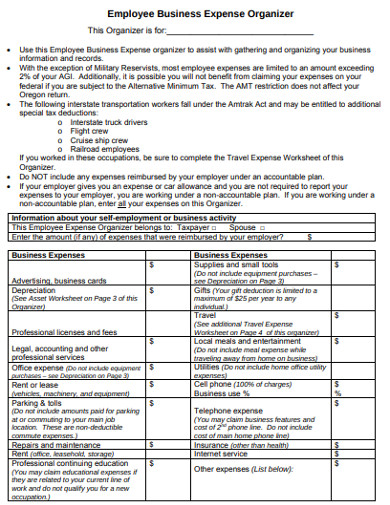

Self-employed expenses: which allowable expenses can I claim? Self-employed allowable expenses list Here is a list of the most common allowable expenses that you can claim against your income tax: 1. Office supplies You can claim for office supplies such as Stationery Printing costs / ink Postage Phone and internet bills Software used for under two years (or on subscription) 2. Office equipment

How to Calculate and Pay Self-Employment Taxes - The Balance Small Business The self-employment tax rate is 15.3% of your net profit or loss from your business for a year. You must figure your business taxes for the year, including income, expenses, tax credits, and other adjustments. The result is your net earnings (the same thing as profit or loss).

Small Business, Self-Employed, Other Business - IRS tax forms Web07/09/2022 · Each spouse files with the Form 1040 or Form 1040-SR a separate Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship), Schedule F (Form 1040), Profit or Loss From Farming, or Form 4835, Farm Rental Income and Expenses, accordingly, and if required, a separate Schedule SE (Form 1040), Self-Employment Tax …

Reporting Self-Employment Business Income and Deductions • List ordinary and necessary business expenses in Part II, including employee wages and pensions (if any), vehicle expenses, advertising, supplies, home office, and more. • If you sell items, enter the cost of goods sold in Part III. This includes the value of merchandise, wages paid to production workers, overhead, and more.

Tax Deductions for Independent Contractors & Self-Employed in 2023 A deduction is a qualifying business expense that can be used to lower your taxable income. By lowering your taxable income, the tax rate applies to a lower figure, which results in a smaller tax bill. ... Use the IRS's Worksheet 6-A to calculate your deduction. Record self-employed health insurance expenses on Line 17 of your Schedule 1.

A Tax Guide for Solopreneurs: Self-Employed Tax Tips Self-employed people pay self-employment taxes As a business, you are required to pay self-employment taxes, which include Social Security and Medicare taxes. These need to be paid by anyone who works for themselves and earns $400 or more in 2022. Self-employment taxes are assessed on a percentage of your net earnings.

17 Big Tax Deductions (Write Offs) for Businesses - Bench Now, with $54,000 in taxable self employment income, he pays $7,630 in SE tax and $4,200 in income tax, for a total of $11,830. Adding the additional business expenses saved Joe over $1,500 in taxes! By locating the $6,000 in contractor expenses, Bench was able to reduce Joe's tax liability by over $1,500 dollars.

Publication 535 (2021), Business Expenses | Internal Revenue … WebIf you are self-employed, you can also deduct the business part of interest on your car loan, state and local personal property tax on the car, parking fees, and tolls, whether or not you claim the standard mileage rate. For more information on car expenses and the rules for using the standard mileage rate, see Pub. 463.

› tax-planning-with-sepSelf-Employed Tax Planning With a SEP-IRA - The Balance Small ... Sep 27, 2022 · A self-employed person reduces income tax only by contributing to his or her own SEP-IRA. A self-employed person who contributes to SEP-IRAs for their employees boosts business expenses. This lowers net profit, reducing both the self-employment tax and the income tax. SEP-IRAs for their employees boost business expenses. This lowers net profit ...

Simplified Employee Pension (SEP) Contribution | Limits & Rules Simplified Employee Pension (SEP) IRA is a retirement savings plan for small business owners and the self-employed. It allows employers to make tax-deductible contributions to their employees' retirement accounts, and employees are not taxed on the contributions until they withdraw the money in retirement.

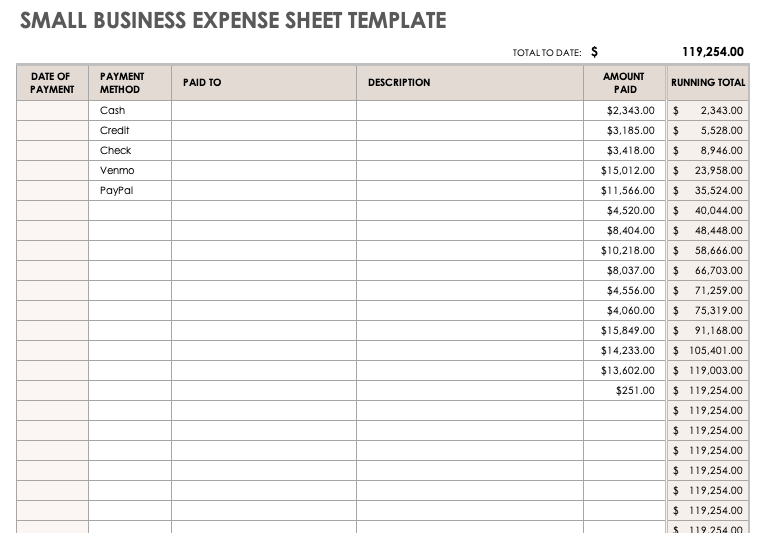

How to Calculate Business Income and Expense in Excel Worksheet - ExcelDemy 5 Quick Steps to Calculate Business Income and Expense in Excel Worksheet. Let's assume we have an Excel large worksheet that contains the information about the Income and Expenses of the Armani Group.From our dataset, we will calculate the Income and Expenses of the Armani Group using a mathematical summation, subtraction formula and the SUM function, and so on.

Frequently Asked Questions on Gift Taxes | Internal Revenue … Web27/10/2022 · Download and complete page 1 of the Same-Day Taxpayer Worksheet, and provide pages 1 and 2 to your financial institution. When completing the Same-Day Taxpayer Worksheet PDF , you will need a two-digit year, a two-digit month, and a five-digit tax type code, depending on the type of payment you are making (use the table of codes listed …

Self-Employed Tax Planning With a SEP-IRA - The Balance Small Business Web27/09/2022 · A self-employed person reduces income tax only by contributing to his or her own SEP-IRA. A self-employed person who contributes to SEP-IRAs for their employees boosts business expenses. This lowers net profit, reducing both the self-employment tax and the income tax. SEP-IRAs for their employees boost business expenses. This …

Tax Support: Answers to Tax Questions | TurboTax® US Support WebEducation Business expenses Charitable donations Family and dependents Healthcare and medical expenses Homeownership. File taxes. Less. More. Work with an expert Deadlines and extensions Print or save Tax payments Tax forms. Get started. Less. More. Install or update products Tax filing status State topics Choose products. Income. Less. …

› articles › tax16 Tax Deductions and Benefits for the Self-Employed Nov 15, 2022 · IRS Publication 587: Business Use of Your Home (Including Use by Day-Care Providers): A document published by the Internal Revenue Service (IRS) that provides information on how taxpayers who use ...

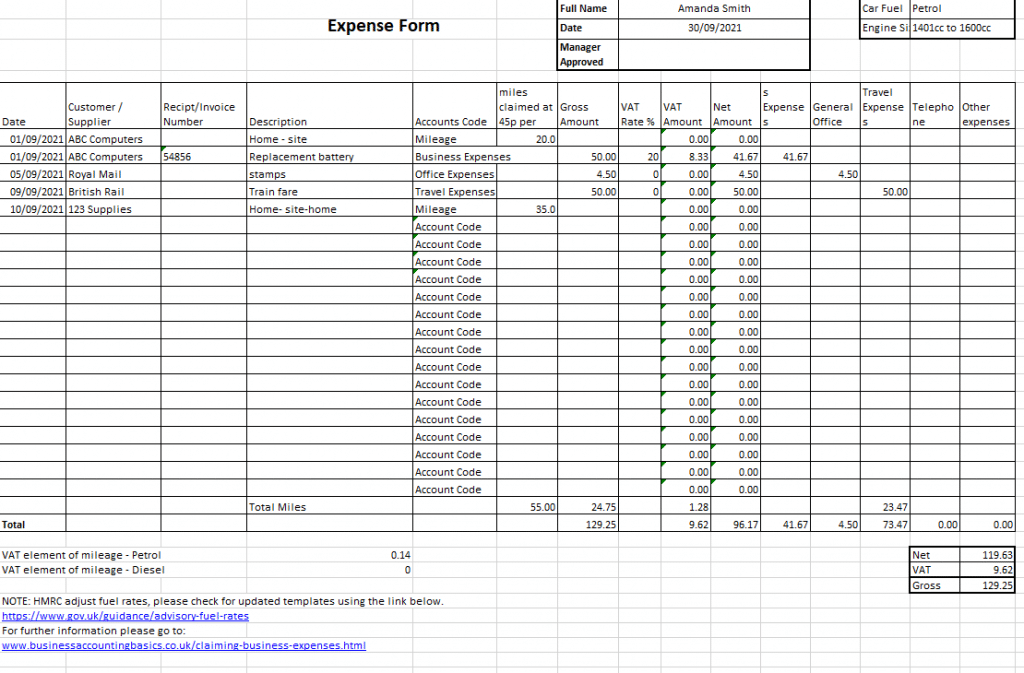

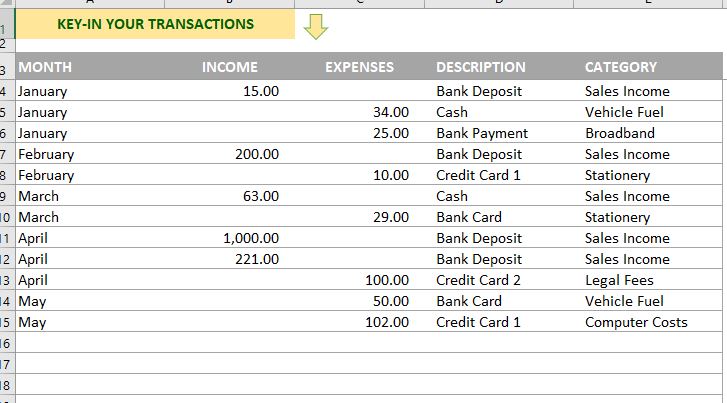

What Is a Self-Employment Ledger and How to Track Your Expenses Open a spreadsheet or download a self-employment ledger template Step 2. Create a column for Income (money you've received) and Expenses (cost of running your business) Step 3. Under Income add three columns: Date, Invoice, and Service/Product Step 4. Under Expenses, add four columns: Date, Cost, Type of Expense, Intent Step 5.

Self-Employed: Definition, Financial & Tax Impact [2022] Therefore they tax at a higher rate. The Self-Employment Tax (SE tax) is a Social Security and Medicare tax for individuals who work for themselves. Self-employed people pay the entire SE tax, whereas an employer would pay some. The current SE tax rate is 15.3%.

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349af5f4a6db36bd21473a4_1099-excel-template.png)

0 Response to "41 self employed business expenses worksheet"

Post a Comment