42 rental income calculation worksheet

› ExcelTemplates › rental-cash-flowCash Flow Analysis Worksheet for Rental Property - Vertex42.com Aug 18, 2021 · It is a fairly basic worksheet for doing a rental property valuation, including calculation of net operating income, capitalization rate, cash flow, and cash on cash return. This worksheet is not going to teach you how to be a good real estate investor. › publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

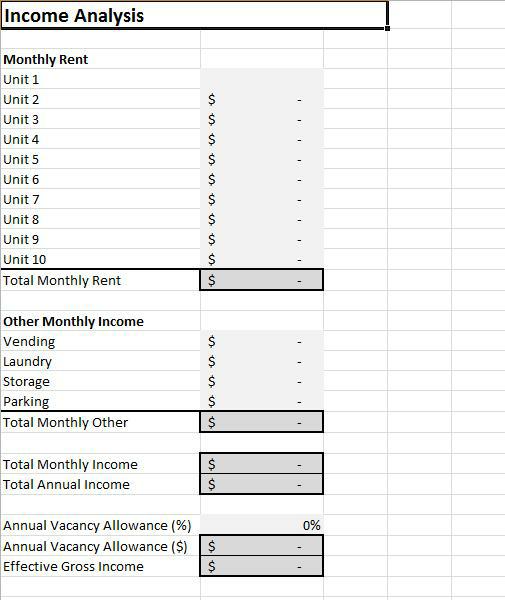

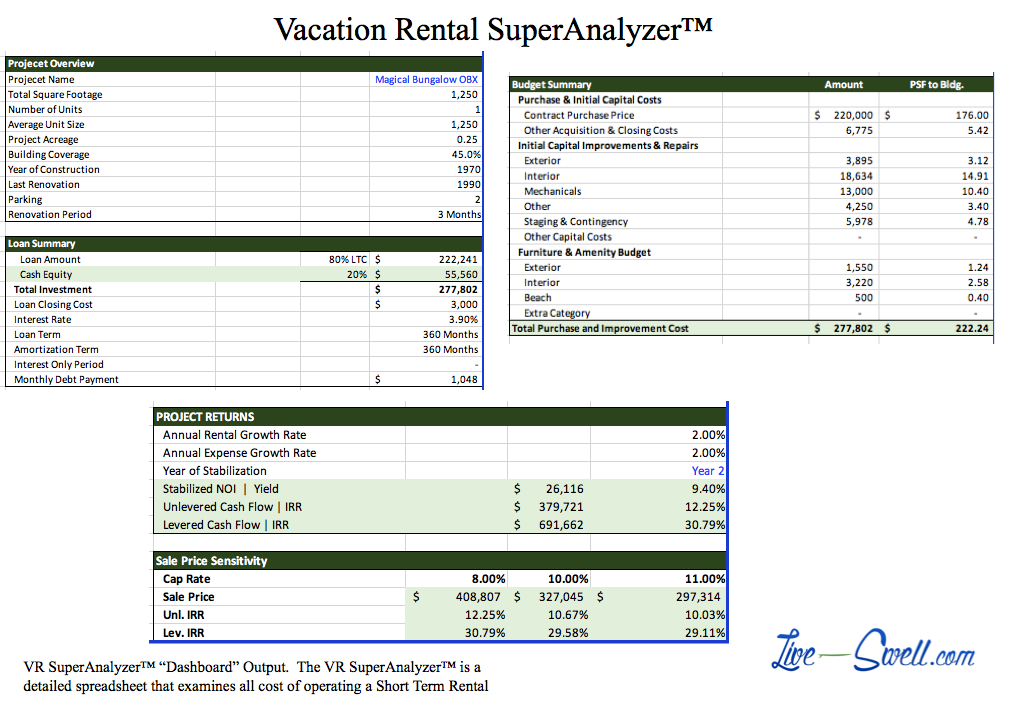

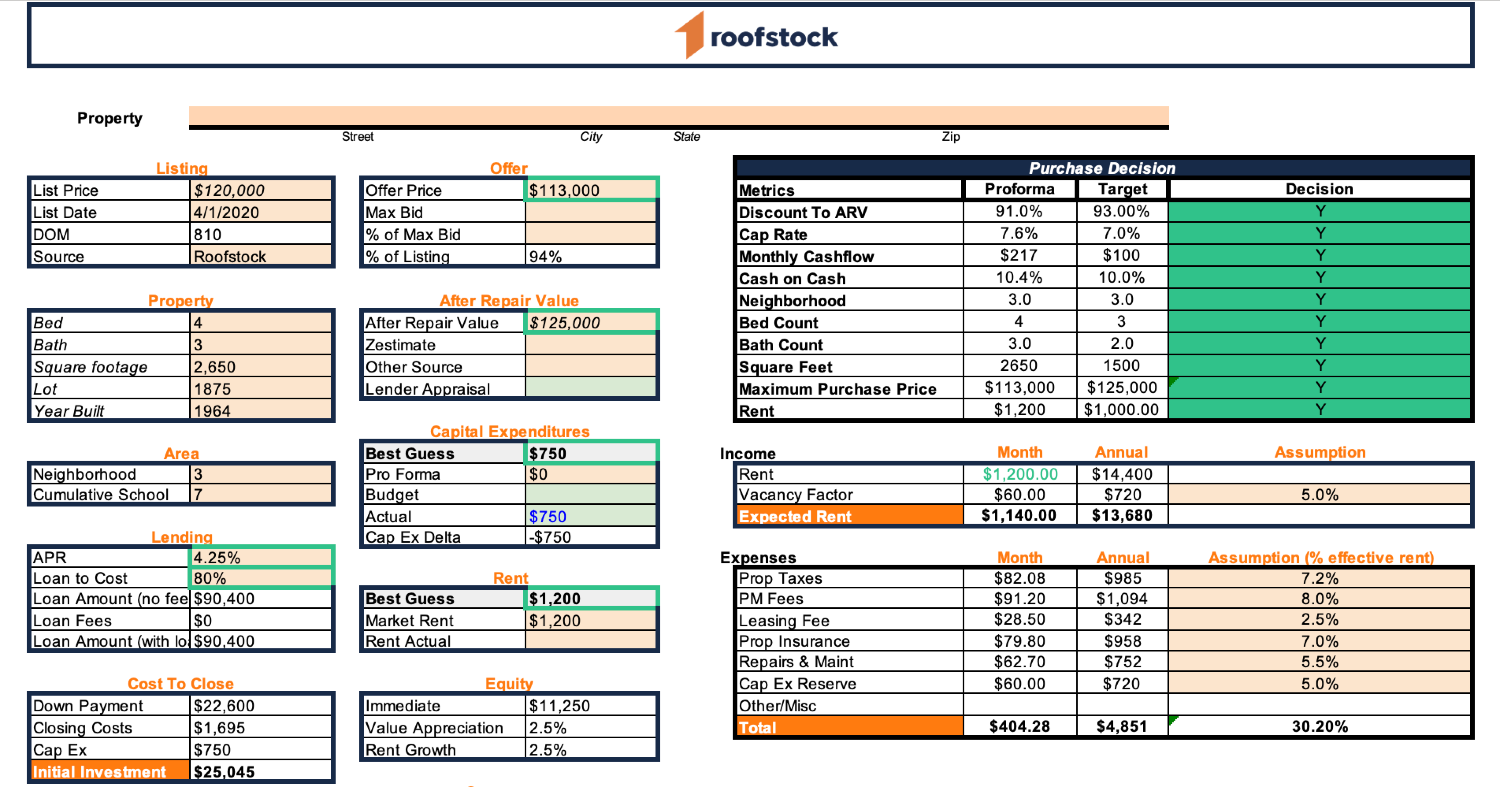

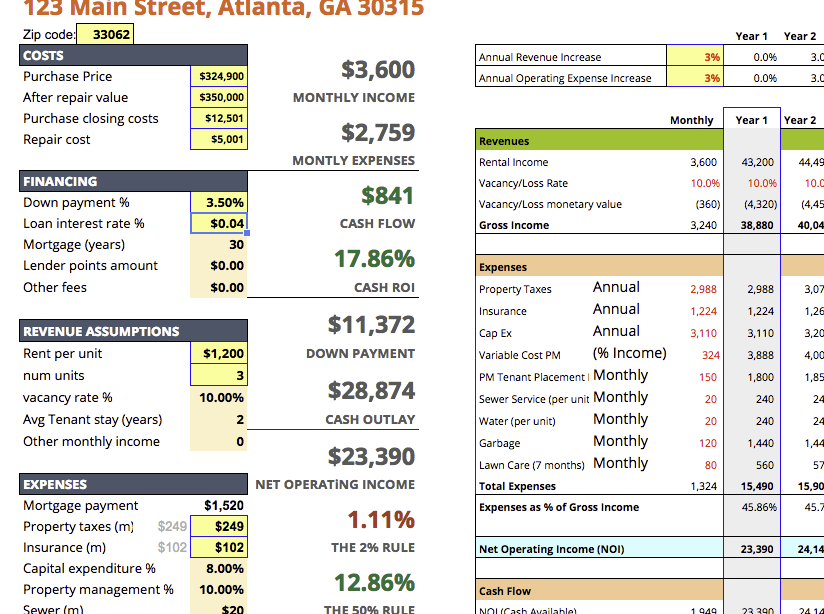

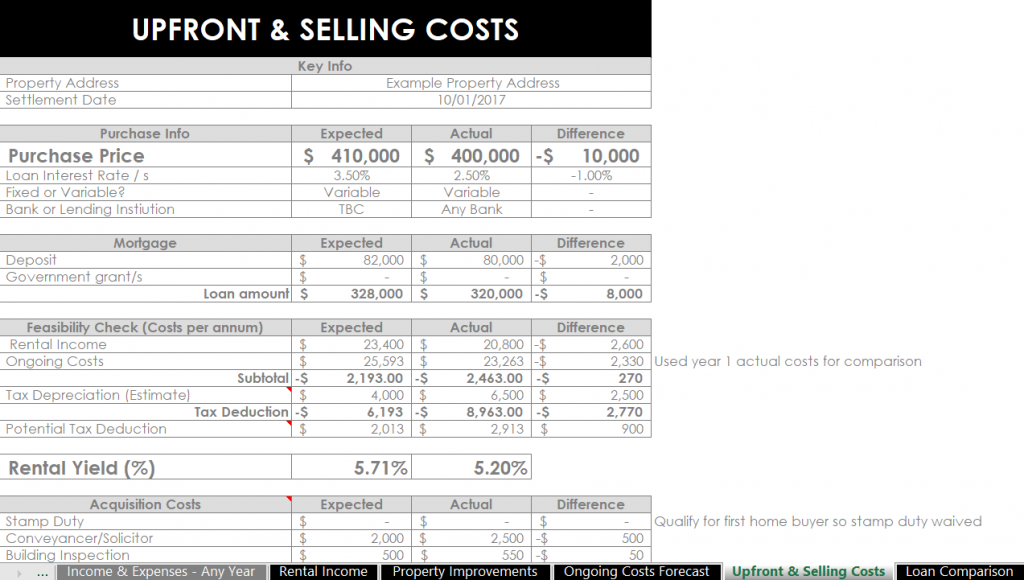

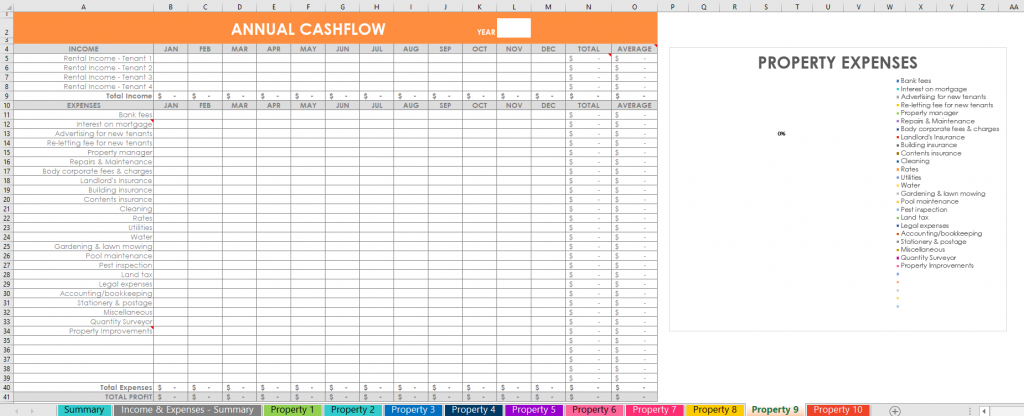

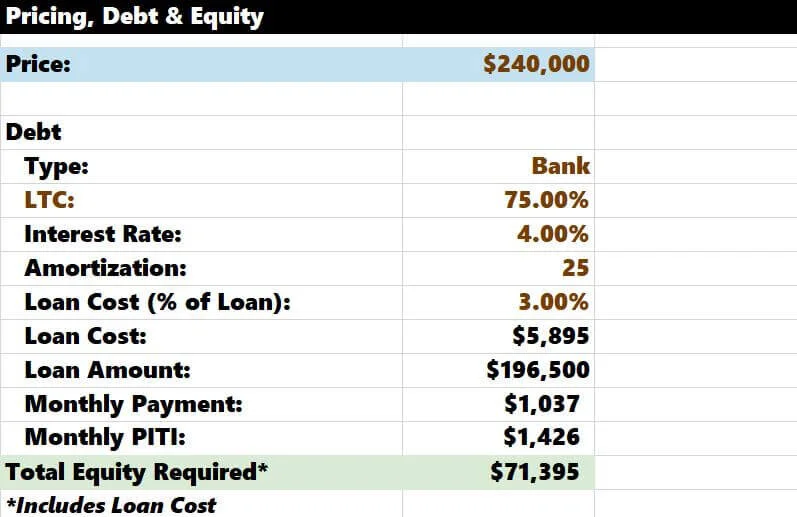

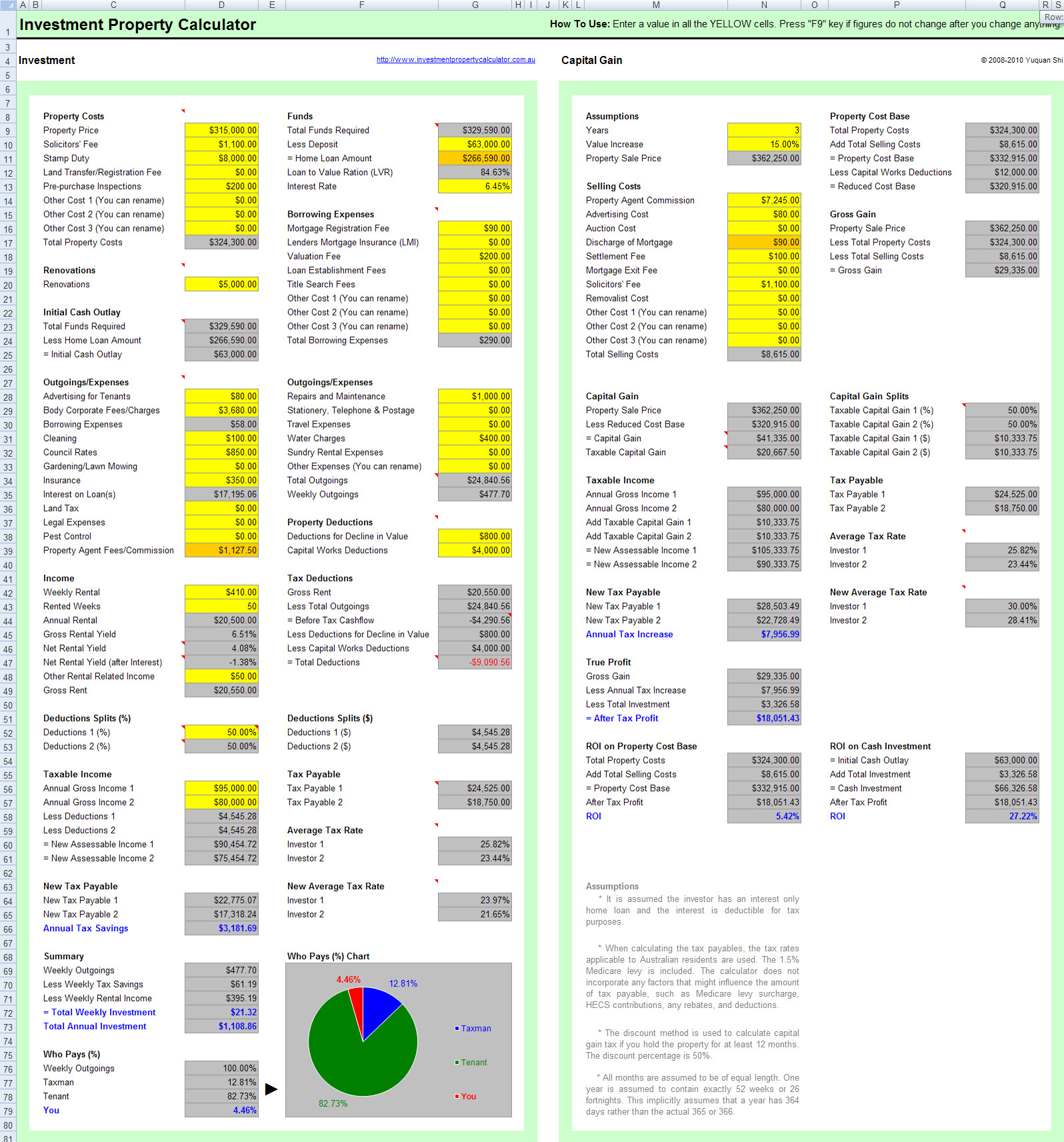

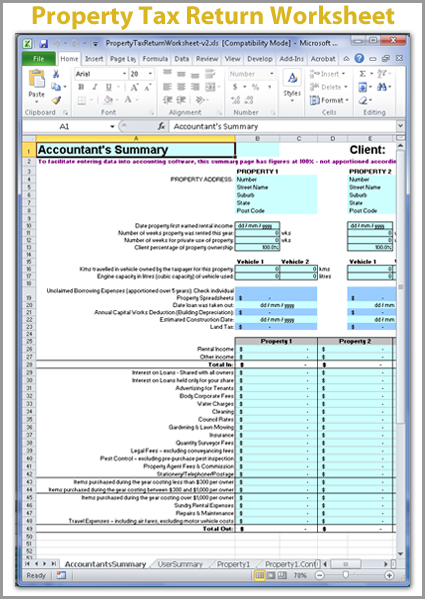

healthywealthywiseproject.com › research-offersRental Income Property Analysis Excel Spreadsheet The spreadsheet can account for multiple unit types such as apartment buildings, duplexes, etc. Rental income assumptions are also entered here. This sheet calculates Gross Scheduled Income, Gross Operating Income, and provides assumptions for rent increase and property price appreciation.

Rental income calculation worksheet

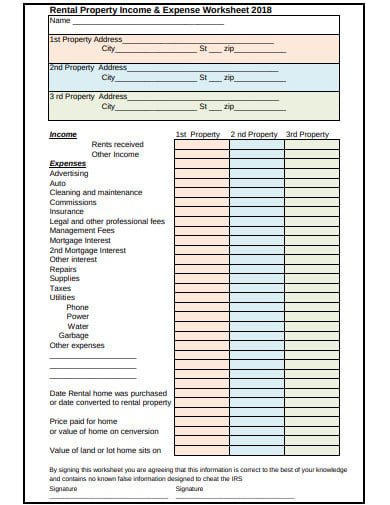

Section 8 Rent Calculation Worksheet PDF Form - FormsPal How to Edit Section 8 Rent Calculation Worksheet Online for Free. It is simple to create forms with the use of our PDF editor. Enhancing the income calculation worksheet hud form is a breeze should you use the following actions: Step 1: Press the orange "Get Form Now" button on the webpage. Rental Income and Expense Worksheet: Free Resources - Stessa The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: Price to Rent Ratio compares the median home price to the median annual rent and is used to predict the potential demand... Gross Rent Multiplier (GRM) ... PDF Form 1038: Rental Income Worksheet - Enact MI B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). For multi-unit properties, combine gross rent from all rental units. Enter B2 Multiply gross monthly rent or market rent by 75% (.75). The remaining 25% accounts for vacancy loss, maintenance, and management expenses. Multiply x.75 x.75

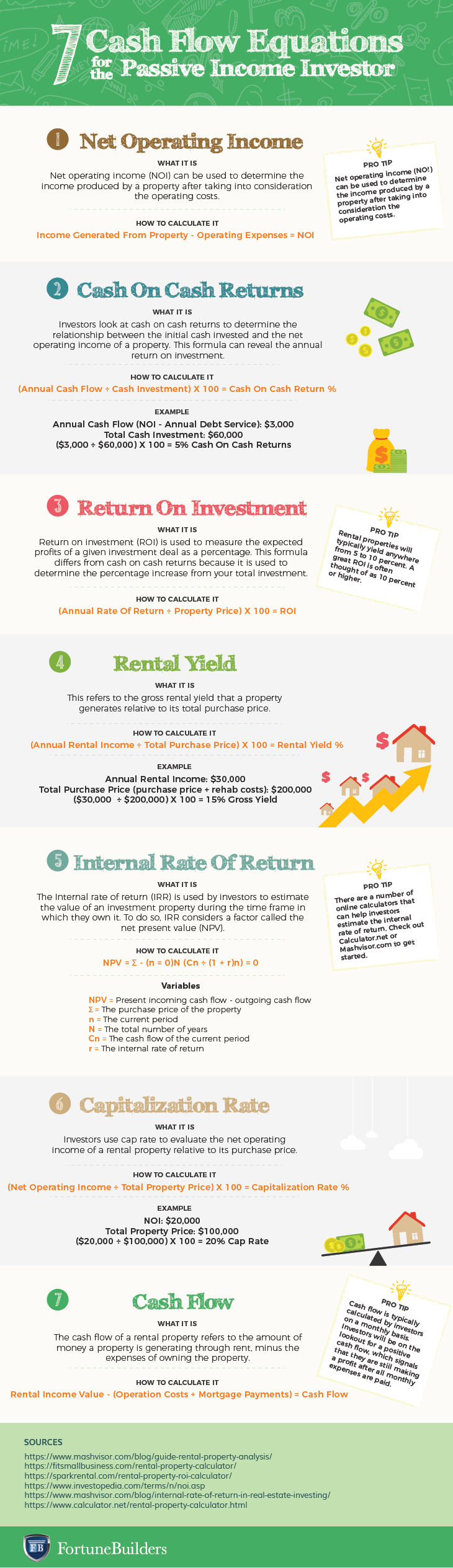

Rental income calculation worksheet. Rental Income Tax Calculator for Landlords - TaxScouts To calculate the income you're taxed on, you should add your rental income to your wages (if you're employed) and any other income you have. The total amount is your taxable income. The Property Income Allowance is only worth claiming if you've spent less than £1,000 during the tax year on your property business. Fill - Free fillable Rental Income (Genworth) PDF form Rental Income (Genworth) On average this form takes 32 minutes to complete The Rental Income (Genworth) form is 2 pages long and contains: 0 signatures 13 check-boxes 120 other fields Country of origin: US File type: PDF Use our library of forms to quickly fill and sign your Genworth forms online. BROWSE GENWORTH FORMS PDF Rental Income Calculator - Enact MI method should not be used when calculating rental income on a borrower's primary residence. Check applicable guidelines when rental income is declining year to year. Please check with your own legal advisors for interpretations of legal and compliance principles applicable to your business. Rental Income Calculation Rental Property Calculator 2022 | WOWA.ca For example, if a property is expected to receive a rental income of $50,000 in a year with costs totalling $20,000, the NOI would be $30,000 ($50,000 - $20,000). If the purchase price of the property was $1 million, then the cap rate would be calculated as: Best Mortgage Rates in Canada. 5 Year Fixed. 4.77 %.

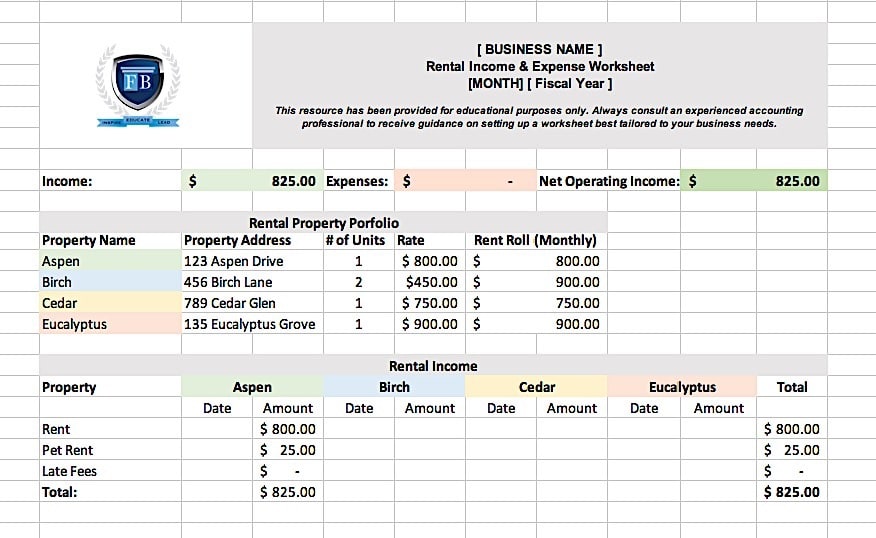

Rental Income and Expense Worksheet - PropertyManagement.com You can view, make a copy, download, and then use the worksheet here. Download the Rental Income and Expense Worksheet Here Convenient and easy to use, this worksheet is designed for property owners with one to five properties. It features sections for each category of income and spending that are associated with rental property finances. Rental Income and Expense Worksheet - Google Sheets Sheet1 ****Note: To DOWNLOAD the sheet, click on "File", then "Download", and select the format you want to download the file as.***** Year:,2019,Gross Income:,$5,105 ... 30++ Fannie Mae Income Calculation Worksheet - Worksheets Decoomo Rental Income Worksheet Individual Rental Income From Investment Property (S): (biweekly gross pay x 26 pay periods) / 12 months. Fannie mae publishes four worksheets that lenders may use to calculate rental income. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual. Arch Mortgage | USMI - Calculators The AMITRAC is an interactive spreadsheet that follows Schedule Analysis Method (SAM) of tax return evaluation. Watch the short videos below to learn how to navigate this comprehensive analysis tool. ... Individual Rental Income from Investment Property(s) (up to 10 properties) Download XLXS. Freddie Mac Form 92 Schedule E - Net Rental Income ...

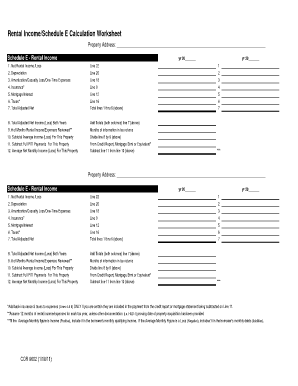

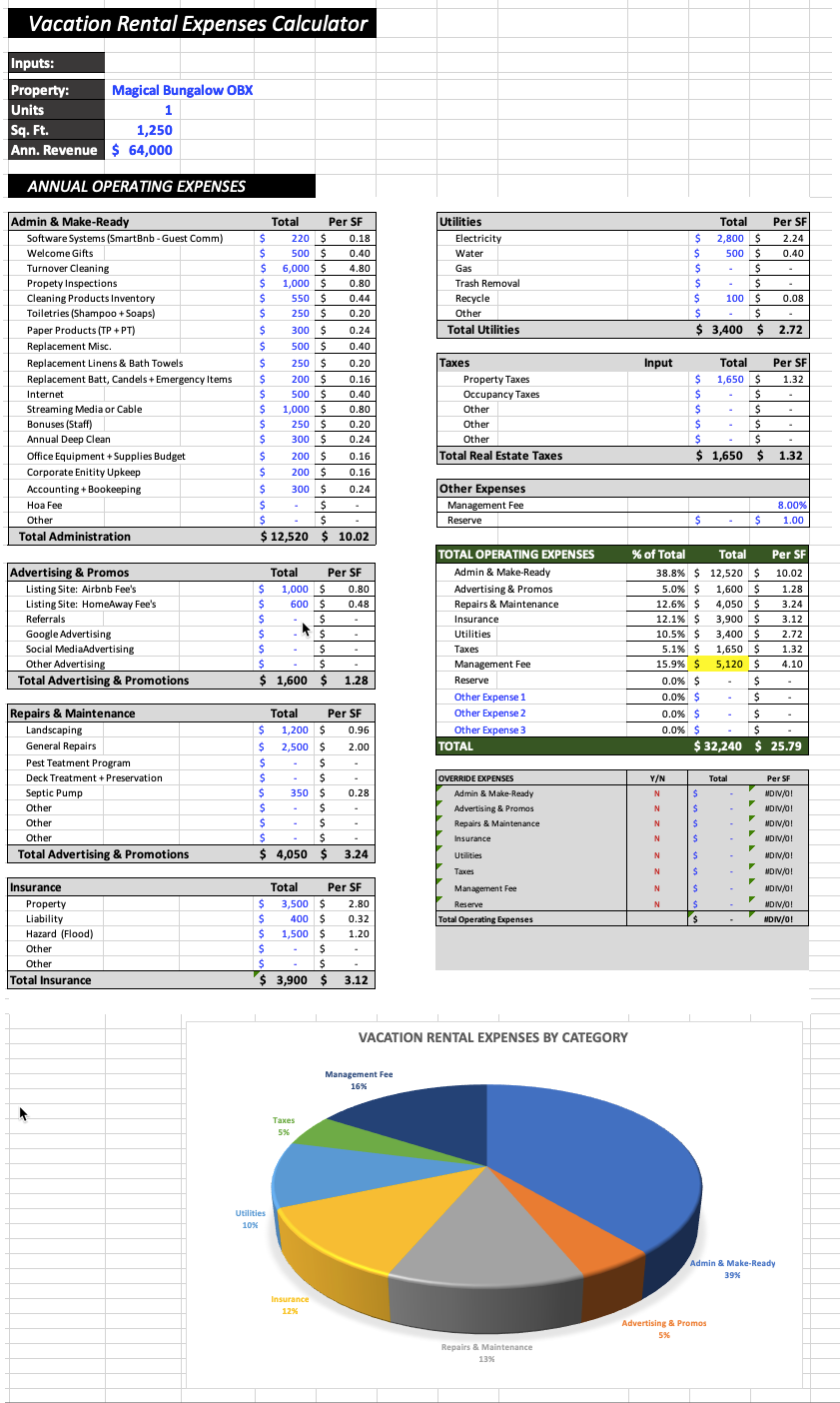

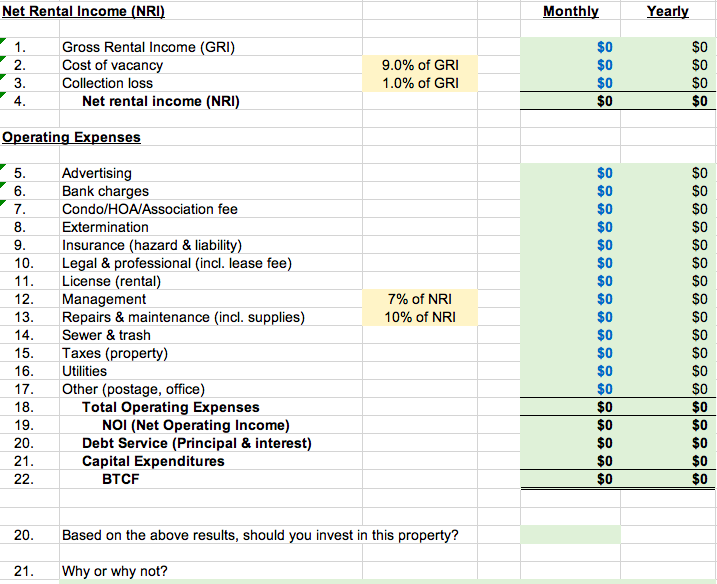

PDF Net Rental Income Calculations - Schedule E - Freddie Mac Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements . 2. This expense, if added back, must be included in the monthly payment amount being used to establish the DTI ratio . 3 How Do You Calculate Rental Income | Rental Choice vacancy rate (10% of rental income) insurance property or real estate taxes marketing and advertising costs miscellaneous fees . 3. Obtain Cash Flow for Rental Property. Deduct property expenses from the gross income to obtain your cash flow or rental income. To calculate rental income yield, multiply rental income by 12 months. Where can I find rental income calculation worksheets? - Fannie Mae Rental Income Calculation Worksheets Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Variable Income Analysis Calculator - Radian Guaranty, Inc. Any data provided must be reviewed to determine if the income source is 1) appropriate, 2) considered to be ongoing, 3) consistent, and 4) meets investor guidelines and requirements. The Variable Income Calculators include: Bonus Income Calculator Overtime Income Calculator Commission Income Calculator Download

PDF FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for FHA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows.

› publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 26, 2022 · Key findings include: Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month, with support among likely voters now falling short of a majority.

PDF Rental Income Schedule E Calculation Worksheet Analysis Form 1084 Fannie Mae. Form 91 Income Calculations Calculator. Qualified business income deduction QBID overview 1040. Rental Income Schedule E Calculation Worksheet. Section 2 23 Veterans Administration VA Loan Program. WSHFC Asset Management and Compliance Tax Credit. 7 Australian annuities and superannuation income streams. 10 Total ...

Income Calculation Worksheet - NRPS Income Calculation Worksheet Income Calculation Worksheet is required to be utilized on all wage earner, fixed income, rental income, residual income types. This Worksheet can also be used to calculate Schedule C income. Click on the hyperlink above to download the Worksheet.

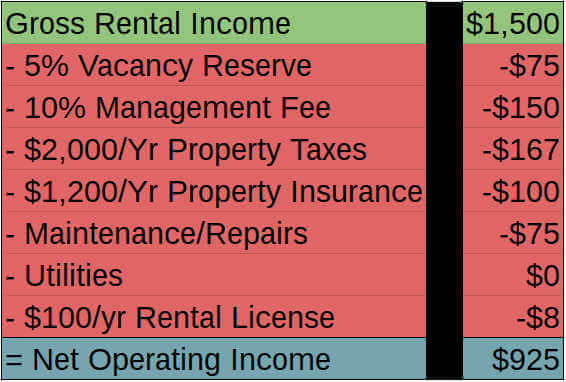

2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Gross annual rental income is the amount that could be collected based on 100% occupancy. Vacancy/credit loss is the amount of potential rental income when the property is vacant (normally estimated at 5% of the gross annual rental income). Effective gross rental income is the difference between the gross annual rent and vacancy/credit loss.

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Work out your rental income when you let property - GOV.UK How to work out your taxable profits. To work out your profit or loss you should treat all receipts and expenses as one business even if you've more than one UK property by: adding together all ...

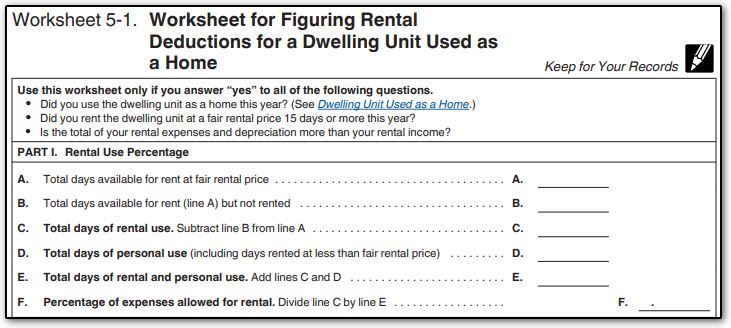

selling-guide.fanniemae.com › Selling-GuideB3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Free Rental Spreadsheet Template - Landlord Studio UK Great, we've emailed your spreadsheet template 📩 ... Simplify every aspect of rental property management with our easy-to-use app that helps you keep track of your rental income and expenses and maximise the return on your investments. Get Started For Free. 40,000+ PROPERTIES. 5,000+ LANDLORDS. 1,000+ 5 STAR REVIEWS. Our

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet

Hud Rent Calculation Worksheet Excel Form - signNow Section 8 Rent Calculation Worksheet. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Get everything done in minutes. ... Start signing hud income calculation worksheet by means of solution and become one of the millions of happy customers who've already experienced the benefits ...

› t4036 › rental-incomeRental Income - Canada.ca If you are a partner, include the net rental income or loss from your T5013 slip in the calculation. Combine the rental income and loss from all your properties, even if they belong to different classes. This also applies to furniture, fixtures and appliances that you use in your rental building.

Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment Schedule E Determine the average monthly income/loss for a non-owner occupied investment property. Download Worksheet (PDF)

› enCanada Mortgage and Housing Corporation | CMHC Rental market data; Housing market information portal; Residential Mortgage Industry Data Dashboard; Housing in Canada Online (HiCO) CMHC licence agreement for the use of data; Housing Knowledge Centre; Industry innovation and leadership. Housing innovation; Our Partners. Partnerships; Federal, Provincial and Territorial Forum on Housing

Rental Calculation Worksheet: Fill & Download for Free - CocoDoc Rental Calculation Worksheet: Fill & Download for Free GET FORM Download the form A Step-by-Step Guide to Editing The Rental Calculation Worksheet Below you can get an idea about how to edit and complete a Rental Calculation Worksheet quickly. Get started now. Push the"Get Form" Button below .

Rental Income Calculation Worksheet : Give you the best choices ... Rental Income Calculation Worksheet · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ,

PDF Form 1038: Rental Income Worksheet - Enact MI B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). For multi-unit properties, combine gross rent from all rental units. Enter B2 Multiply gross monthly rent or market rent by 75% (.75). The remaining 25% accounts for vacancy loss, maintenance, and management expenses. Multiply x.75 x.75

Rental Income and Expense Worksheet: Free Resources - Stessa The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: Price to Rent Ratio compares the median home price to the median annual rent and is used to predict the potential demand... Gross Rent Multiplier (GRM) ...

Section 8 Rent Calculation Worksheet PDF Form - FormsPal How to Edit Section 8 Rent Calculation Worksheet Online for Free. It is simple to create forms with the use of our PDF editor. Enhancing the income calculation worksheet hud form is a breeze should you use the following actions: Step 1: Press the orange "Get Form Now" button on the webpage.

0 Response to "42 rental income calculation worksheet"

Post a Comment